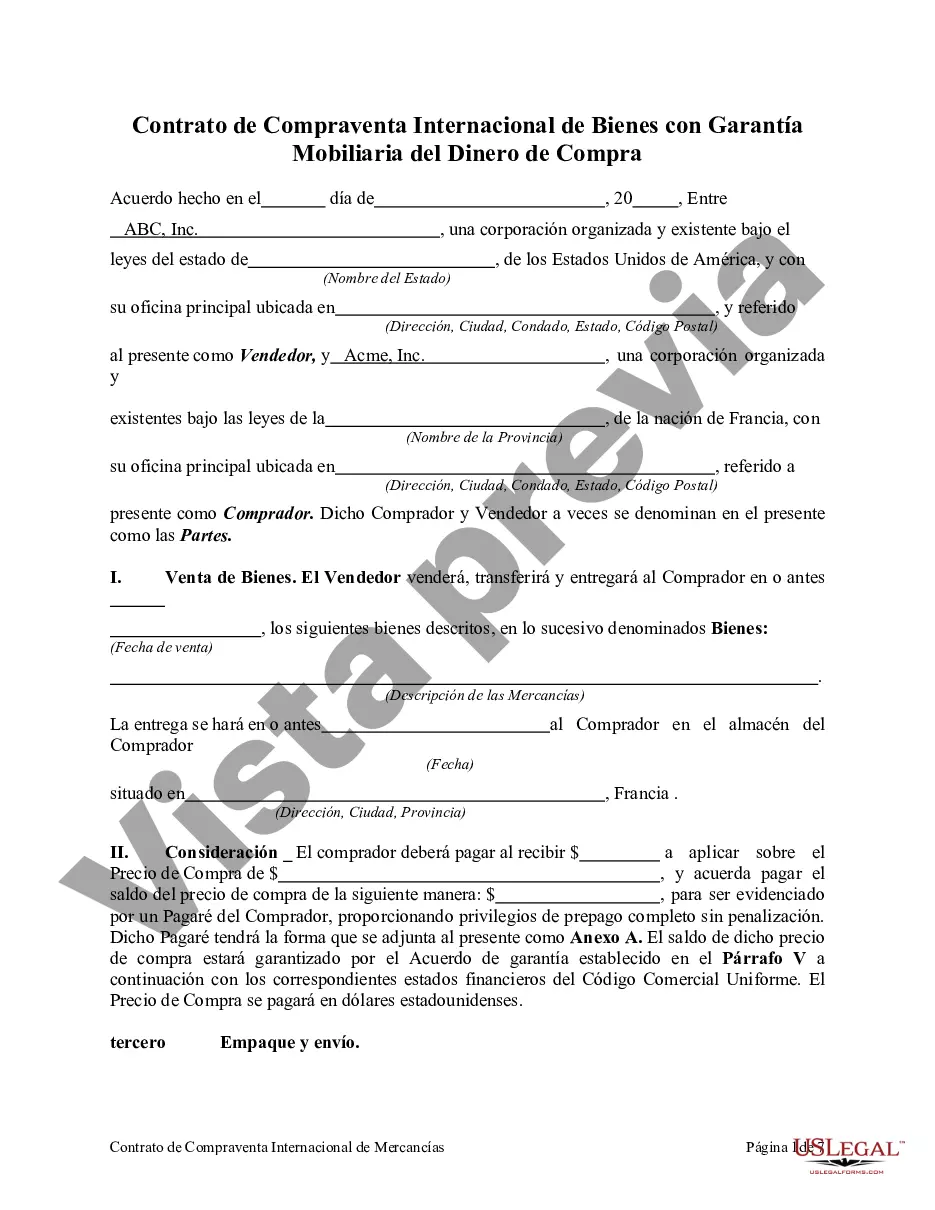

Santa Clara California Contract for the International Sale of Goods with Purchase Money Security Interest is a legal agreement that outlines the terms and conditions of a transaction between parties engaged in international commerce. It specifically pertains to the sale of goods where the buyer, located in Santa Clara, California, provides a security interest in the purchased goods as collateral to the seller. This contract establishes the rights and obligations of both the buyer and the seller, ensuring a smooth and secure transaction. It incorporates the key principles of the United Nations Convention on Contracts for the International Sale of Goods (CSG) and follows the provisions of the Uniform Commercial Code (UCC) in the state of California. The Santa Clara California Contract for the International Sale of Goods with Purchase Money Security Interest includes the following essential elements: 1. Identification of the parties: The contract clearly identifies the buyer and the seller, including their legal names, addresses, and relevant contact information. 2. Description of goods: It provides a detailed description of the goods being sold, ensuring clarity and accuracy to avoid any disputes or misunderstandings. 3. Purchase price: The contract specifies the agreed-upon purchase price for the goods and outlines the payment terms and methods, such as installment payments or letter of credit. 4. Security interest: This contract incorporates a purchase money security interest in the goods. It outlines the nature and extent of this security interest, including the collateral and the conditions under which the interest may be enforced. 5. Risk of loss: The contract addresses the allocation of risks associated with the goods, determining at what point the responsibility transfers from the seller to the buyer. 6. Delivery and acceptance: It outlines the delivery terms, such as the place, time, and method of delivery, as well as the procedures for inspection and acceptance of goods by the buyer. 7. Warranties and disclaimers: The contract includes any warranties provided by the seller regarding the quality, fitness for a particular purpose, or conformity of the goods. It also specifies any disclaimers or limitations of these warranties. 8. Governing law and jurisdiction: This clause determines the applicable law (California state law) and the jurisdiction where any litigation or disputes arising from the contract will be resolved (Santa Clara County). Different types of Santa Clara California Contract for the International Sale of Goods with Purchase Money Security Interest may include variations based on specific industry requirements or additional clauses specific to certain types of goods. Some examples of specialized contracts could be for the sale of technology products, agricultural goods, or manufacturing equipment, each with its own unique terms and conditions tailored to the respective industries. In conclusion, the Santa Clara California Contract for the International Sale of Goods with Purchase Money Security Interest ensures a clear and binding agreement between parties involved in international commerce, protecting their rights and providing a mechanism for resolving potential disputes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Contrato de Compraventa Internacional de Bienes con Garantía Mobiliaria del Dinero de Compra - Contract for the International Sale of Goods with Purchase Money Security Interest

Description

How to fill out Santa Clara California Contrato De Compraventa Internacional De Bienes Con Garantía Mobiliaria Del Dinero De Compra?

Whether you plan to start your company, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you must prepare certain paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Santa Clara Contract for the International Sale of Goods with Purchase Money Security Interest is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several additional steps to obtain the Santa Clara Contract for the International Sale of Goods with Purchase Money Security Interest. Adhere to the guide below:

- Make sure the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the file once you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Santa Clara Contract for the International Sale of Goods with Purchase Money Security Interest in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!