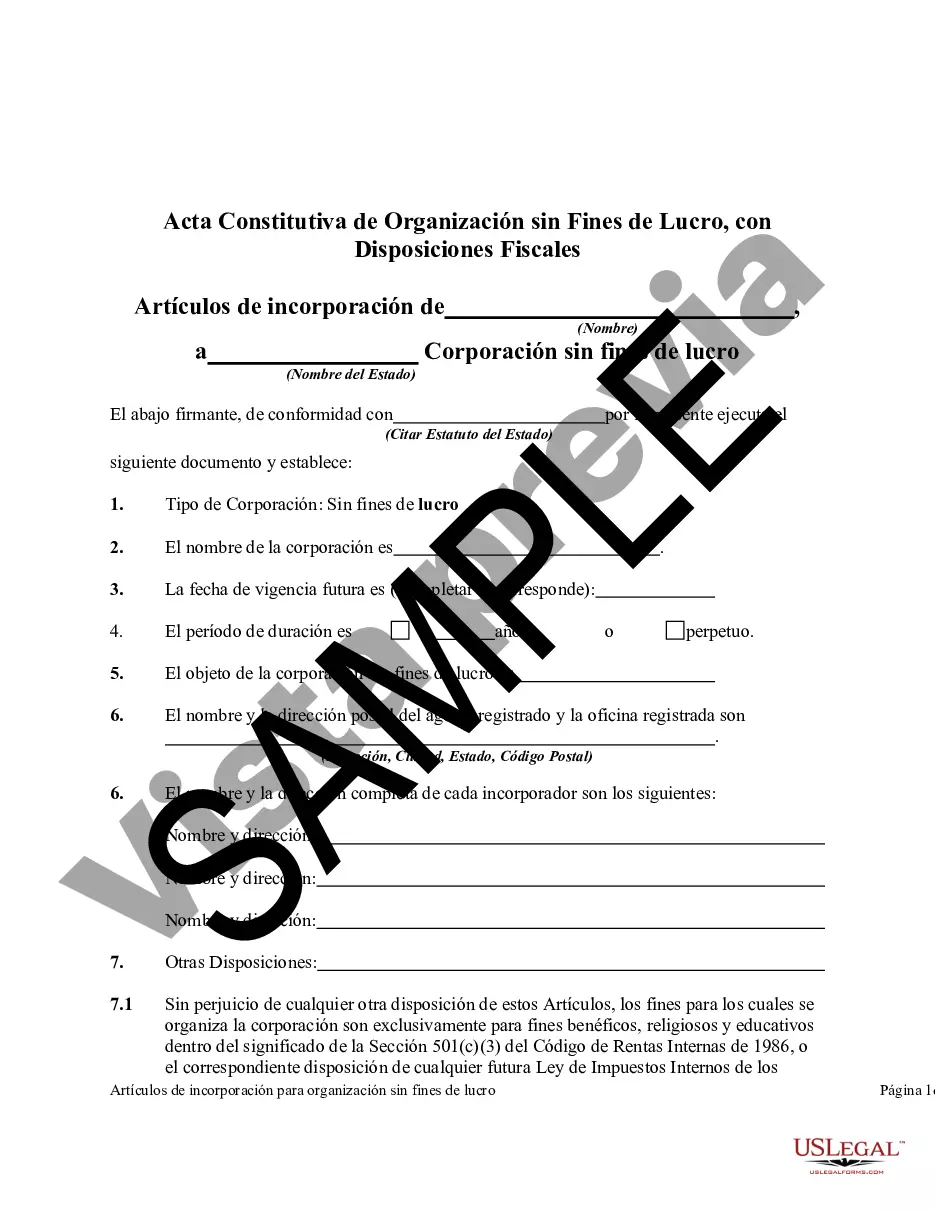

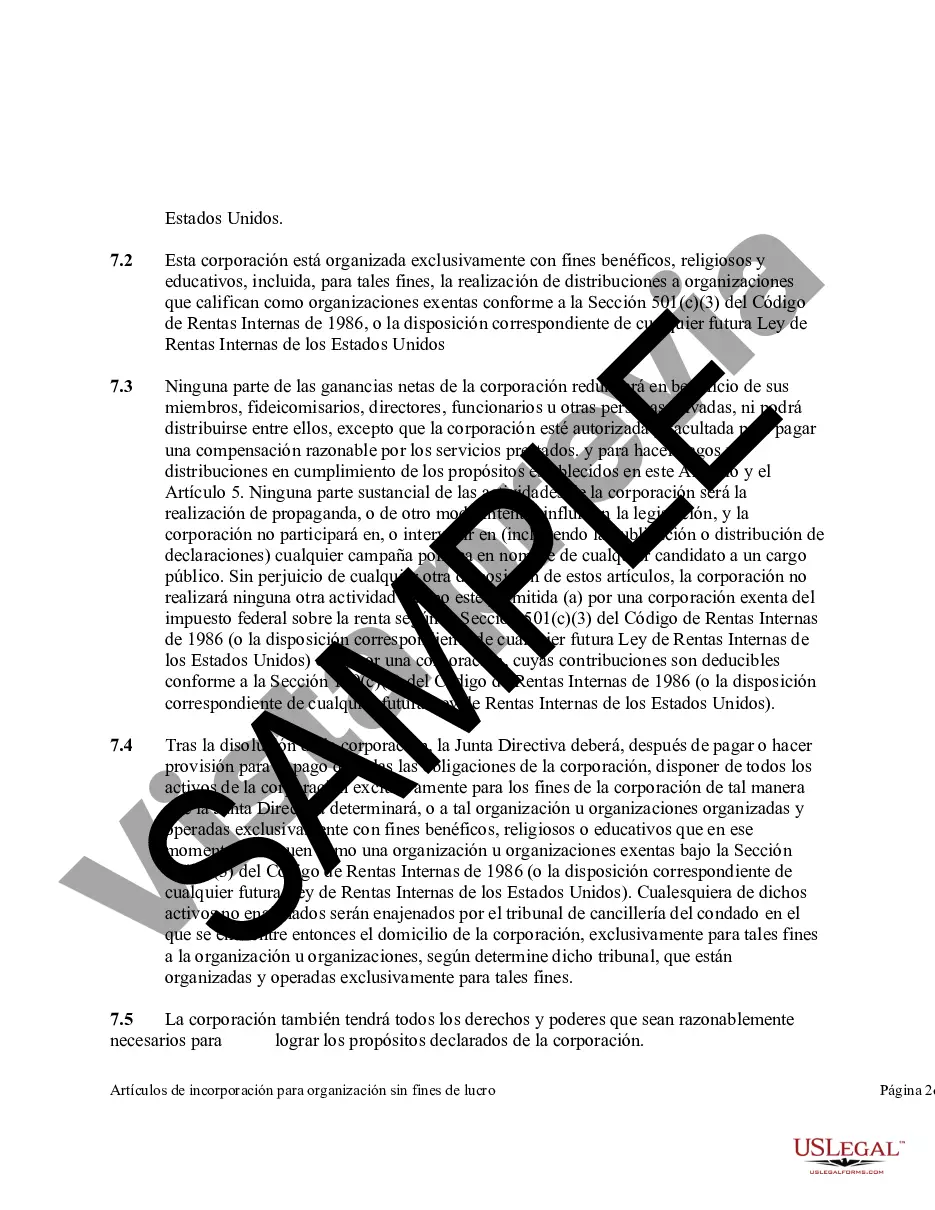

Palm Beach, Florida is a renowned coastal town located in Palm Beach County. It is known for its beautiful beaches, luxury resorts, prestigious golf courses, and vibrant social scene. Palm Beach is a popular destination among tourists and a sought-after residential area for affluent individuals. Now, let's delve into the topic of Articles of Incorporation for Non-Profit Organizations in Palm Beach, Florida, specifically focusing on tax provisions. The Articles of Incorporation are a legal document that establishes the existence and purpose of a non-profit organization. In Palm Beach, Florida, non-profit organizations are required to adhere to specific legal guidelines to operate lawfully. The Articles of Incorporation for Non-Profit Organizations in Palm Beach, Florida typically consist of several important provisions related to taxes. Tax provisions play a crucial role in the financial management of non-profit organizations, as they determine the tax-exempt status and the organization's ability to receive tax-deductible donations. One prominent type of Articles of Incorporation for Non-Profit Organizations in Palm Beach, Florida is the 501(c)(3) corporation. This type of non-profit organization is recognized by the Internal Revenue Service (IRS) as exempt from federal income taxes. However, to qualify for this tax-exempt status, a non-profit organization must meet specific criteria, such as operating exclusively for charitable, educational, religious, or scientific purposes. Another type of Articles of Incorporation relevant to Palm Beach, Florida is the community foundation. Community foundations are non-profit organizations that focus on improving a specific geographical area by managing and distributing charitable funds. These organizations play a significant role in supporting local causes and initiatives within the Palm Beach community. When drafting the Articles of Incorporation for Non-Profit Organizations in Palm Beach, Florida, it is essential to include specific tax provisions to ensure compliance with federal and state regulations. These provisions may