Salt Lake Utah Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws: In Salt Lake City, Utah, the Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws refers to a specific type of transaction where a corporation sells its assets without the requirement of adhering to bulk sales laws. These laws govern the transfer of a significant portion of a corporation's assets to another entity, typically ensuring that creditors and other interested parties are notified and have the opportunity to claim any outstanding debts. However, under certain circumstances, corporations in Salt Lake City, Utah, have the option to bypass bulk sales laws when selling their assets. This exemption might be granted if the corporation is in good financial standing, and there is no risk of creditors being left unpaid. Several types of Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws can be identified: 1. Voluntary Asset Sale: In this scenario, a corporation proactively decides to sell its assets without having to comply with bulk sales laws. It may do so to strategically streamline its operations, restructure its businesses, or focus on its core competencies. 2. Intercompany Asset Transfer: Occasionally, corporations within the same overarching company might transfer assets between subsidiaries without going through the traditional bulk sales process. This type of transfer is typically facilitated to optimize resources and efficiently allocate assets within the corporation. 3. Distressed Asset Sale: Although bulk sales laws are generally more relevant in distressed or financially troubled situations, there may be instances where Salt Lake City corporations experiencing financial difficulties might still be exempted from complying with these laws while selling their assets. This exemption is usually subject to court approval, ensuring transparency and fair treatment to all stakeholders involved. 4. Prominent Corporation Asset Sale: Prominent corporations in Salt Lake City might negotiate special exemptions from bulk sales laws due to their strong financial position, significant standing in the business community, or established goodwill. These exceptions acknowledge that such corporations possess the means and reputation to honor their financial obligations without jeopardizing creditors' interests. It is crucial to note that although these exemptions may allow corporations in Salt Lake City, Utah, to bypass bulk sales laws, they are still bound by other relevant business regulations, such as contract laws, tax obligations, and general corporate governance requirements. Compliance with these regulations ensures the fairness and legality of the asset sales, protecting the rights of all parties involved. When engaging in a Salt Lake Utah Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws, it is advisable for corporations to consult legal counsel familiar with the specific regulations and requirements of the local jurisdiction to navigate the transaction smoothly, while also safeguarding the rights and interests of all stakeholders.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Venta de Activos de Corporación sin Necesidad de Cumplir con Leyes de Ventas al por Mayor - Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws

