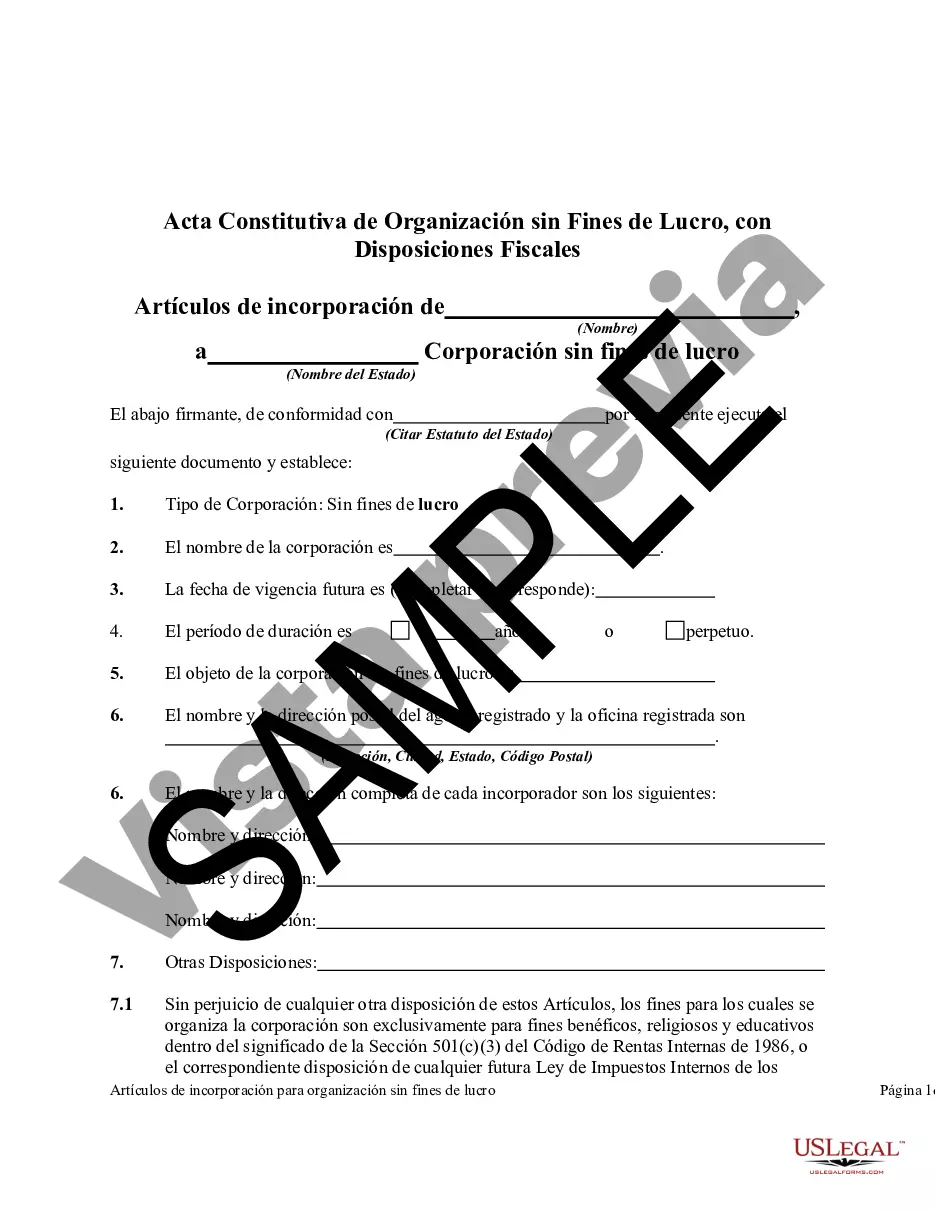

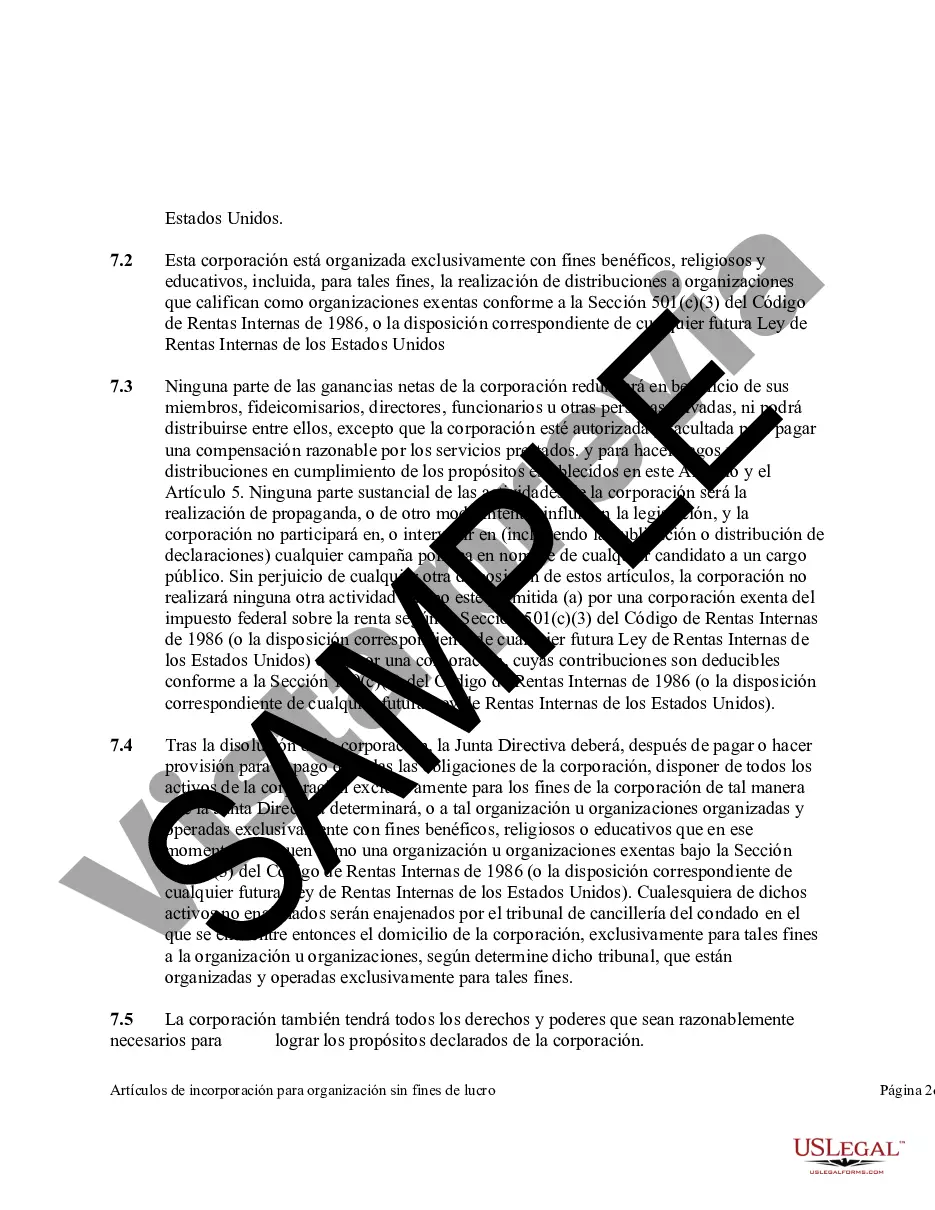

Orange, California is a vibrant city located in Orange County, California. Known for its rich history, charming neighborhoods, and stunning landscapes, Orange is a popular destination for residents and tourists alike. From its historic Old Town district to its beautiful parks and cultural attractions, Orange offers a wealth of experiences for all to enjoy. Now let's delve into the specifics of the Articles of Incorporation for a Non-Profit Organization in Orange, California, with a focus on tax provisions. The Articles of Incorporation provide essential information regarding the formation and operation of a nonprofit organization. They outline the organization's purpose, structure, and governance, ensuring its compliance with both state and federal regulations. When it comes to nonprofit organizations in Orange, there are specific Articles of Incorporation that address tax provisions and exemptions. One type of Orange California Articles of Incorporation for Non-Profit Organizations is specifically tailored to organizations seeking 501(c)(3) tax-exempt status. Obtaining this status is crucial for nonprofits as it allows them to receive tax-deductible donations and grants. These Articles of Incorporation must conform to the requirements set forth by the Internal Revenue Service (IRS) and the California Franchise Tax Board (FT). They typically include provisions explaining the organization's charitable purpose, limitations on activities, dissolution clauses, and provisions regarding the distribution of assets upon dissolution. Another type of Orange California Articles of Incorporation for Non-Profit Organizations is designed for organizations applying for tax exemptions other than 501(c)(3). While these organizations may not be eligible for the same tax benefits as 