Riverside, California, is a vibrant city located in the southern part of the state. Known for its picturesque views of the Santa Ana River, stunning mountain landscapes, and a thriving business community, Riverside offers numerous opportunities for various transactions and legal proceedings. One such transaction is the sale of assets of a corporation without the necessity to comply with bulk sales laws. When a corporation decides to sell its assets, there are typically legal requirements that must be followed, including compliance with bulk sales laws. These laws are in place to protect the interests of creditors and ensure fair treatment during asset sales. However, certain circumstances may exempt a corporation from having to adhere to bulk sales laws. One type of Riverside, California sale of assets of a corporation with no necessity to comply with bulk sales laws occurs when a corporation is filing for bankruptcy. In this situation, the bankruptcy court may grant permission for the sale, waiving the requirement for the corporation to comply with bulk sales laws. This exemption is primarily aimed at helping corporations in financial distress to efficiently liquidate their assets and repay their outstanding debts. Another type of Riverside sale of assets of a corporation with no necessity to comply with bulk sales laws is when the assets are being sold to another entity within the same corporate group or as part of an internal reorganization. In these instances, the assets are not being offered to external parties, thereby reducing the need for bulk sales laws' compliance. It is important to note that the sale of assets without complying with bulk sales laws does not absolve the corporation from its financial obligations. The corporation is still liable for fulfilling its outstanding debts and obligations to creditors. However, the exemption from bulk sales laws allows for a more streamlined process, facilitating the efficient transfer of assets and ensuring the corporation's ability to meet its financial obligations. Overall, the sale of assets of a corporation with no necessity to comply with bulk sales laws in Riverside, California, offers corporations facing certain circumstances an opportunity to expedite the asset sale process. Whether it is during a bankruptcy filing or internal reorganization, this exemption can help corporations adapt to their unique circumstances, ensure fair treatment to creditors, and pave the way for a fresh start.

