Palm Beach Florida is a sunny and vibrant coastal town located in the southeastern part of the state. Known for its luxurious lifestyle, pristine beaches, and world-class resorts, Palm Beach is a popular destination for tourists and residents alike. With its tropical climate and picturesque landscapes, Palm Beach offers a plethora of outdoor activities such as boating, fishing, golfing, and relaxing beach walks. The town is also home to stunning botanical gardens, nature preserves, and wildlife sanctuaries, providing visitors with ample opportunities to immerse themselves in the region's natural beauty. Palm Beach is renowned for its exquisite shopping and dining experiences. The vibrant downtown area is lined with upscale boutiques, designer shops, and fine dining restaurants. The internationally renowned Worth Avenue stands out as one of Palm Beach's premier shopping destinations, offering high-end fashion brands, art galleries, and specialty stores. For those seeking cultural attractions, Palm Beach hosts various art exhibitions, music festivals, and theater performances throughout the year. The Travis Center for the Performing Arts is an iconic venue that showcases Broadway shows, concerts by acclaimed musicians, and ballet performances. Palm Beach is also home to numerous elite clubs and exclusive resorts, attracting affluent visitors from around the world. The Breakers, an iconic oceanfront hotel, provide guests with luxurious amenities, exceptional dining options, and a private beach. When it comes to accommodations, Palm Beach offers a wide range of options. From lavish beachfront resorts to boutique hotels and charming bed and breakfasts, visitors can find the perfect place to stay that caters to their preferences and budget. As for different types of collection letters addressed to small businesses in advance, they can vary based on the situation and the purpose of the letter. Some common types include: 1. Friendly Reminder: This type of collection letter is used when a small business wants to gently remind clients or customers about an upcoming payment deadline. It typically includes polite language and includes information about the outstanding balance and payment due date. 2. Past Due Notice: If a small business has not received payment by the due date, a past due notice can be sent. This type of collection letter highlights the overdue balance, emphasizes the consequences of non-payment, and provides clear instructions on how to resolve the issue. 3. Demand for Payment: A demand for payment letter is a formal and assertive communication that asserts the small business's right to receive payment for goods or services. It may include a final warning before legal action is taken if the matter remains unresolved. 4. Final Notice: A final notice is typically the last attempt to collect an outstanding debt before legal action is pursued. It is often more formal and less forgiving than previous letters, clearly conveying the severe consequences of continued non-payment. 5. Legal Action Warning: If all previous attempts to collect payment have failed, a small business may send a collection letter warning the recipient of imminent legal action. This letter serves as a last effort to resolve the issue before pursuing legal remedies. It is essential to tailor collection letters to the specific circumstances and maintain professionalism and empathy while communicating with small businesses to ensure a favorable resolution.

