San Diego, California, known as America's Finest City, is a vibrant coastal city located in Southern California. With its beautiful beaches, diverse culture, and perfect weather, San Diego attracts millions of visitors every year. In addition to being a popular tourist destination, San Diego is also home to a thriving business community and numerous non-profit organizations that play a crucial role in the city's development. Non-profit corporations in San Diego, like in any other city, often require financial assistance to fulfill their missions. In certain cases, refinancing loans can be a viable solution for non-profit organizations to manage their finances effectively. The Board of Trustees of these corporations plays a crucial role in authorizing the refinancing of a loan. Minutes and resolutions of the Board of Trustees of a non-profit corporation authorizing the refinancing of a loan are vital documents that demonstrate the decision-making process and provide a legal record of the actions taken. These documents outline the specific details and terms of the refinancing, ensuring transparency and accountability within the organization. When it comes to different types of San Diego California Minutes and Resolutions of the Board of Trustees of a Non-Profit Corporation Authorizing the Refinancing of a Loan, they can vary based on various factors. Some possible variations and scenarios of these minutes and resolutions may include: 1. Regular Meeting Minutes: These minutes and resolutions document a routine board meeting where the refinancing decision was discussed and approved, covering the necessary details and reasons behind the refinancing. 2. Emergency Meeting Minutes: In urgent situations where immediate refinancing is required to address financial challenges or unforeseen circumstances, the board may hold an emergency meeting to authorize the refinancing. These minutes and resolutions highlight the urgency and critical nature of the decision. 3. Special Meeting Minutes: If a specific issue related to refinancing arises between regular meetings, the board may convene for a special meeting solely dedicated to discussing and authorizing the refinancing. These minutes concentrate on the specific refinancing matter at hand. 4. Unanimous Written Consent Resolution: In some cases, the board may choose to bypass a formal meeting and seek unanimous written consent from all the trustees. This type of resolution consolidates the trustees' agreement on refinancing and serves as a legally binding document. 5. Board Resolution for Loan Refinancing: A comprehensive board resolution can be drafted to detail the terms and conditions of the refinancing, including interest rates, payment plans, and any additional stipulations. This resolution provides a comprehensive overview of the refinancing decision, creating an official record that can guide future actions. By carefully documenting and authorizing the refinancing of a loan, non-profit corporations in San Diego strive to ensure financial stability and sustainability, enabling them to continue making a positive impact on the community they serve.