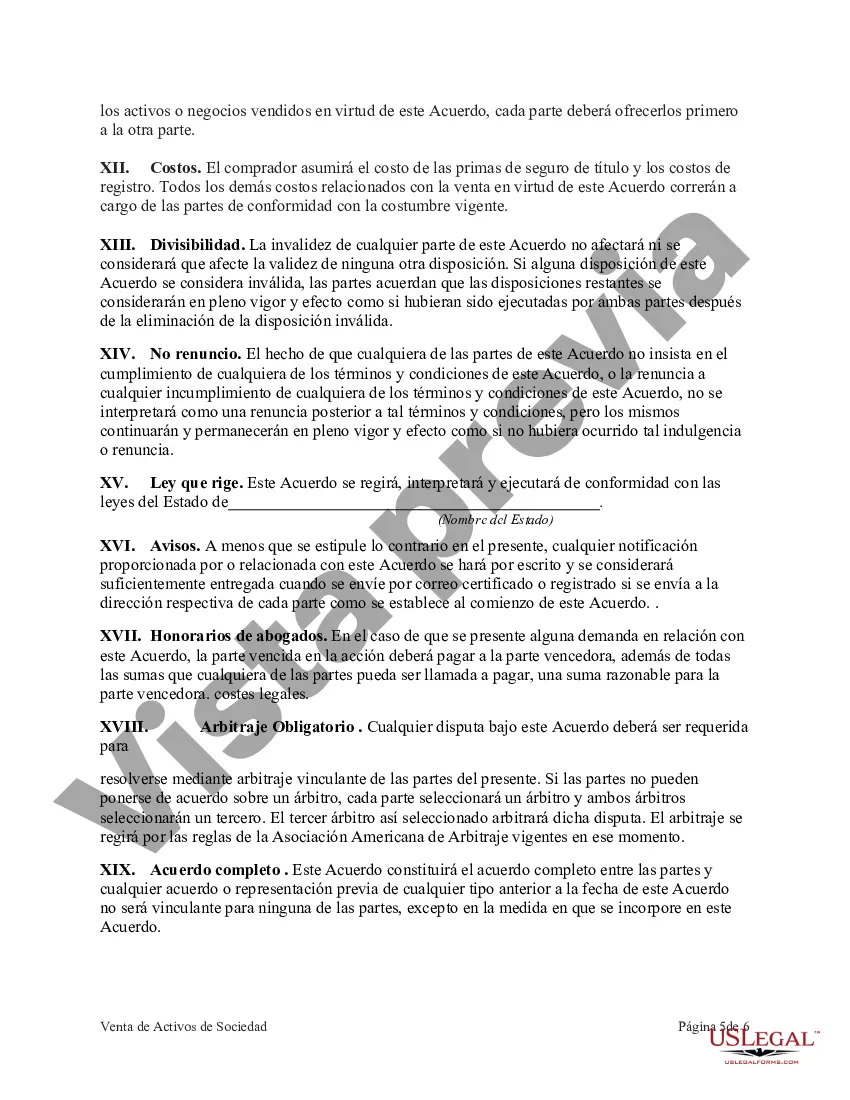

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Venta de Activos de Corporación sin Necesidad de Cumplir con Leyes de Ventas al por Mayor - Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws