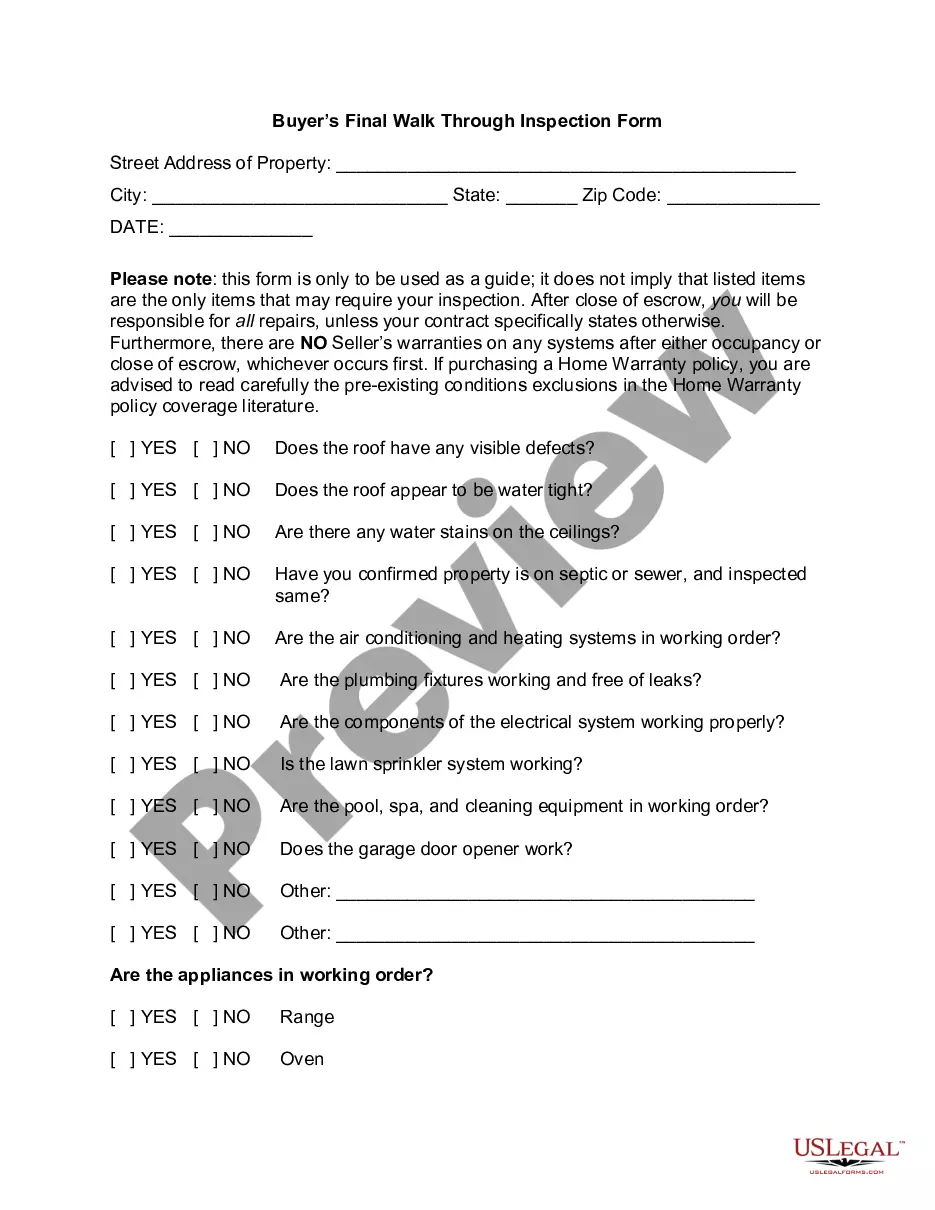

Description

How to fill out Salt Lake Utah Venta De Activos De Corporación Sin Necesidad De Cumplir Con Leyes De Ventas Al Por Mayor?

