Santa Clara California Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price: The Santa Clara California Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price is a legal document that outlines the terms and conditions of the sale of a business in Santa Clara, California. This agreement is specifically designed to ensure compliance with the Bulk Sales Act, a legislation aimed at protecting the interests of creditors during the sale of a business. Under this agreement, the seller of the business agrees to finance a portion of the purchase price, allowing the buyer to make payments over an agreed-upon period. This arrangement can be advantageous for both parties involved, as it provides the buyer with more flexible financing options and allows the seller to potentially earn additional income through the collection of interest on the financed amount. The Santa Clara California Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price typically includes the following key provisions: 1. Identification of the parties involved: The agreement clearly states the names and addresses of both the seller and the buyer. 2. Purchase price: The agreement specifies the total purchase price of the business, which may include both the upfront payment and the additional amount to be financed by the seller. 3. Payment terms: The agreement outlines the payment terms, including the amount of the down payment, the frequency and amount of subsequent payments, and any applicable interest rates. It may also include provisions for late payments and penalties. 4. Assets and liabilities: The agreement details the specific assets and liabilities that are included in the sale, ensuring that both parties have a clear understanding of what is being transferred. 5. Bulk Sales Act compliance: This section of the agreement ensures that all necessary steps are taken to comply with the Bulk Sales Act, including providing proper notice to creditors and addressing any outstanding claims or debts associated with the business. 6. Representations and warranties: The agreement may include representations and warranties made by both the seller and the buyer, ensuring that each party is legally authorized to enter into the agreement and that all the information provided is accurate. Types of Santa Clara California Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price: While there may not be specific "types" of this agreement, as each agreement will vary depending on the specific terms negotiated between the buyer and seller, there can be variations in the financing terms, such as: 1. Installment Payments: The buyer may negotiate to make equal monthly or quarterly payments until the financed amount is fully paid off. 2. Balloon Payment: Instead of regular installments, the buyer may agree to make smaller payments over the agreed-upon period, with a larger balloon payment due at the end to cover the remaining balance. 3. Interest Rates: Depending on the negotiation between the parties, the agreement may specify a fixed or variable interest rate on the financed amount. 4. Collateral: The agreement may include provisions for collateral, such as specific assets or personal guarantees, to secure the financed portion of the purchase price. Regardless of the specific terms, it is important for both parties to carefully review and understand the agreement before signing, and it is advised to seek legal counsel to ensure compliance with local laws and regulations.

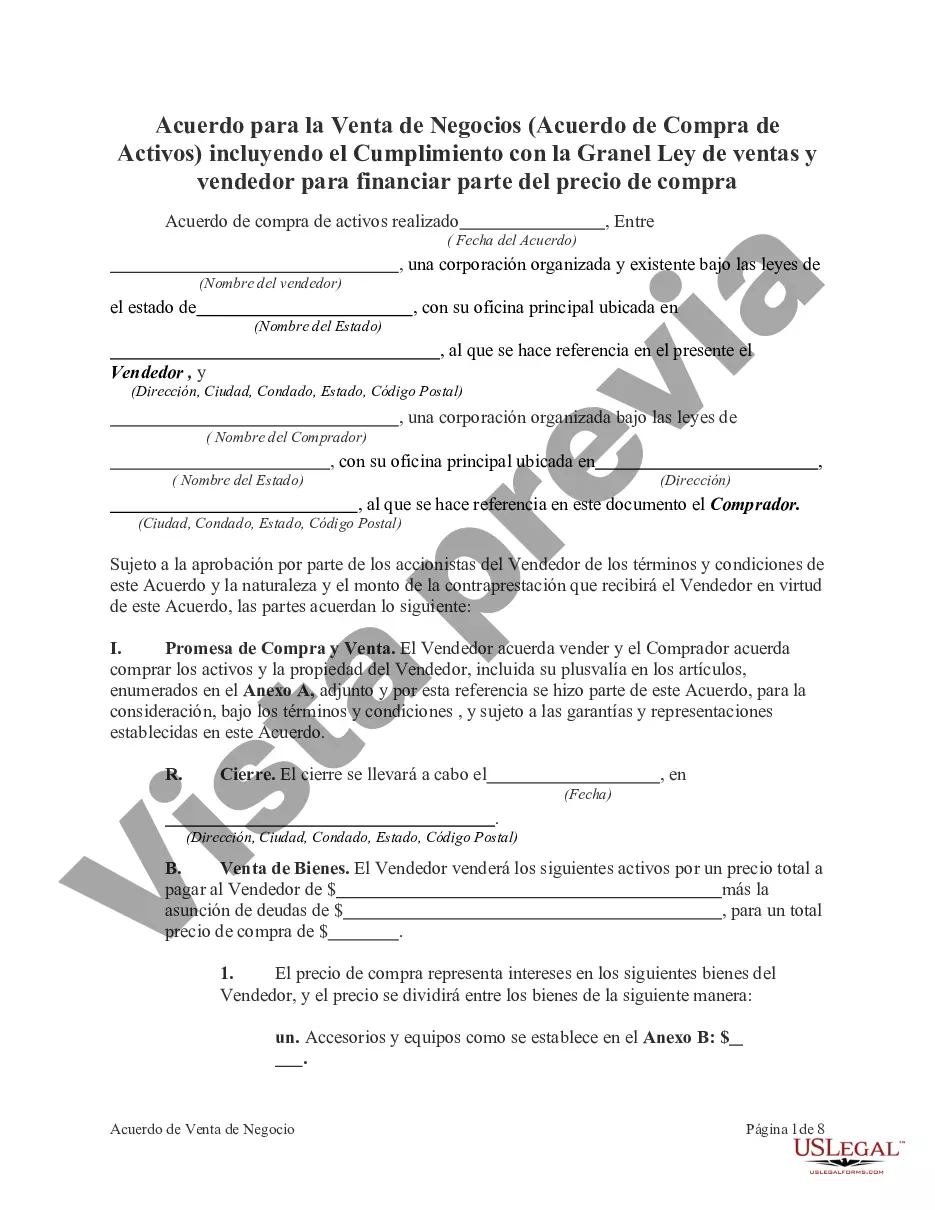

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Acuerdo para la venta de negocios, incluido el cumplimiento de la Ley de ventas al por mayor y el vendedor para financiar parte del precio de compra - Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price

Description

How to fill out Santa Clara California Acuerdo Para La Venta De Negocios, Incluido El Cumplimiento De La Ley De Ventas Al Por Mayor Y El Vendedor Para Financiar Parte Del Precio De Compra?

Whether you plan to start your company, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain documentation meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occurrence. All files are grouped by state and area of use, so picking a copy like Santa Clara Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to get the Santa Clara Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price. Follow the instructions below:

- Make sure the sample fulfills your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample once you find the proper one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Santa Clara Agreement for Sale of Business Including Compliance with Bulk Sales Act and Seller to Finance Part of Purchase Price in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!