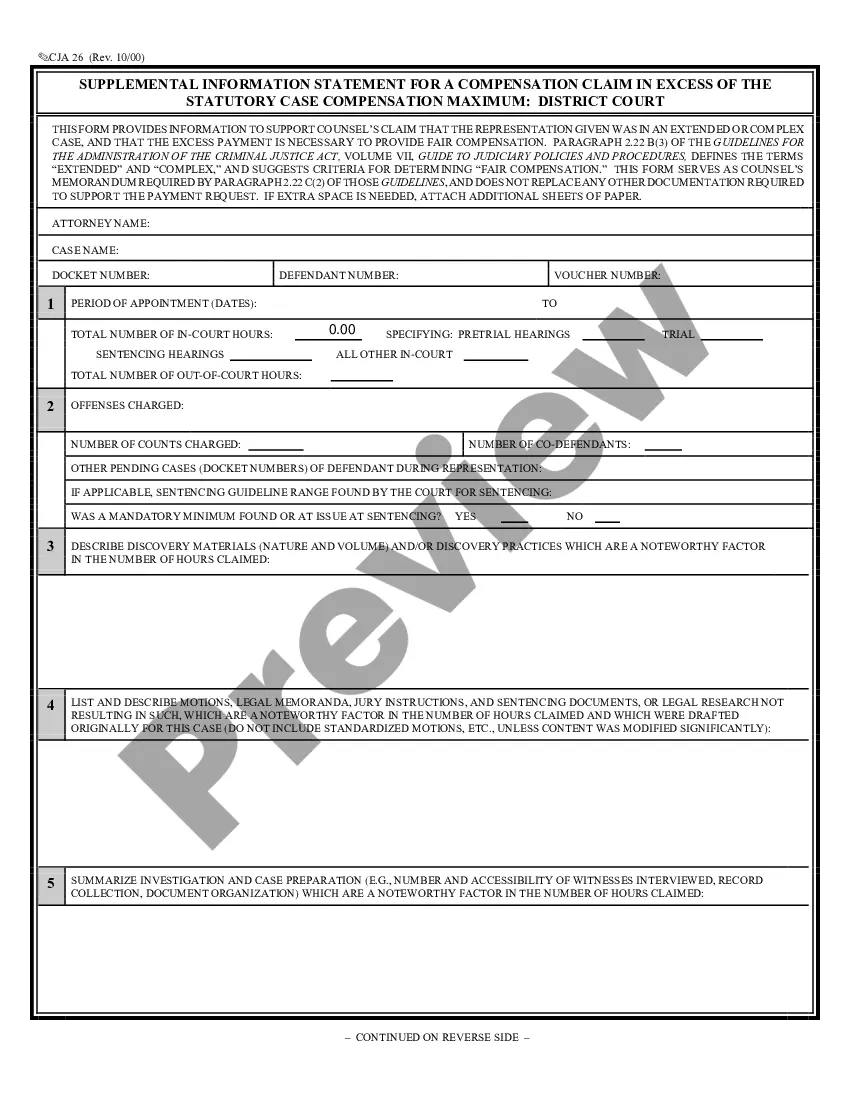

Description

How to fill out Riverside California Venta De Activos De Corporación Sin Necesidad De Cumplir Con Leyes De Ventas Al Por Mayor?

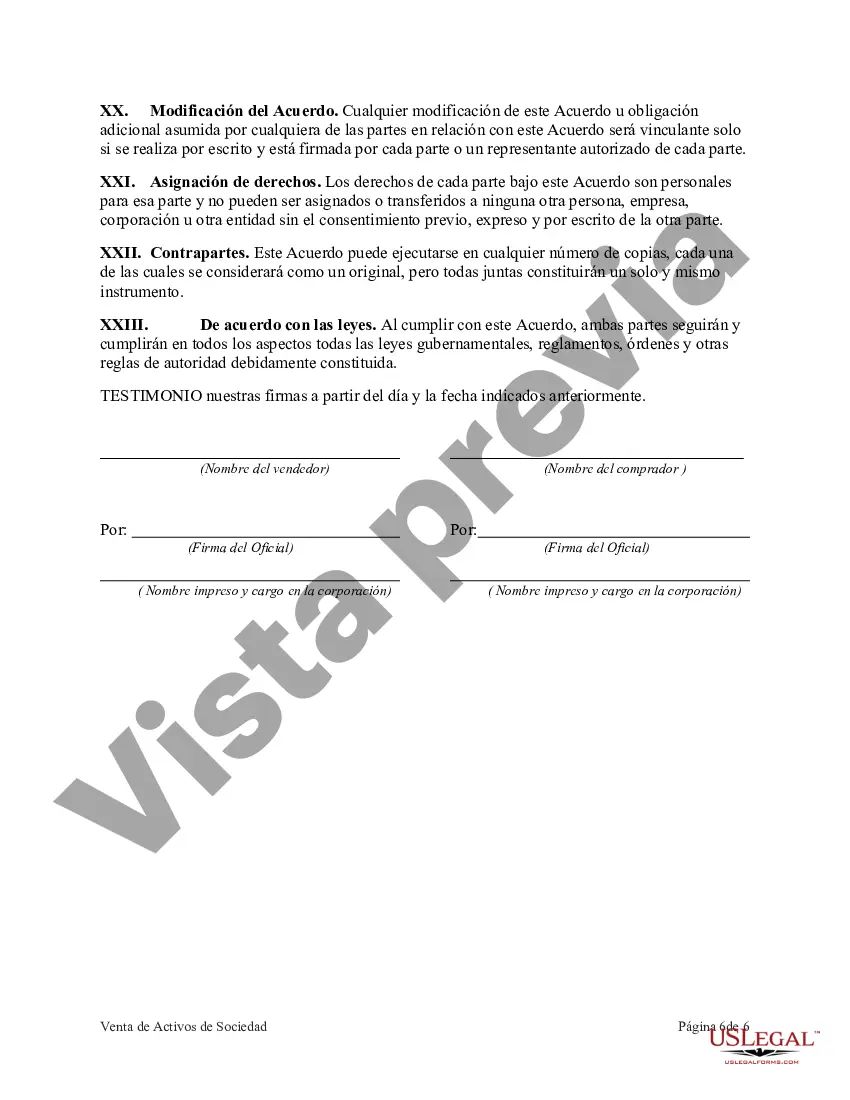

Whether you intend to open your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Riverside Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to get the Riverside Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws. Adhere to the instructions below:

- Make sure the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the file when you find the right one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Riverside Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!