Cuyahoga County, Ohio, has specific laws and regulations governing the sale of assets of a corporation without the necessity to comply with bulk sales laws. This process allows corporations to transfer their assets to another entity without the need to follow the usual requirements and procedures set forth in bulk sales laws. The sale of assets of a corporation in Cuyahoga County, Ohio, without the need to comply with bulk sales laws provides numerous benefits for both the corporations involved and potential buyers. This unique arrangement allows for a faster, more streamlined transaction process, enabling corporations to dispose of their assets efficiently and buyers to acquire assets with reduced legal complexities. When engaging in a Cuyahoga Ohio Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws, it is essential to understand the different types of transactions that fall under this category. Some common types include: 1. Corporate Acquisition: This refers to the purchase of a corporation's assets by another corporation. The buyer acquires the assets, including property, inventory, intellectual property, contracts, and more, without having to comply with bulk sales laws. This type of transaction typically occurs when a corporation merges with or acquires another entity. 2. Asset Purchase Agreement: In this scenario, a buyer purchases specific assets of a corporation. This can include equipment, real estate, intellectual property, and more. The sale of these assets occurs without the buyer needing to adhere to bulk sales laws, enhancing the efficiency of the transaction. 3. Business Restructuring: Corporation restructuring involves altering the organization's structure, ownership, or assets to improve its financial standing or operational effectiveness. This process might involve the sale of certain assets to streamline operations or focus on core competencies. Cuyahoga Ohio Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws expedites these transactions, making it an attractive option for corporations wishing to restructure. It is important for parties involved in a Cuyahoga Ohio Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws to seek legal advice to ensure compliance with all county regulations. Additionally, understanding the tax implications and potential liabilities associated with these transactions is crucial. Overall, the Cuyahoga Ohio Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws offers a convenient and efficient framework for corporations looking to transfer assets. This streamlined process benefits both sellers and buyers, promoting economic growth and business opportunities within Cuyahoga County.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Venta de Activos de Corporación sin Necesidad de Cumplir con Leyes de Ventas al por Mayor - Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws

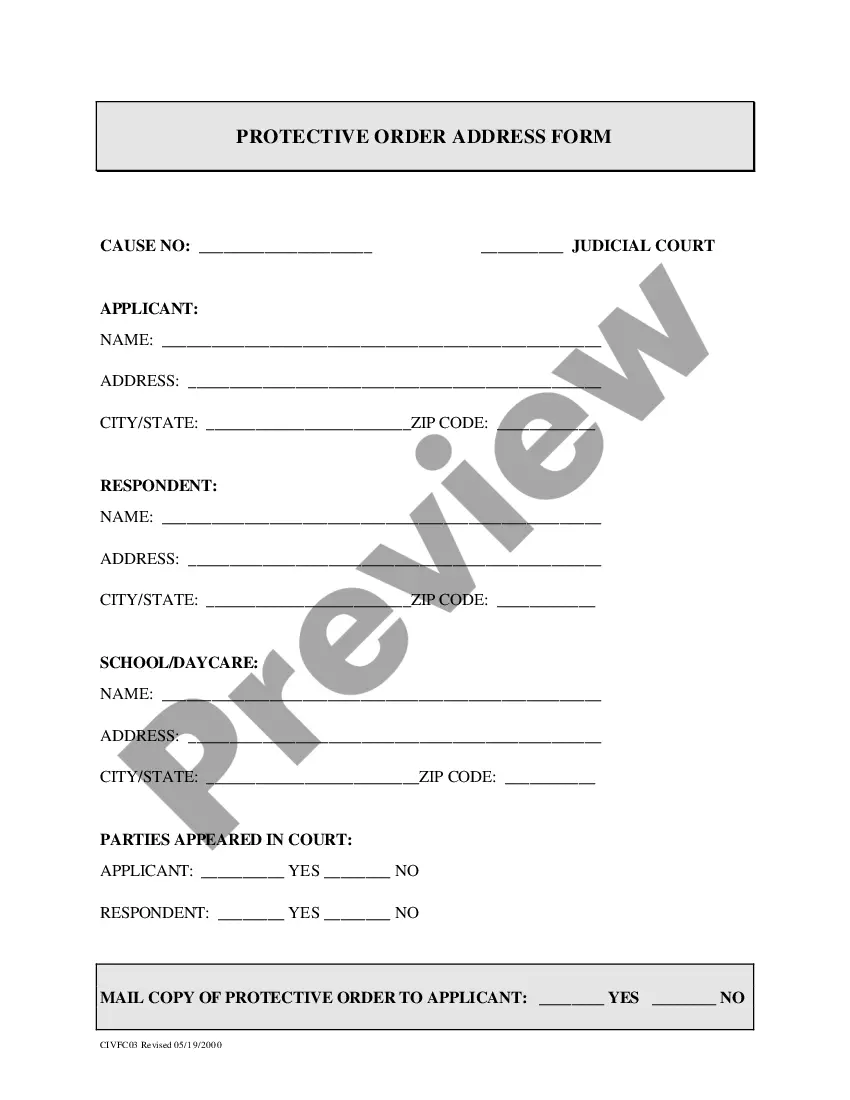

Description

How to fill out Cuyahoga Ohio Venta De Activos De Corporación Sin Necesidad De Cumplir Con Leyes De Ventas Al Por Mayor?

Whether you intend to start your business, enter into a contract, apply for your ID update, or resolve family-related legal issues, you need to prepare specific paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occurrence. All files are collected by state and area of use, so picking a copy like Cuyahoga Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to obtain the Cuyahoga Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws. Follow the instructions below:

- Make sure the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the sample when you find the proper one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Cuyahoga Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!