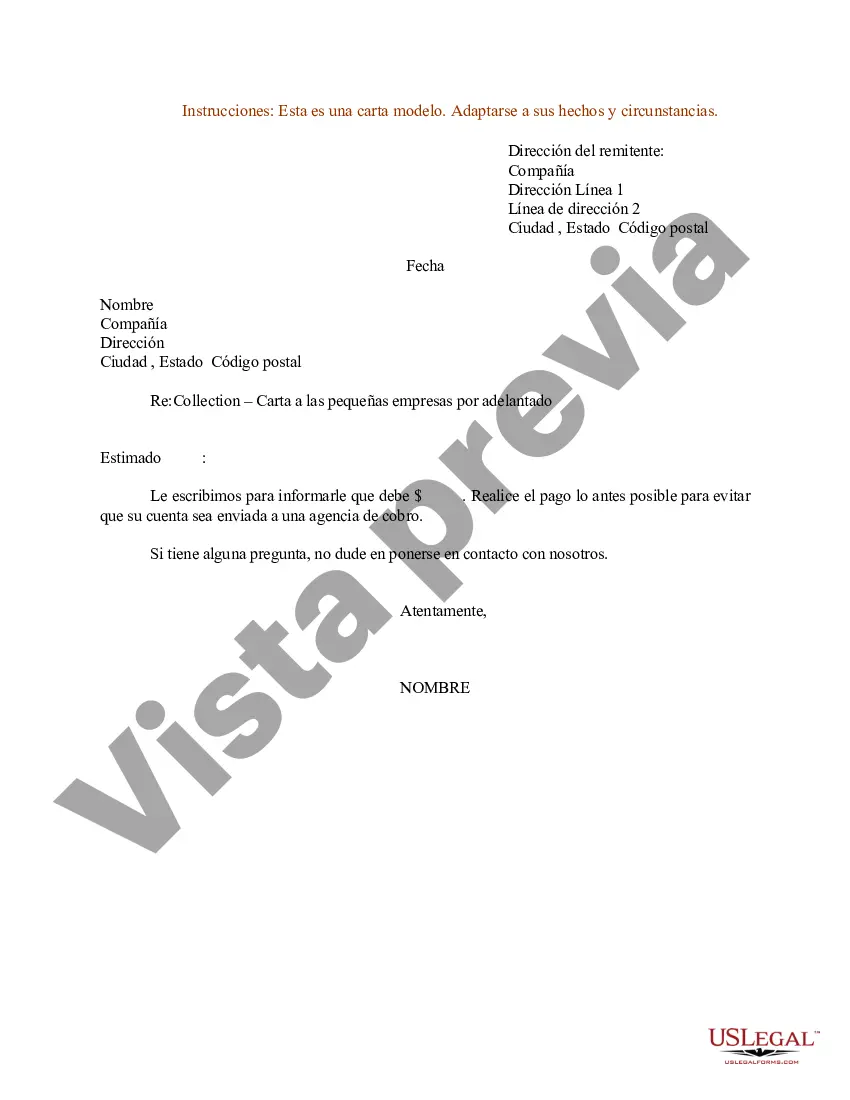

Title: Collection Letter to Small Business in Houston, Texas: A Detailed Description Introduction: When businesses face outstanding payments from their clients, it becomes necessary to send a collection letter to prompt payment and maintain a smooth cash flow. In Houston, Texas, several types of collection letters cater to different scenarios. This article provides a comprehensive overview of collection letters for small businesses in advance, highlighting their significance and offering a sample letter format. 1. Importance of Collection Letters: Collection letters are crucial for small businesses in Houston, Texas, as they ensure effective communication and help recover overdue payments. By maintaining a professional tone and addressing the matter promptly, businesses can preserve their financial stability and safeguard relationships with their clients. 2. Sample Collection Letter to Small Business in Advance: Here's a sample collection letter format tailored specifically for small businesses in Houston, Texas, seeking to recover outstanding payments in advance: [Your Company's Letterhead] [Your Company's Name] [Your Company's Address] [City, State, ZIP Code] [Date] [Client's Name] [Client's Company Name] [Client's Address] [City, State, ZIP Code] Subject: Payment Reminder — Outstanding Balance Due Dear [Client's Name], I hope this letter finds you well. We appreciate your continued business and the trust you have placed in our services/products. However, we have noticed that your account (#XXX) currently carries an outstanding balance of [Amount due]. This payment was due on [Due date], as outlined in the invoice sent to you on [Invoice date]. We understand that unexpected situations can arise, but prompt payment is crucial for the smooth functioning of our business. As a valued client, we kindly request that you settle the outstanding balance within 10 business days from the receipt of this letter. To facilitate a seamless payment process, I have attached a copy of the invoice along with the details of our accepted payment methods. Should you have any queries or require assistance in resolving this matter, please do not hesitate to contact our accounting department at [Phone number] or [Email address]. Your cooperation is genuinely appreciated. Thank you for your immediate attention to this matter. We value our business relationship and aim to resolve this matter amicably. We look forward to your prompt resolution. Sincerely, [Your Name] [Your Position/Title] [Your Company's Contact Information] 3. Types of Collection Letters in Houston, Texas: — **Initial Reminder Letters**: Sent shortly after payment becomes due to inform the client about the outstanding balance. — **Second and Third Reminder Letters**: Sent when the initial reminder letter fails to yield payment, increasing the urgency for settlement. — **Final Demand Letters**: Used as a last resort to warn clients of the potential consequences, such as legal action, if payment is not made promptly. Conclusion: Whether it is an initial reminder or final demand letter, collection letters play a vital role for small businesses in Houston, Texas, to ensure timely payment. Adhering to a professional tone while addressing the issue is crucial to preserving client relationships. By utilizing the provided sample format and understanding the various types of collection letters, small businesses in Houston can enhance their chances of successful debt recovery.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Ejemplo de una carta de cobro a una pequeña empresa por adelantado - Sample of a Collection Letter to Small Business in Advance

Description

How to fill out Houston Texas Ejemplo De Una Carta De Cobro A Una Pequeña Empresa Por Adelantado?

How much time does it typically take you to create a legal document? Given that every state has its laws and regulations for every life scenario, finding a Houston Sample of a Collection Letter to Small Business in Advance meeting all regional requirements can be tiring, and ordering it from a professional attorney is often pricey. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, gathered by states and areas of use. Apart from the Houston Sample of a Collection Letter to Small Business in Advance, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Specialists check all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can retain the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Houston Sample of a Collection Letter to Small Business in Advance:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Houston Sample of a Collection Letter to Small Business in Advance.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!