501(c)(3) organizations, they can still qualify for certain exemptions and reduced tax rates. These Articles of Incorporation will contain specific clauses and provisions based on the nature of the nonprofit, whether it be educational, religious, charitable, or another qualifying purpose recognized by the IRS and FT. In summary, the Articles of Incorporation for Non-Profit Organizations in Orange, California, with tax provisions, play a crucial role in establishing the legal framework and tax status of a nonprofit. Understanding and correctly drafting these articles is essential for organizations seeking tax-exempt status or related benefits. By complying with the regulations set by the IRS and FT, nonprofits can focus on their mission and contribute to the betterment of Orange and the surrounding communities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Acta Constitutiva de Organización sin Fines de Lucro, con Disposiciones Fiscales - Articles of Incorporation for Non-Profit Organization, with Tax Provisions

Description

How to fill out Orange California Acta Constitutiva De Organización Sin Fines De Lucro, Con Disposiciones Fiscales?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask an attorney to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Orange Articles of Incorporation for Non-Profit Organization, with Tax Provisions, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Therefore, if you need the current version of the Orange Articles of Incorporation for Non-Profit Organization, with Tax Provisions, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Orange Articles of Incorporation for Non-Profit Organization, with Tax Provisions:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Orange Articles of Incorporation for Non-Profit Organization, with Tax Provisions and download it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!