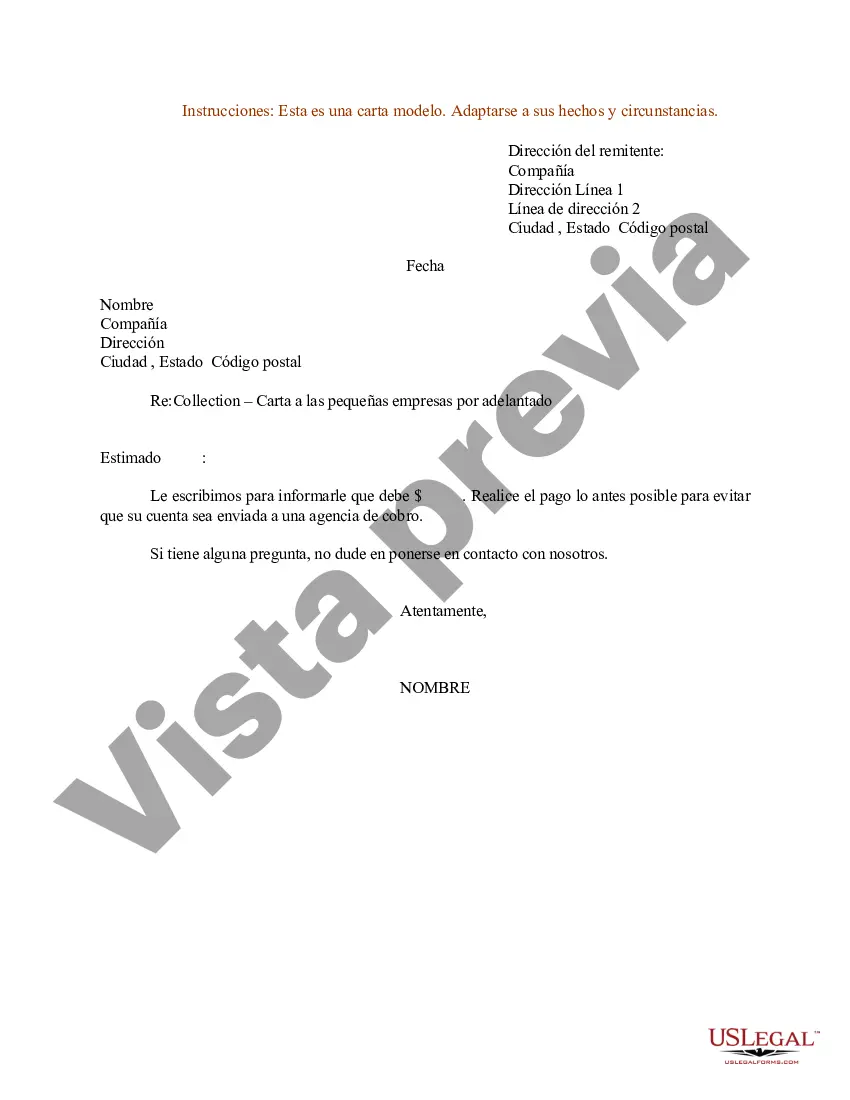

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Beach Florida Ejemplo de una carta de cobro a una pequeña empresa por adelantado - Sample of a Collection Letter to Small Business in Advance

Description

How to fill out Palm Beach Florida Ejemplo De Una Carta De Cobro A Una Pequeña Empresa Por Adelantado?

If you need to find a reliable legal document provider to find the Palm Beach Sample of a Collection Letter to Small Business in Advance, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can search from over 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of learning materials, and dedicated support team make it simple to get and execute various paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply select to look for or browse Palm Beach Sample of a Collection Letter to Small Business in Advance, either by a keyword or by the state/county the document is created for. After finding the necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Palm Beach Sample of a Collection Letter to Small Business in Advance template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and select a subscription plan. The template will be instantly ready for download once the payment is processed. Now you can execute the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes this experience less expensive and more affordable. Create your first business, arrange your advance care planning, create a real estate agreement, or complete the Palm Beach Sample of a Collection Letter to Small Business in Advance - all from the comfort of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

Usted puede dirigir una demanda a la parte que le debe una deuda. En su demanda, usted debe ser lo mas especifico posible sobre la deuda que usted crea que se le debe, y solicitar que la deuda se pague en una fecha determinada.

Detalles que incluyen el numero de factura, la fecha y el monto. Mencion de intentos anteriores de cobrar. Indique claramente que la factura esta vencida. Una advertencia y acciones especificas que planea tomar si el pago no se recibe dentro de un numero especifico de dias.

La carta de cobro es el documento mas importante para cualquier medico que trabaje con seguros, especialmente con seguros privados. Este documento es «el permiso» que le da la aseguradora al medico de completar su tramite y recibir su dinero.

Buenos dias XXX, A pesar de mi mensaje anterior del dia XXX y salvo error por mi parte, sigo sin recibir el pago de la factura XXX con fecha XXX e importe XXX que adjunto en copia. Espero un pago inmediato. De no ser asi, tendre que tomar medidas formales para ejercer mi derecho al cobro.

Una carta de solicitud de pago debe ser cortes, clara y debe ofrecer detalles sobre el infraccion que esta cometiendo el cliente. Utiliza el membrete de la compania, ya que contiene toda la informacion sobre la organizacion y, a menudo se ve mas formal. La carta debe estar dirigida a una persona en concreto.

Como pedirle a alguien que te pague por el trabajo Evita que pase demasiado tiempo desde la fecha de vencimiento del pago.Configura un horario de envio de correos electronicos.Envia recordatorios amables antes de la fecha de vencimiento.Envia un correo electronico cortes pero directo en la fecha de vencimiento.

Analiza los procesos de cobro y crea informes. Categoriza a los clientes. Adecua servicios y productos a las particularidades del cliente. Establece una politica de credito y cobranza y hazla publica. Toma en cuenta el autoservicio. Limita parcialmente beneficios a clientes deudores.

Lo primero que debe hacer para cobrar de manera forzada una deuda es presentar una demanda solicitando a un juez civil, o a uno de pequenas causas, que ordene el pago que se le debe usted o que haga cumplir la obligacion al moroso. Esta demanda debe ser interpuesta en el municipio donde reside la persona en mora.

La carta de cobro es el documento mas importante para cualquier medico que trabaje con seguros, especialmente con seguros privados. Este documento es «el permiso» que le da la aseguradora al medico de completar su tramite y recibir su dinero.

El objetivo prioritario de una carta de reclamacion de pago es que el deudor la lea en su integridad en el mismo momento de recibirla. El acreedor debe despertar el interes del deudor para que dedique unos minutos a leer la misiva. Los otros objetivos de la carta son: Informar al cliente de la existencia de un impago.