Collin Texas, located in the United States, is a vibrant county known for its thriving small business ecosystem. This article provides an in-depth description of what Collin Texas offers to small businesses, particularly focusing on the importance of implementing collection letters in advance to maintain healthy financial operations. Furthermore, it explores various types of collection letters commonly used by small businesses in Collin Texas. Collin Texas provides a conducive environment for entrepreneurs and small business owners to establish and grow their ventures. With its diverse economy and proximity to major metropolitan areas like Dallas and Plano, Collin Texas offers abundant opportunities and a customer base that supports local businesses. When it comes to ensuring a smooth cash flow and preventing payment delays or defaults, small businesses in Collin Texas often utilize collection letters in advance. A collection letter acts as a formal communication tool to kindly remind customers about outstanding payments and request prompt settlement of overdue bills. By sending such letters in advance, small business owners can actively address payment issues, avoiding potential disruption to their financial stability. Here are a few types of collection letters commonly employed by small businesses in Collin Texas: 1. Initial Notice of Payment: This type of collection letter is usually the first step taken by a small business to bring attention to an overdue payment. It includes essential details such as the outstanding amount, invoice number, and a polite request for payment within a specified timeframe. 2. Follow-Up Reminder: If the initial notice of payment doesn't receive a response or payment, a follow-up reminder is sent. This letter reiterates the overdue status, emphasizes the importance of clearing the outstanding balance, and may include potential consequences of non-payment, such as late fees or credit reporting. 3. Final Demand Letter: If the previous letters fail to elicit a satisfactory response, a final demand letter is sent. This letter serves as the last formal notice before escalating the matter to legal action or a collection agency. It outlines the consequences of continued non-payment and may provide a final opportunity for the debtor to settle the debt before taking further action. 4. Goodwill Letter: Occasionally, small businesses in Collin Texas may use a goodwill letter as a compassionate approach to addressing payment issues with valued customers. This letter empathizes with the debtor's circumstances, expresses understanding, and proposes mutually beneficial solutions to clear the outstanding balance. By using these collection letters in advance, small businesses in Collin Texas can effectively manage their accounts receivable, maintain positive cash flow, and ensure the continuity of their operations. In conclusion, Collin Texas provides an ideal setting for small businesses seeking growth and success. Implementing collection letters in advance is a crucial strategy to safeguard financial stability. This article has outlined different types of collection letters frequently used by small businesses in Collin Texas as an effective means to ensure timely payments and maintain healthy business relationships.

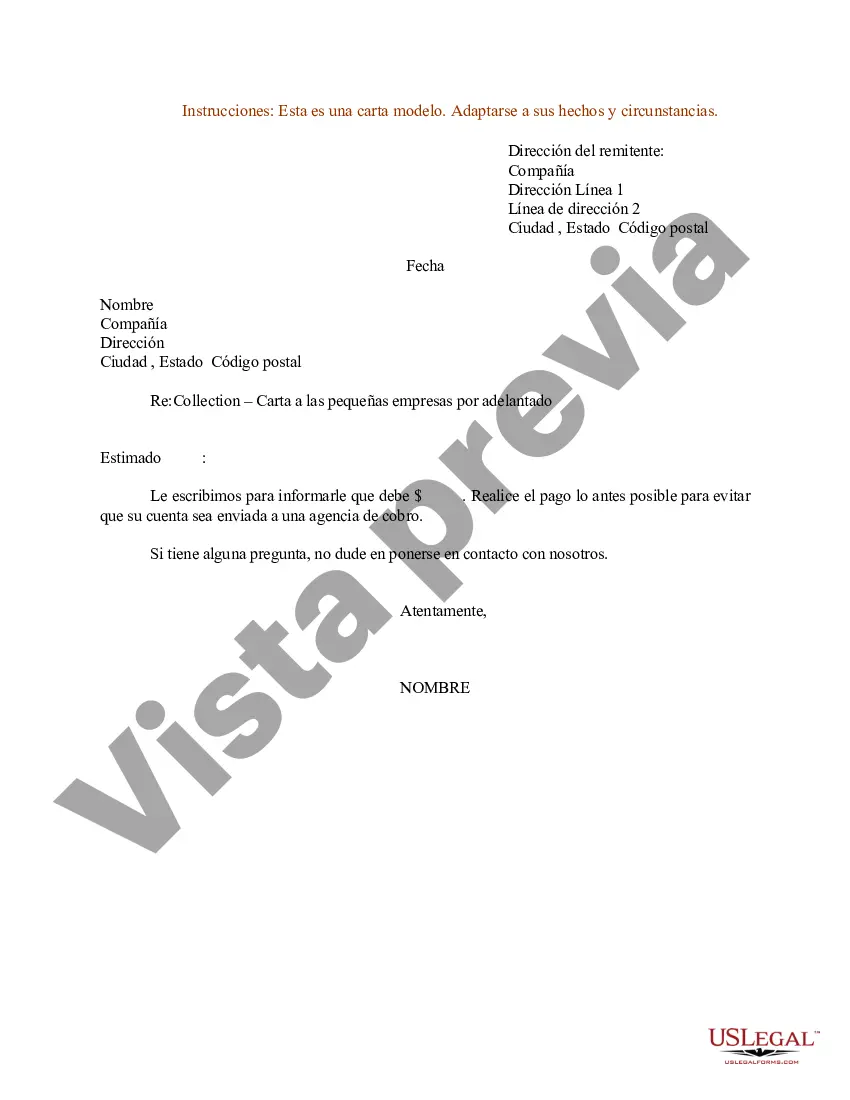

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Ejemplo de una carta de cobro a una pequeña empresa por adelantado - Sample of a Collection Letter to Small Business in Advance

Description

How to fill out Collin Texas Ejemplo De Una Carta De Cobro A Una Pequeña Empresa Por Adelantado?

Dealing with legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Collin Sample of a Collection Letter to Small Business in Advance, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in various categories ranging from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching experience less challenging. You can also find detailed materials and tutorials on the website to make any tasks related to paperwork execution straightforward.

Here's how to locate and download Collin Sample of a Collection Letter to Small Business in Advance.

- Take a look at the document's preview and description (if available) to get a general information on what you’ll get after getting the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can impact the legality of some documents.

- Check the related forms or start the search over to locate the appropriate document.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment gateway, and buy Collin Sample of a Collection Letter to Small Business in Advance.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Collin Sample of a Collection Letter to Small Business in Advance, log in to your account, and download it. Of course, our website can’t replace a lawyer entirely. If you have to cope with an extremely challenging case, we recommend using the services of a lawyer to examine your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Become one of them today and get your state-specific documents with ease!