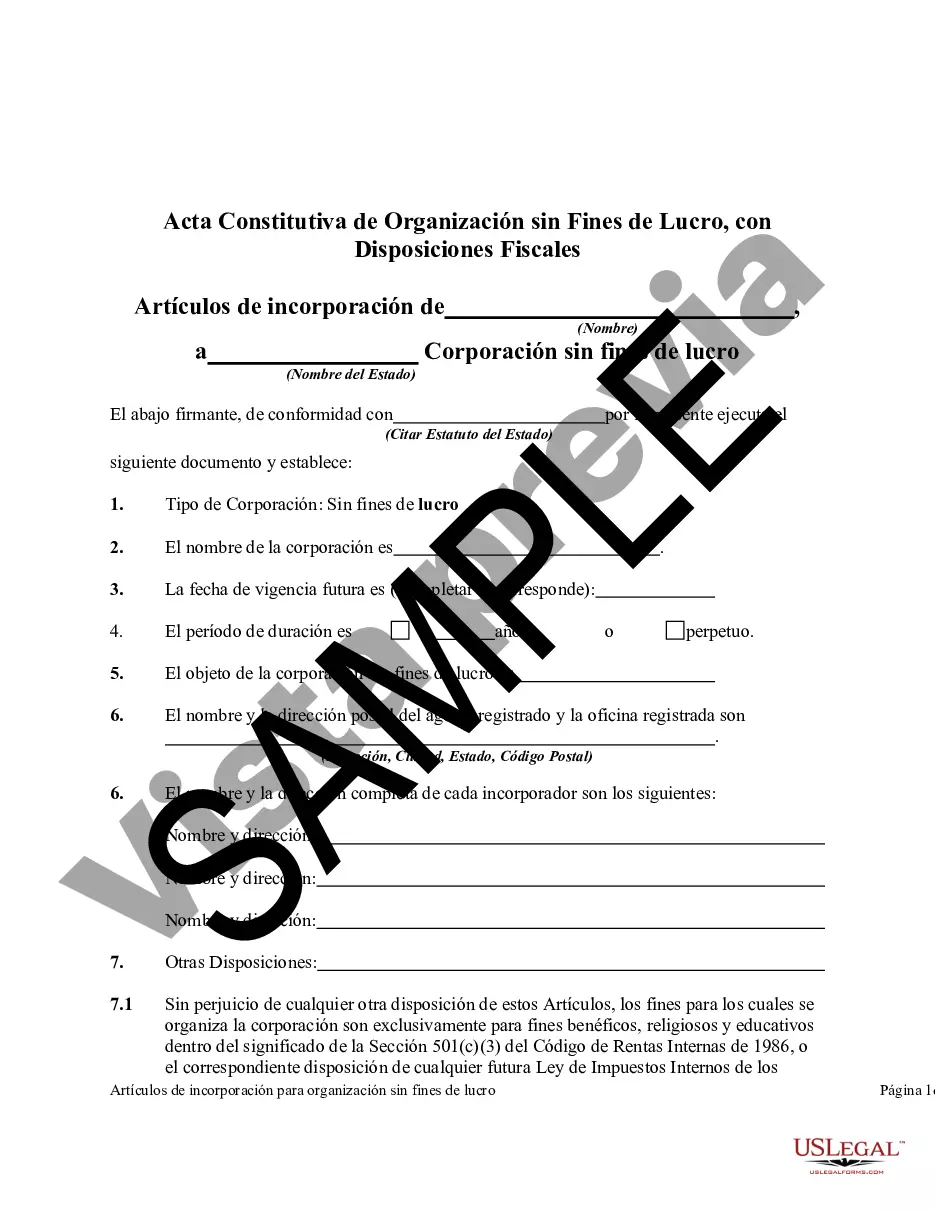

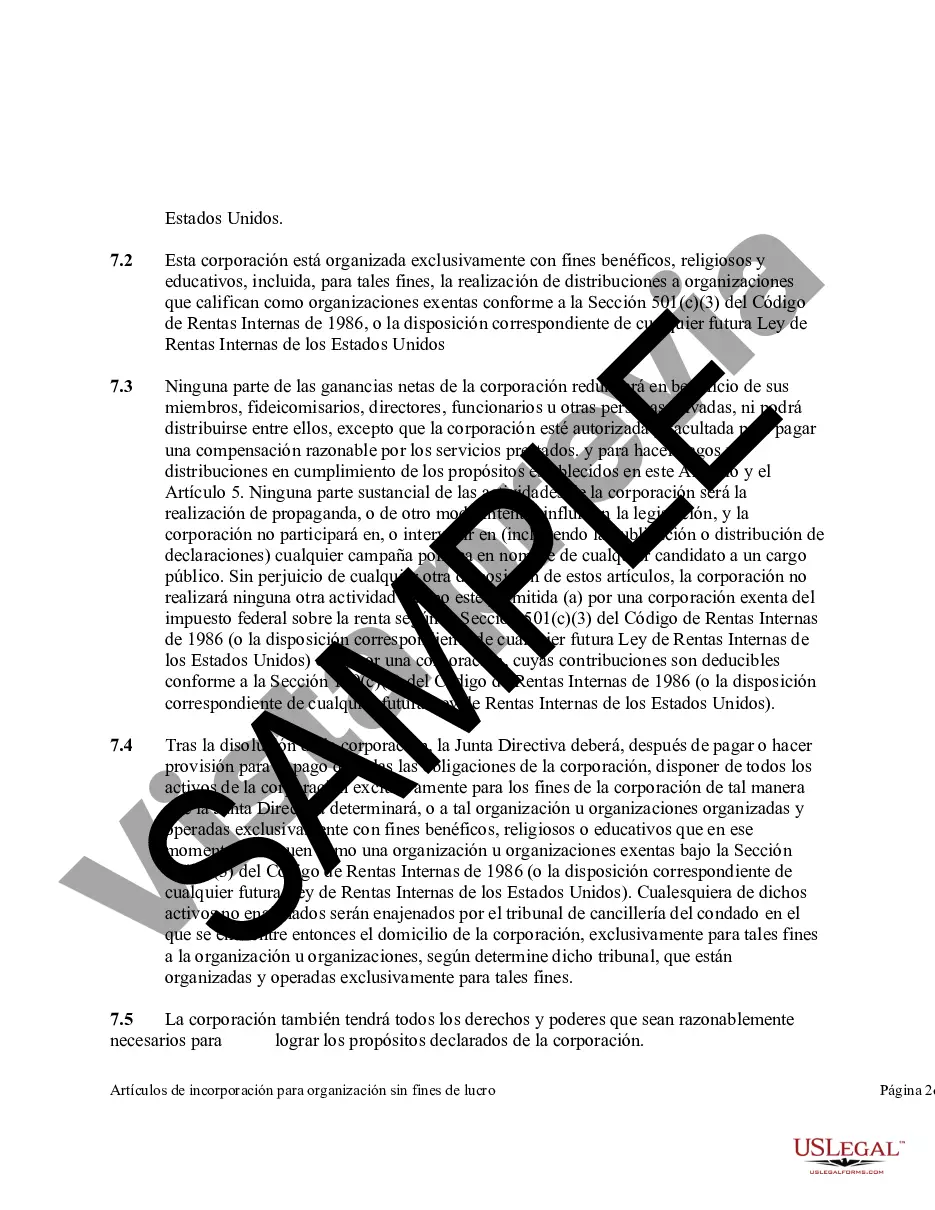

Title: Understanding Maricopa Arizona Articles of Incorporation for Non-Profit Organization with Tax Provisions Introduction: In Maricopa, Arizona, non-profit organizations play a significant role in serving the community and making a positive impact. To establish a non-profit organization, the first step involves filing the Articles of Incorporation. This article aims to provide a detailed description of Maricopa Arizona's Articles of Incorporation for Non-Profit Organizations, highlighting essential tax provisions. Moreover, it will also explore additional types of Articles of Incorporation with tax provisions commonly utilized in Maricopa, Arizona. 1. Maricopa Arizona Articles of Incorporation for Non-Profit Organization: The Articles of Incorporation serve as a legal document required to register a non-profit organization in Maricopa, Arizona. This document sets out various key provisions, including: a. Name and Purpose: The Articles outline the official name and the purpose for which the non-profit organization is formed. The statement should be clear, concise, and in compliance with state laws. b. Organizational Structure: This section outlines the organization's structure, including the roles of directors and officers and how decisions are made. c. Membership: The Articles detail whether the non-profit organization will have members or be a membership-free organization. d. Registered Agent and Address: A registered agent, residing in Arizona, must be appointed to receive legal and official documents on behalf of the organization. e. Dissolution Clause: This clause explains the process for dissolving the non-profit organization if required. 2. Additional Types of Maricopa Arizona Articles of Incorporation for Non-Profit Organization with Tax Provisions: In addition to the standard Articles of Incorporation, there are specific types that focus on incorporating tax provisions, such as: a. 501(c)(3) Tax-Exempt Status: Organizations seeking federal tax-exempt status under section 501(c)(3) of the Internal Revenue Code must include