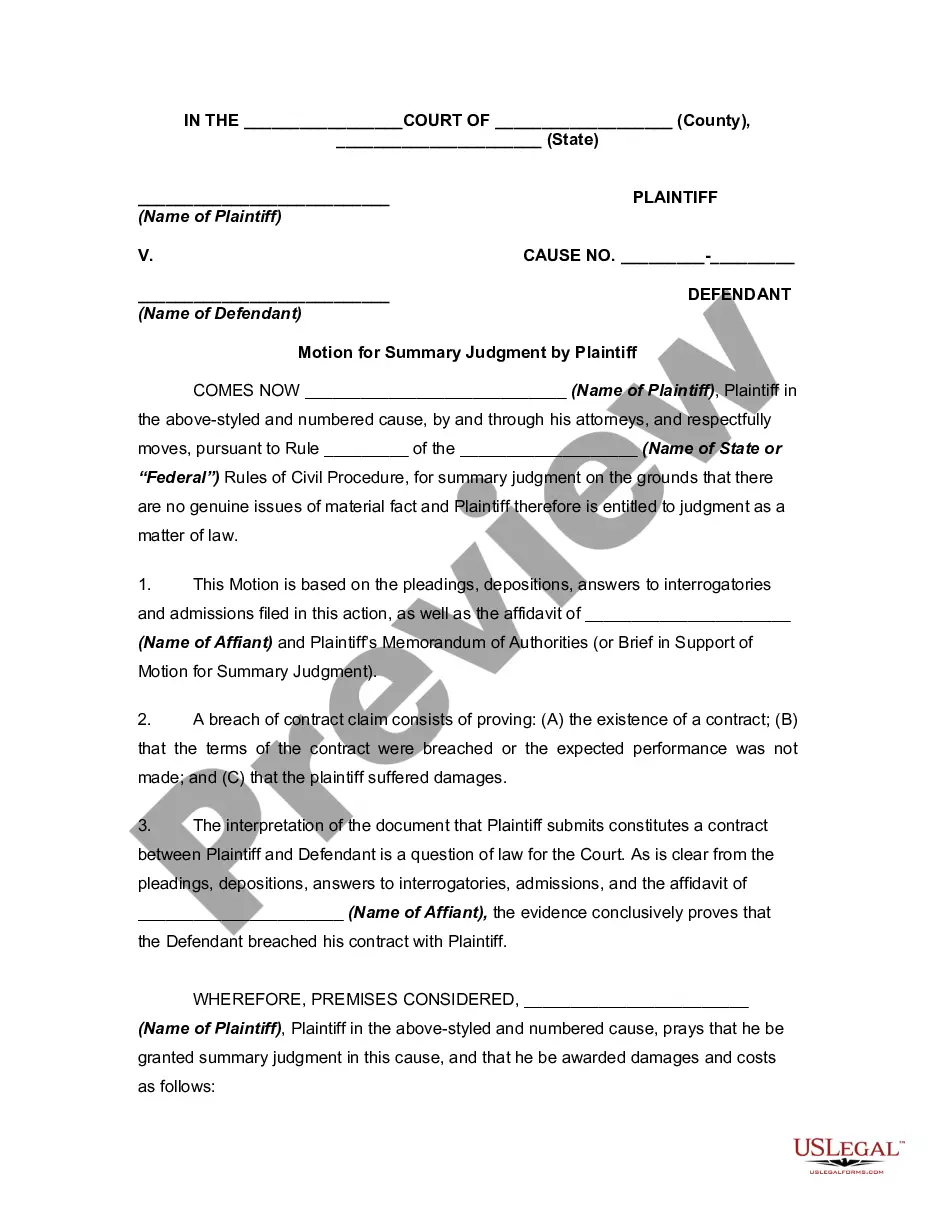

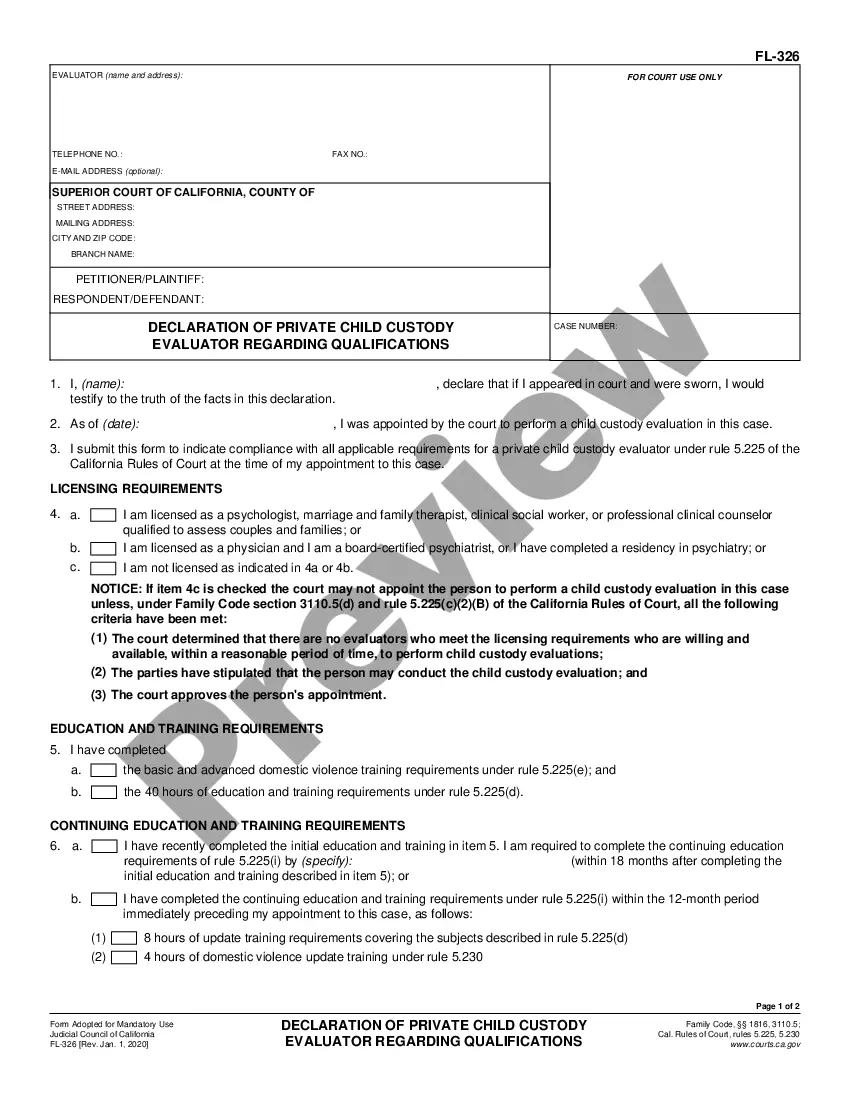

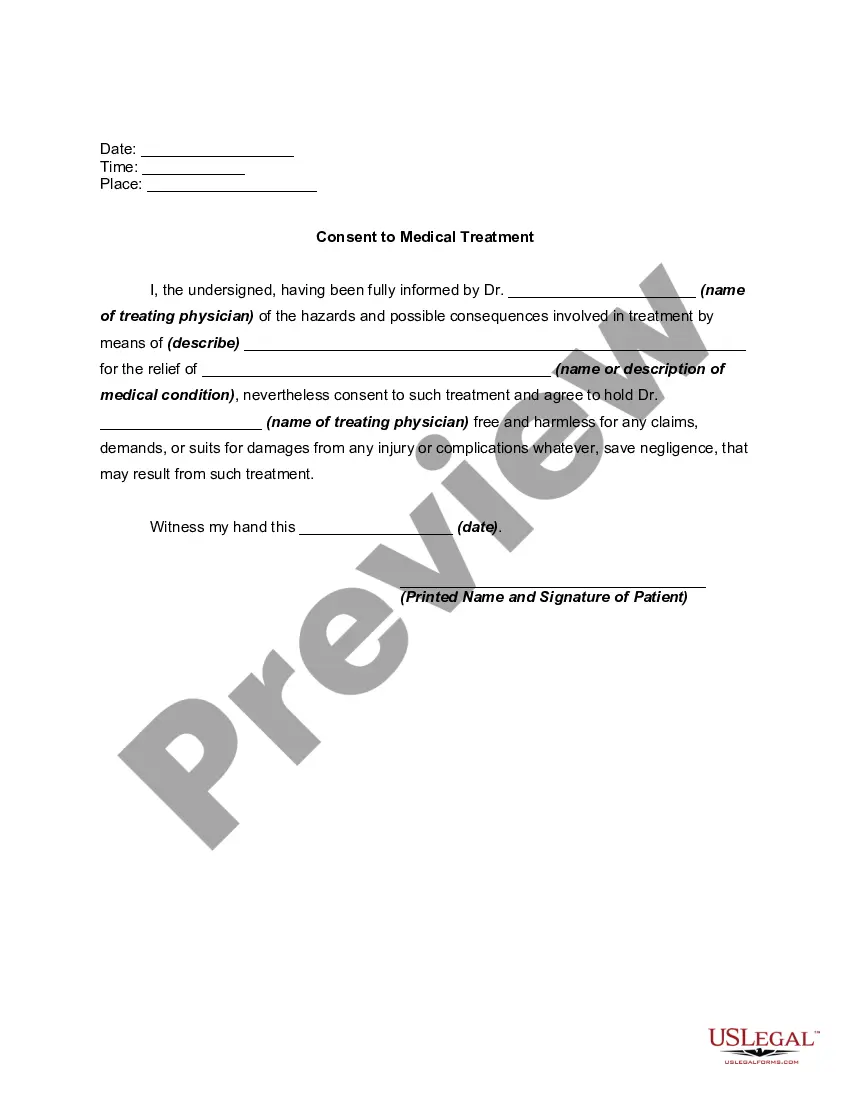

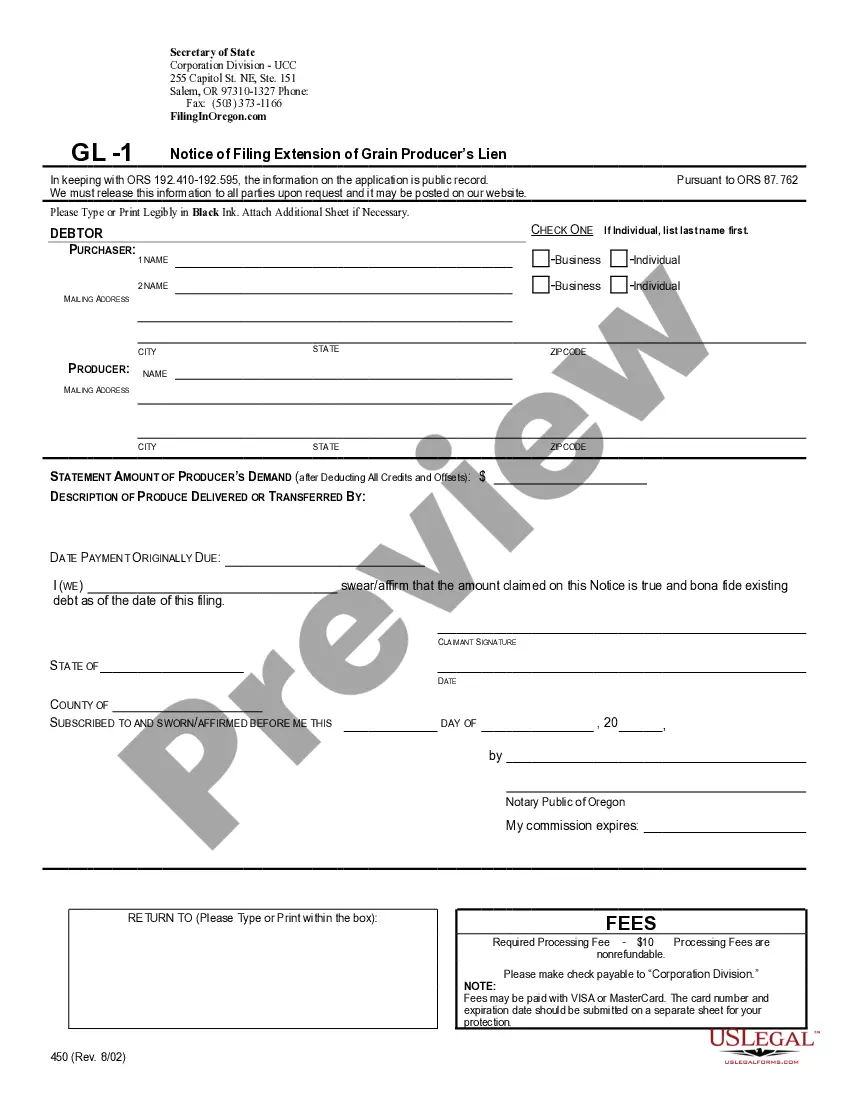

Draftwing paperwork, like Salt Lake Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws, to manage your legal affairs is a tough and time-consumming task. Many cases require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can take your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms crafted for a variety of scenarios and life circumstances. We ensure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Salt Lake Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws template. Go ahead and log in to your account, download the form, and personalize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before downloading Salt Lake Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws:

- Ensure that your template is compliant with your state/county since the rules for creating legal papers may vary from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Salt Lake Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin using our service and get the document.

- Everything looks good on your end? Click the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment information.

- Your form is all set. You can go ahead and download it.

It’s easy to find and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!