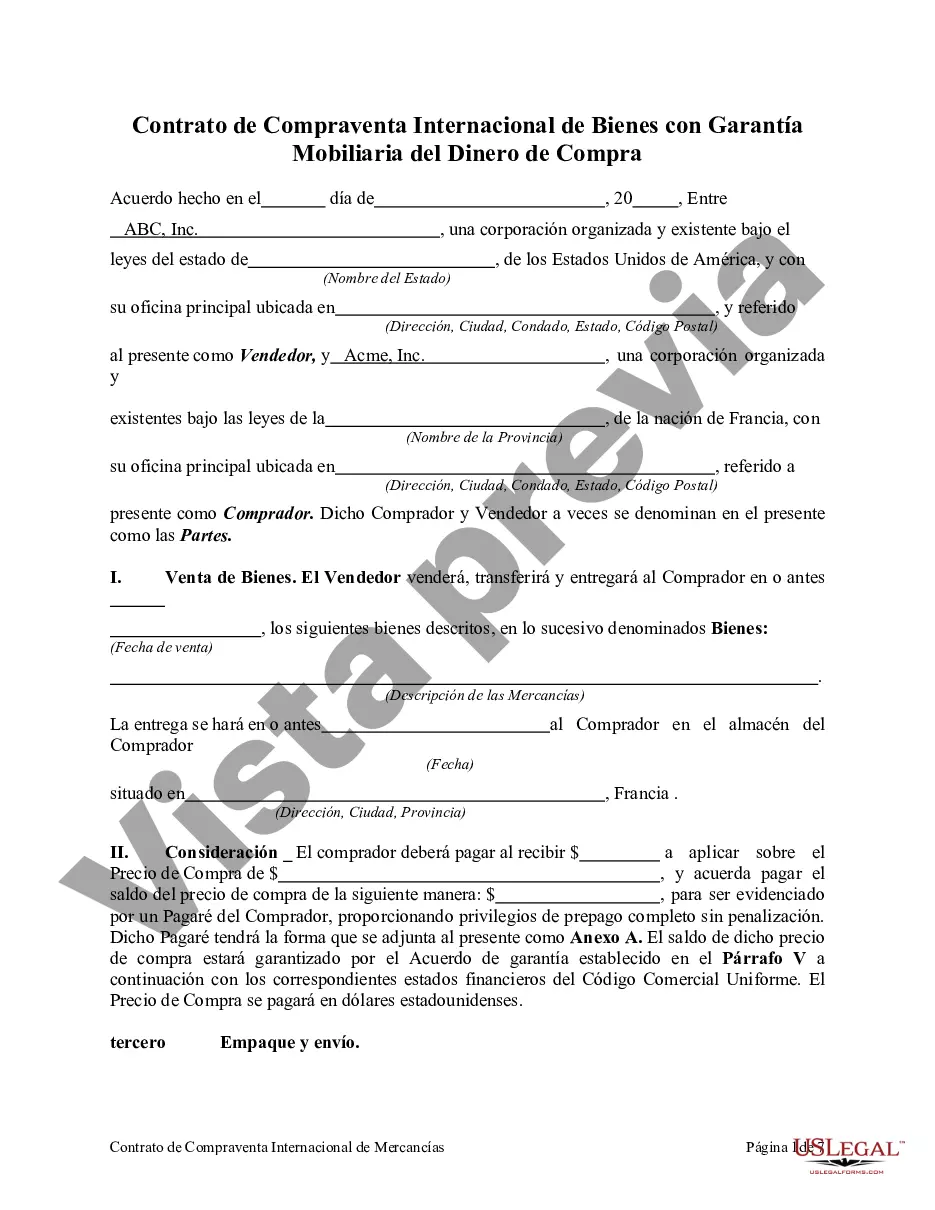

The Dallas Texas Contract for the International Sale of Goods with Purchase Money Security Interest is a legal agreement that governs the sale of goods between international parties, specifically involving the purchase of goods with a security interest attached to them. This contract is specifically designed to provide clarity, protection, and legal enforceability to both the buyer and the seller in cross-border transactions. Under this contract, both the buyer and the seller agree to abide by the provisions set forth by the United Nations Convention on Contracts for the International Sale of Goods (CSG), which provides a standardized set of rules and regulations for international sales contracts. The inclusion of a Purchase Money Security Interest (PSI) further enhances the security for the seller by granting them a security interest in the goods sold, allowing them to repossess or reclaim the goods in case of default or non-payment. There are different types of Dallas Texas Contracts for the International Sale of Goods with Purchase Money Security Interest that address specific circumstances or variations in the agreement. These include: 1. Standard Dallas Texas Contract for the International Sale of Goods with PSI: This is the most common form of this contract, outlining the general provisions, payment terms, delivery conditions, and parties' rights and obligations. 2. Dallas Texas Contract for the International Sale of Goods with PSI in Installments: This type of contract applies when the goods are to be delivered in multiple installments, allowing for separate payments and security interests applicable to each installment. 3. Dallas Texas Contract for the International Sale of Goods with PSI and Guaranty Agreement: When additional security is required, usually in cases where the buyer's creditworthiness is questionable, a guaranty agreement may be included to strengthen the seller's position and secure payment. 