specific language stating their commitment to operate exclusively for charitable, educational, religious, or scientific purposes. b. 501(c)(4) Social Welfare Organizations: If forming a social welfare organization, under section 501(c)(4) of the Internal Revenue Code, additional language outlining the organization's purpose and activities related to community betterment and social welfare should be included. c. 501(c)(6) Business or Professional Associations: For organizations aiming to qualify as business or professional associations for tax-exempt status under section 501(c)(6) of the Internal Revenue Code, specific provisions regarding its purpose, structure, and activities should be addressed. Conclusion: Understanding the Maricopa Arizona Articles of Incorporation for Non-Profit Organization with Tax Provisions is crucial for establishing a legally compliant and tax-exempt non-profit organization. Whether applying for 501(c)(3), 501(c)(4), or 501(c)(6) status, it's essential to include the relevant provisions and language to meet the requirements. By adhering to these important guidelines, non-profit organizations in Maricopa, Arizona can operate effectively while also benefiting from tax exemptions and fulfilling their philanthropic goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Acta Constitutiva de Organización sin Fines de Lucro, con Disposiciones Fiscales - Articles of Incorporation for Non-Profit Organization, with Tax Provisions

Description

How to fill out Maricopa Arizona Acta Constitutiva De Organización Sin Fines De Lucro, Con Disposiciones Fiscales?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Maricopa Articles of Incorporation for Non-Profit Organization, with Tax Provisions, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Maricopa Articles of Incorporation for Non-Profit Organization, with Tax Provisions from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Maricopa Articles of Incorporation for Non-Profit Organization, with Tax Provisions:

- Examine the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template once you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!