Title: Oakland Michigan Minutes of Annual Meeting of a Non-Profit Corporation Introduction: The Minutes of Annual Meeting of a Non-Profit Corporation in Oakland, Michigan provide a comprehensive record of the proceedings and decisions made during the annual meeting of a non-profit organization. These minutes serve as an official document that offers insight into the governance and operations of the corporation. All vital discussions, resolutions, elections, reports, and other significant matters are documented in detail to ensure transparency and compliance with legal requirements. Keywords: Oakland Michigan, Minutes of Annual Meeting, Non-Profit Corporation, governance, transparency, legal requirements, decision-making. Types of Oakland Michigan Minutes of Annual Meeting of a Non-Profit Corporation: 1. Regular Minutes: Regular annual meeting minutes involve the routine activities and decisions that typically occur during an organization's annual meeting. They encompass discussions on financial reports, committee reports, changes to bylaws or articles of incorporation, election of officers, and any other crucial business matters. These minutes are crucial for maintaining a comprehensive record of the corporation's activities, ensuring transparency and accountability. Keywords: Regular annual meeting minutes, routine activities, financial reports, committee reports, bylaws, articles of incorporation, election of officers, transparency, accountability. 2. Special Minutes: Special annual meeting minutes are created when an organization conducts an additional meeting apart from the regular annual meeting. These meetings are usually held to address specific urgent matters such as amending bylaws, fundraising campaigns, organizational restructuring, or emergency situations. Special minutes provide a concise record of discussions and decisions made during these extraordinary meetings. Keywords: Special annual meeting minutes, urgent matters, bylaw amendments, fundraising campaigns, organizational restructuring, emergency situations, decisive discussions. 3. Annual Meeting Minutes for Tax Purposes: Non-profit corporations are required to maintain detailed annual meeting minutes for tax purposes. These minutes primarily focus on the financial aspects of the organization, including discussions on donations, grants, fundraising efforts, and other revenue-generating activities. They provide documentary evidence for compliance with tax regulations, ensuring the corporation maintains its non-profit status. Keywords: Annual meeting minutes for tax purposes, financial aspects, donations, grants, fundraising efforts, revenue-generating activities, compliance, non-profit status. Conclusion: The Minutes of Annual Meeting of a Non-Profit Corporation in Oakland, Michigan play a crucial role in documenting the decision-making processes, discussions, and important business matters of non-profit organizations. They provide transparency, accountability, and compliance with legal requirements. Regular, special, and tax-related minutes are some types associated with these important records. By maintaining consistent and detailed minutes, non-profit corporations in Oakland, Michigan can establish credibility and ensure the efficient functioning of their organizations. Keywords: Minutes of Annual Meeting, decision-making, discussions, business matters, transparency, accountability, legal requirements, credibility, efficient functioning.

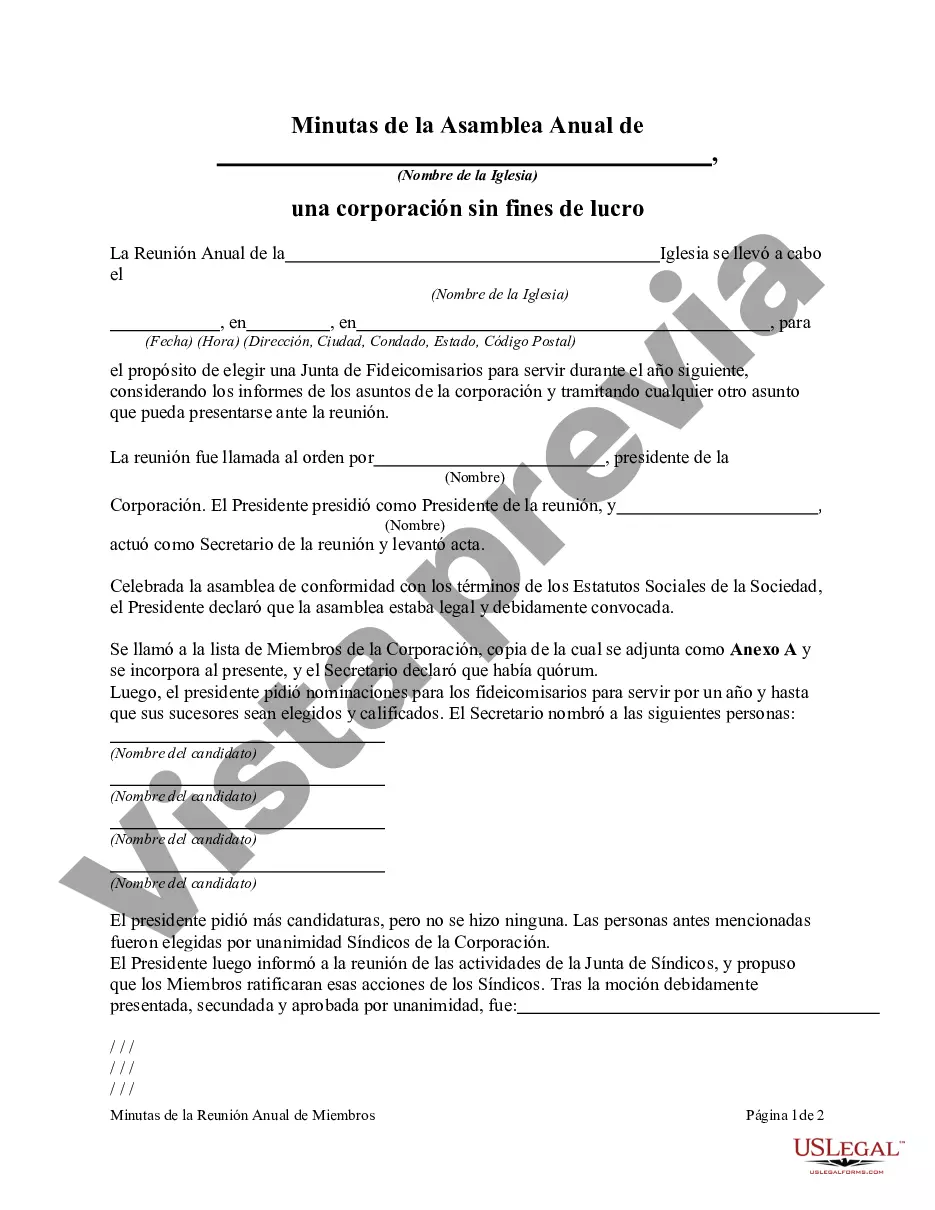

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Minutas de la reunión anual de una corporación sin fines de lucro - Minutes of Annual Meeting of a Non-Profit Corporation

Description

How to fill out Oakland Michigan Minutas De La Reunión Anual De Una Corporación Sin Fines De Lucro?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare official documentation that differs from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any individual or business objective utilized in your region, including the Oakland Minutes of Annual Meeting of a Non-Profit Corporation.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Oakland Minutes of Annual Meeting of a Non-Profit Corporation will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to obtain the Oakland Minutes of Annual Meeting of a Non-Profit Corporation:

- Ensure you have opened the proper page with your local form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template meets your requirements.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Oakland Minutes of Annual Meeting of a Non-Profit Corporation on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!