4. Dallas Texas Contract for the International Sale of Goods with PSI and Collateral Agreement: In certain situations, additional collateral may be required to secure the seller's interests. A collateral agreement outlines the terms and enforceability of the additional security provided. It is essential to consult legal professionals experienced in international trade and contract law to ensure the contract is tailored to the specific needs and circumstances of the parties involved. This contract provides a comprehensive framework that protects the rights and interests of both the buyer and the seller, fostering transparency and trust in cross-border commercial transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Contrato de Compraventa Internacional de Bienes con Garantía Mobiliaria del Dinero de Compra - Contract for the International Sale of Goods with Purchase Money Security Interest

Description

How to fill out Dallas Texas Contrato De Compraventa Internacional De Bienes Con Garantía Mobiliaria Del Dinero De Compra?

Whether you plan to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like Dallas Contract for the International Sale of Goods with Purchase Money Security Interest is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to get the Dallas Contract for the International Sale of Goods with Purchase Money Security Interest. Adhere to the guidelines below:

- Make certain the sample meets your individual needs and state law requirements.

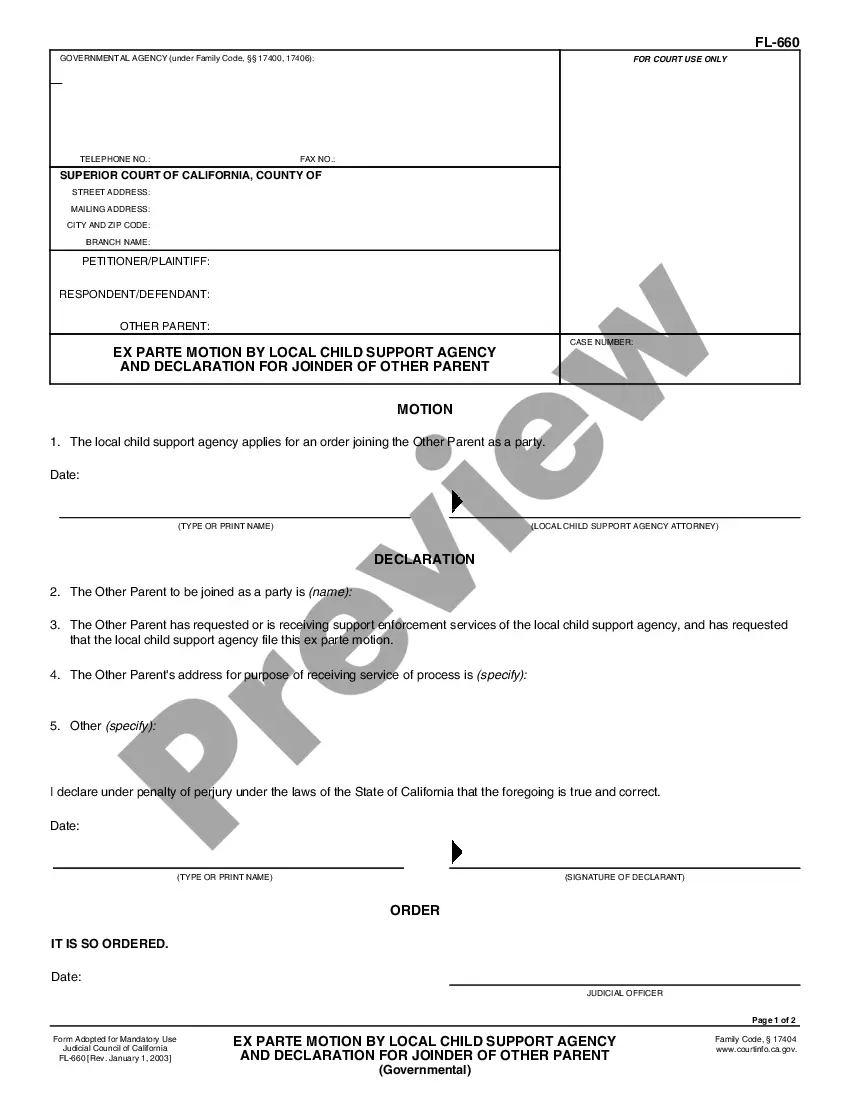

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the file when you find the correct one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Dallas Contract for the International Sale of Goods with Purchase Money Security Interest in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!