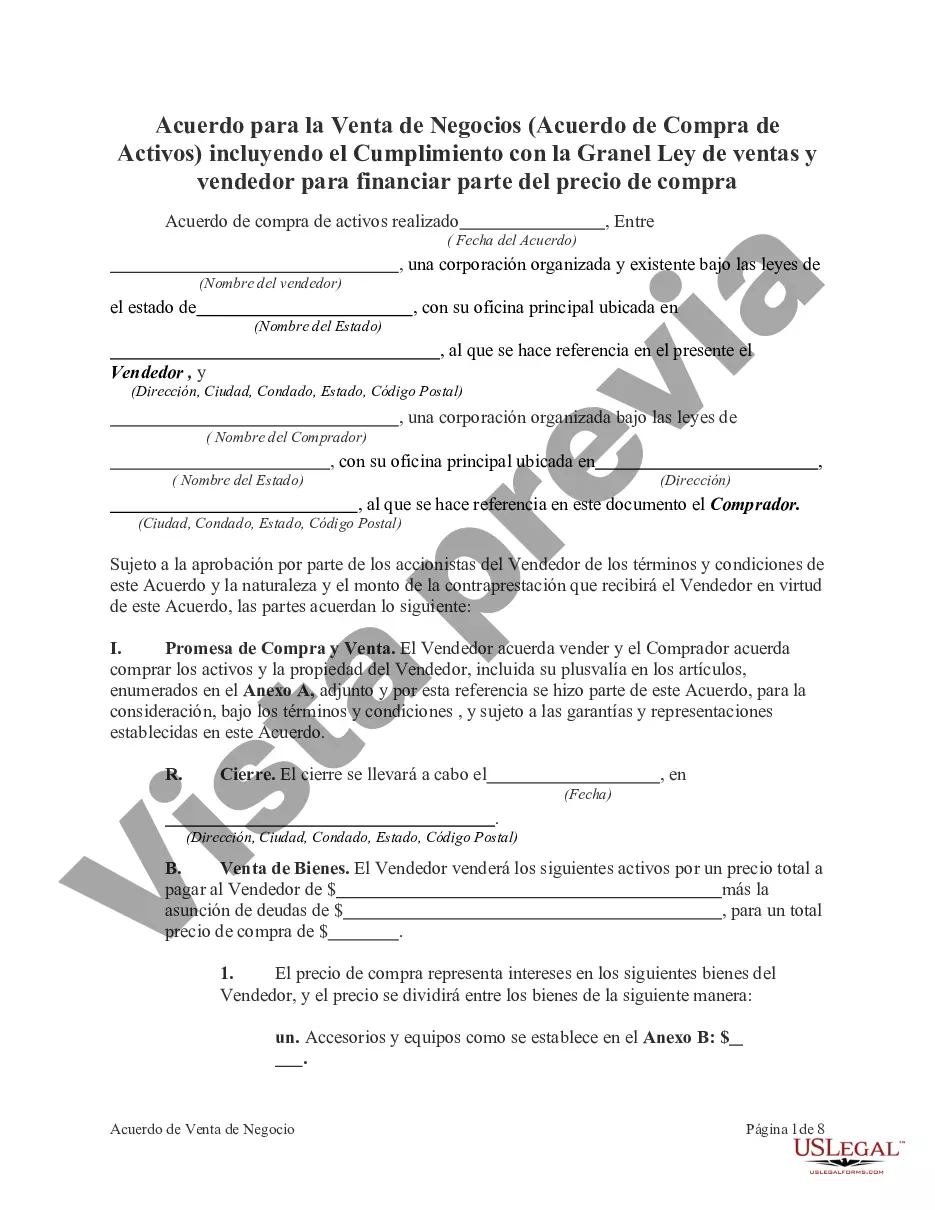

Sacramento, California Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price When it comes to buying or selling a business in Sacramento, California, it is crucial to have a comprehensive agreement in place that complies with both state laws and the Bulk Sales Act. This legal document, known as the Sacramento California Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price, ensures a smooth transaction and protects the rights and obligations of both parties involved. The Sacramento California Agreement for Sale of Business allows for a seller-financed purchase price, which means that the seller provides financing to the buyer for a portion of the total purchase price. This arrangement offers several advantages, including flexibility in payment terms and potentially attracting more potential buyers who may not have access to traditional financing options. Within this agreement, there are several key provisions to consider: 1. Identification of Parties: The agreement clearly defines the buyer and seller, including their legal names and contact information. 2. Business Description: A detailed description of the business being sold, including its assets, inventory, location, and any other key aspects that define its value. 3. Purchase Price and Payment Terms: The total purchase price is specified, along with the portion that will be financed by the seller. Payment terms, including the interest rate, down payment, and repayment schedule, should also be outlined clearly. 4. Assets and Liabilities: A thorough inventory of all assets being transferred, including equipment, supplies, intellectual property, and any liabilities associated with the business, such as outstanding debts or legal disputes. 5. Bulk Sales Act Compliance: This agreement ensures compliance with the California Bulk Sales Act, which protects creditors from potential fraud by requiring public notice of bulk transfers of business assets. 6. Representations and Warranties: Both parties are expected to make certain representations and warranties about the accuracy of information provided and their ability to enter into the agreement. 7. Confidentiality: In the case of confidential information being exchanged during the negotiation or execution of the agreement, confidentiality provisions must be included to prevent unauthorized disclosure. 8. Closing and Future Transition: The agreement should outline the specific steps and timeline for closing the transaction, transferring ownership of assets, and assisting the buyer during the transition phase. There may be variations of the Sacramento California Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price, tailored to different industries or specific circumstances. For example, a separate agreement might be needed for the sale of an online business or a franchise. In conclusion, a well-drafted agreement that complies with relevant laws like the Bulk Sales Act and provides a seller-financed purchase price option, is imperative to ensure a successful and legally sound business sale or purchase in Sacramento, California. Buyers and sellers should seek legal advice to fully understand their rights, obligations, and the intricacies associated with such agreements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sacramento California Acuerdo para la venta de negocios, incluido el cumplimiento de la Ley de ventas al por mayor y el vendedor para financiar parte del precio de compra - Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price

Description

How to fill out Sacramento California Acuerdo Para La Venta De Negocios, Incluido El Cumplimiento De La Ley De Ventas Al Por Mayor Y El Vendedor Para Financiar Parte Del Precio De Compra?

Creating forms, like Sacramento Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price, to manage your legal matters is a tough and time-consumming process. Many situations require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can take your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents crafted for various scenarios and life circumstances. We make sure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Sacramento Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price template. Simply log in to your account, download the template, and customize it to your needs. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as straightforward! Here’s what you need to do before downloading Sacramento Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price:

- Make sure that your template is specific to your state/county since the rules for creating legal documents may vary from one state another.

- Learn more about the form by previewing it or going through a brief intro. If the Sacramento Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to begin using our website and download the document.

- Everything looks great on your side? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your template is all set. You can try and download it.

It’s easy to locate and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!