cover topics such as the organization's purpose, limitations on activities, and the distribution of assets upon dissolution. To preserve their tax-exempt status, non-profit organizations in Palm Beach, Florida must adhere to ongoing reporting requirements and maintain accurate financial records. This includes filing annual information returns (Form 990) with the IRS to disclose financial information and ensure transparency. In conclusion, Palm Beach, Florida offers a favorable environment for non-profit organizations aiming to make a positive impact. The Articles of Incorporation for Non-Profit Organizations with Tax Provisions in Palm Beach play a vital role in establishing and maintaining compliance with tax regulations and requirements. The 501(c)(3) corporation and community foundation are two notable types of non-profit organizations commonly found in Palm Beach, Florida. By incorporating specific tax provisions into their Articles of Incorporation, non-profit organizations in Palm Beach can maximize their tax-exempt status and effectively pursue their philanthropic missions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Beach Florida Acta Constitutiva de Organización sin Fines de Lucro, con Disposiciones Fiscales - Articles of Incorporation for Non-Profit Organization, with Tax Provisions

Description

How to fill out Palm Beach Florida Acta Constitutiva De Organización Sin Fines De Lucro, Con Disposiciones Fiscales?

Whether you intend to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business case. All files are grouped by state and area of use, so picking a copy like Palm Beach Articles of Incorporation for Non-Profit Organization, with Tax Provisions is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few more steps to obtain the Palm Beach Articles of Incorporation for Non-Profit Organization, with Tax Provisions. Adhere to the guide below:

- Make sure the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to obtain the file once you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Palm Beach Articles of Incorporation for Non-Profit Organization, with Tax Provisions in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!