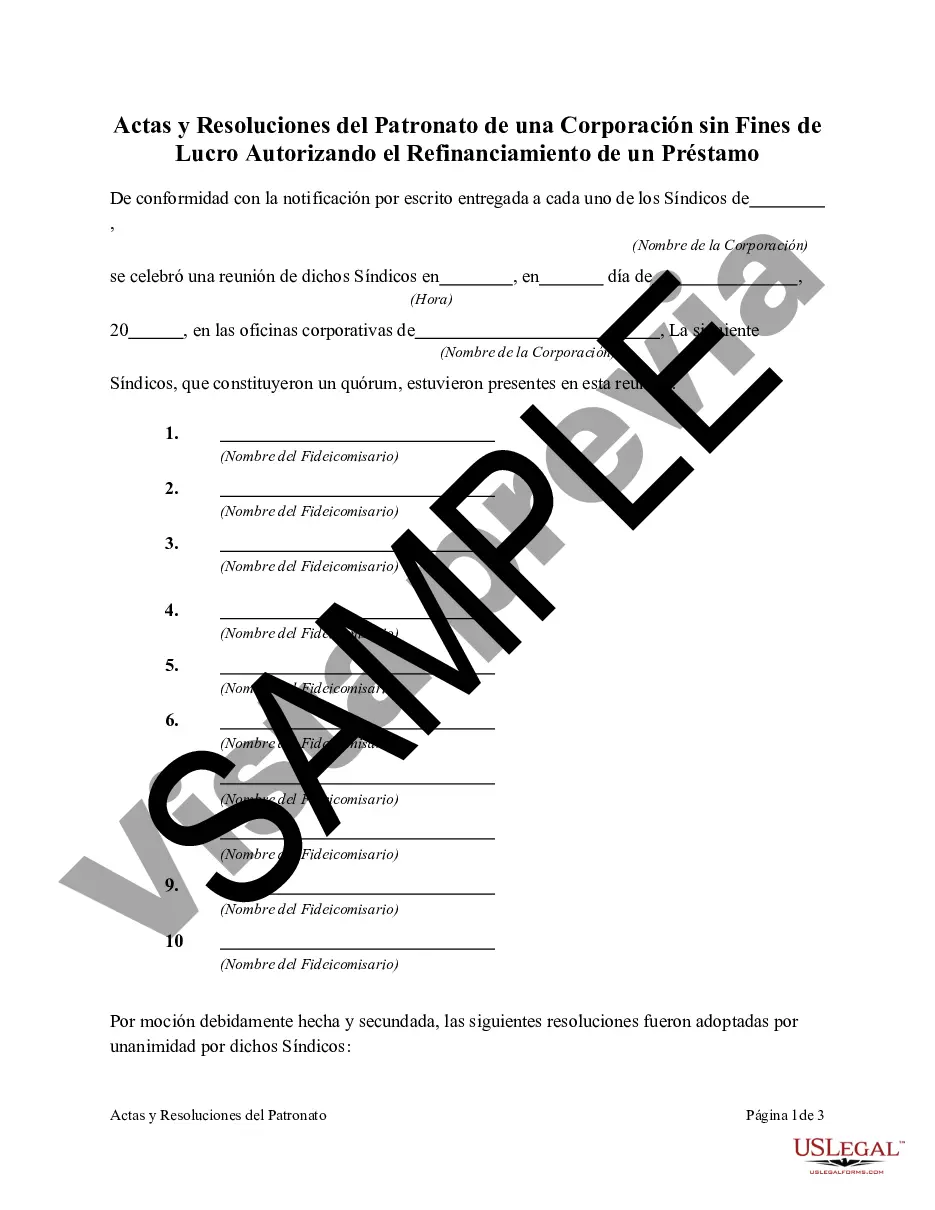

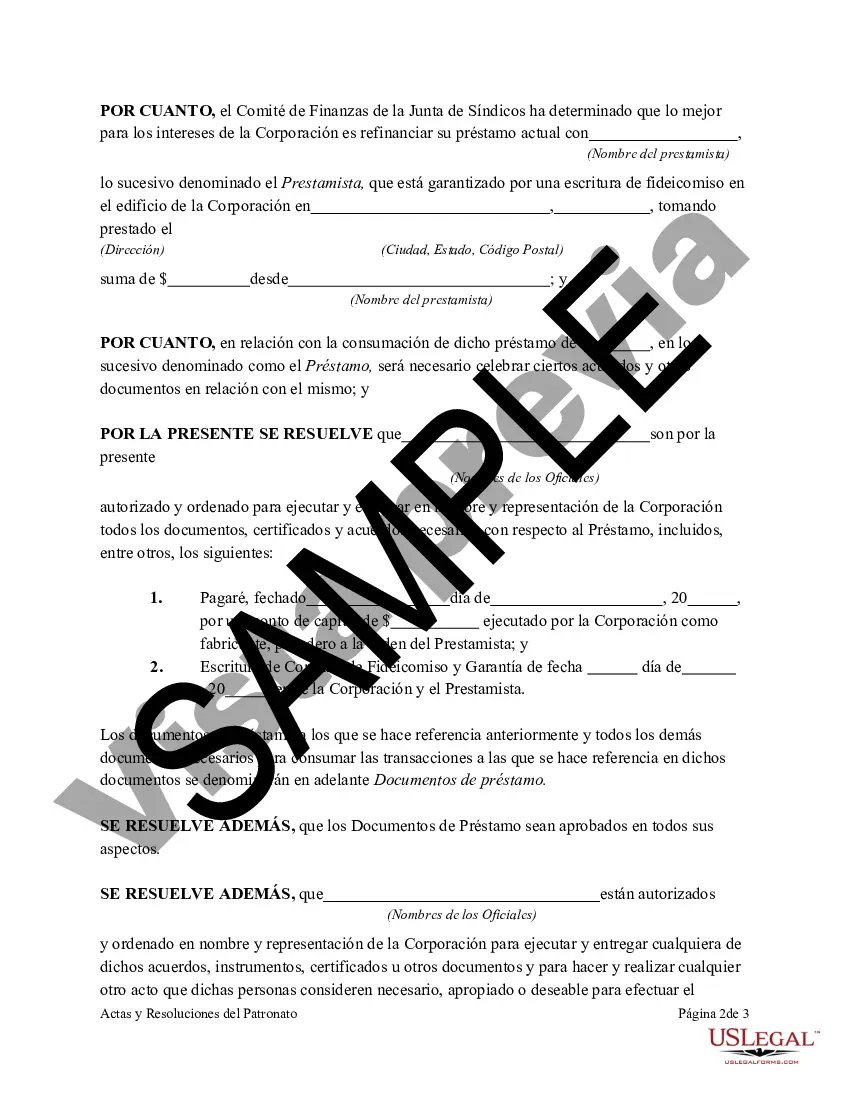

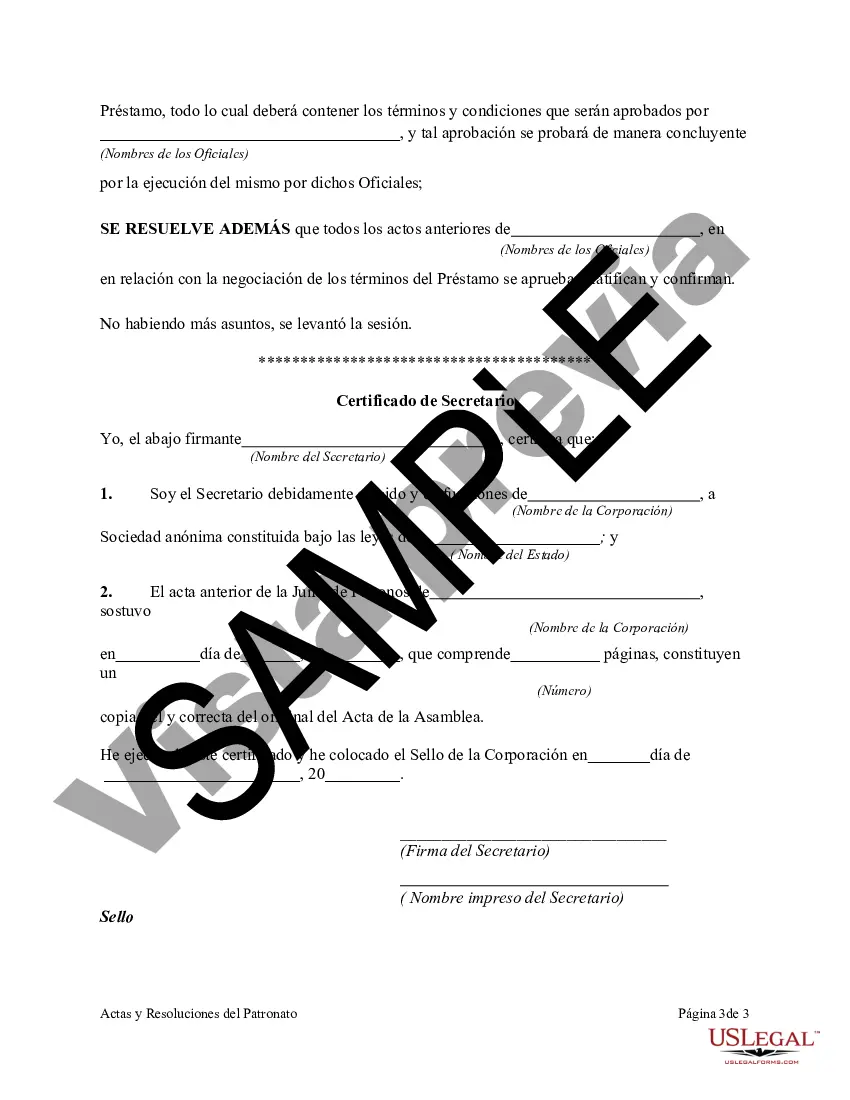

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Actas y Resoluciones de la Junta de Síndicos de una Sociedad Anónima sin Fines de Lucro Autorizando el Refinanciamiento de un Préstamo - Minutes and Resolutions of the Board of Trustees of a Non-Profit Corporation Authorizing to the Refinancing of a Loan

Description

How to fill out San Diego California Actas Y Resoluciones De La Junta De Síndicos De Una Sociedad Anónima Sin Fines De Lucro Autorizando El Refinanciamiento De Un Préstamo?

Whether you plan to start your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you must prepare specific documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business occasion. All files are grouped by state and area of use, so opting for a copy like San Diego Minutes and Resolutions of the Board of Trustees of a Non-Profit Corporation Authorizing to the Refinancing of a Loan is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to get the San Diego Minutes and Resolutions of the Board of Trustees of a Non-Profit Corporation Authorizing to the Refinancing of a Loan. Adhere to the instructions below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample when you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Diego Minutes and Resolutions of the Board of Trustees of a Non-Profit Corporation Authorizing to the Refinancing of a Loan in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!