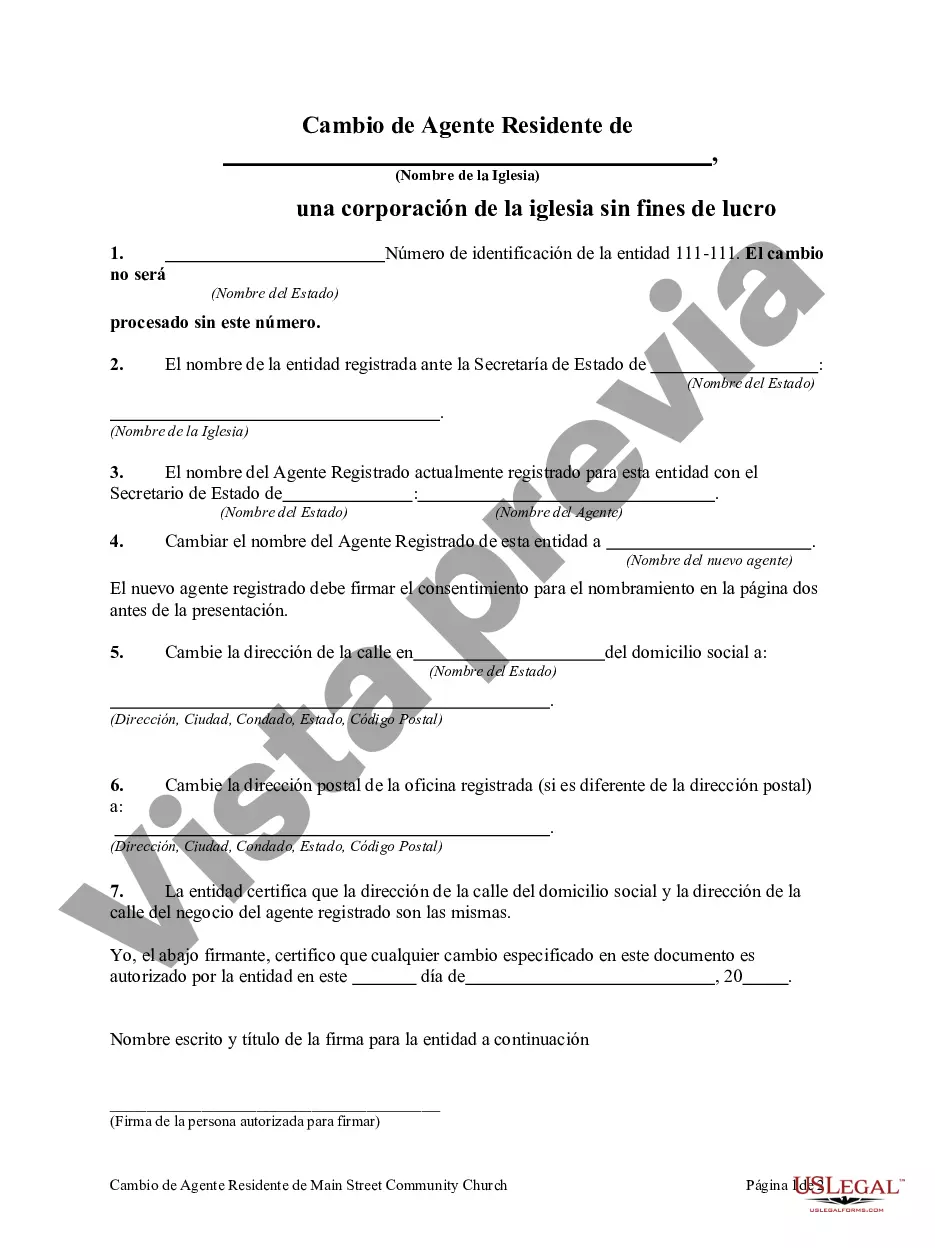

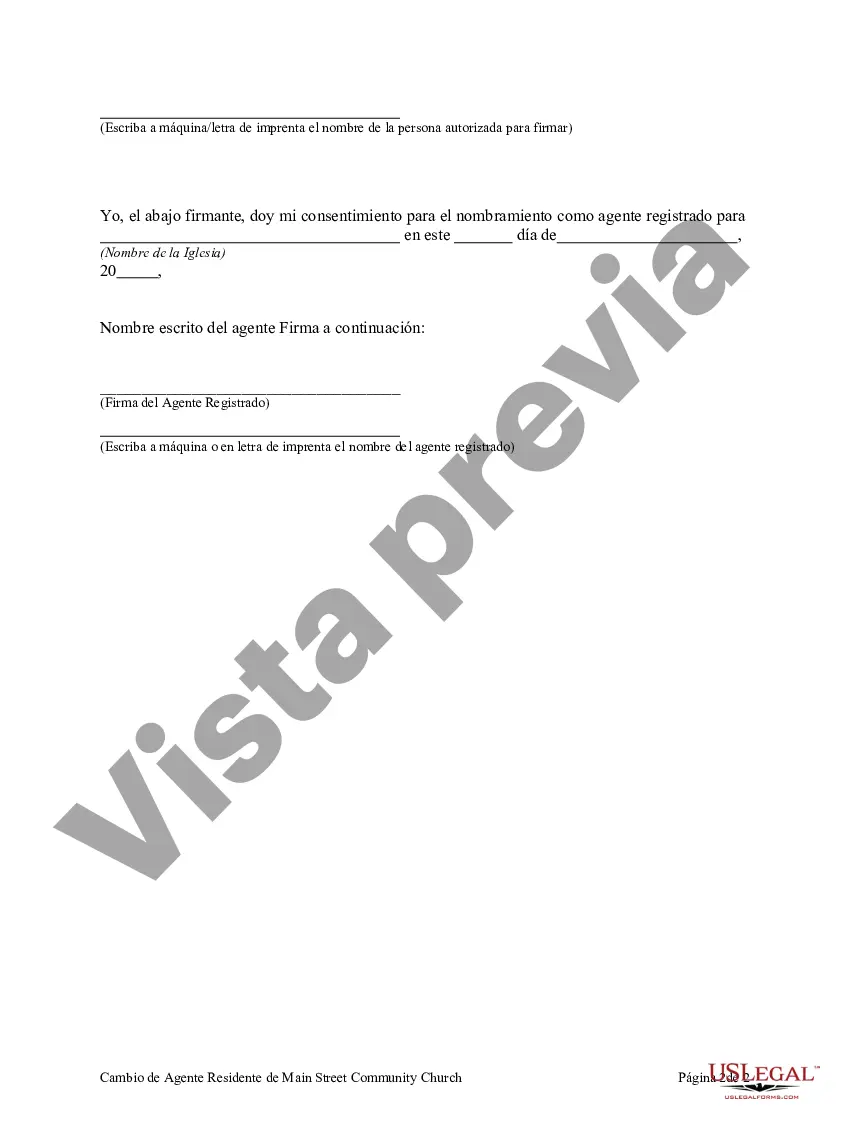

Alameda California Change of Resident Agent of Non-Profit Church Corporation refers to the process of updating the resident agent for a non-profit church corporation located in Alameda, California. The resident agent is the individual or entity designated to receive important legal and official documents on behalf of the organization. When a non-profit church corporation undergoes a change in its resident agent, it must follow specific procedures to ensure accurate and up-to-date information is available to the public and relevant authorities. The process typically involves filing the necessary paperwork and notifying the appropriate state agency responsible for maintaining corporate records. There are various reasons why a non-profit church corporation might need to change its resident agent. For example, the organization may have a new appointed agent due to a change in leadership, relocation, or a desire to work with a different agent who can better meet their needs. Regardless of the reason, adhering to the legal requirements is crucial for maintaining compliance and avoiding any potential legal complications. In Alameda, California, the process of changing the resident agent for a non-profit church corporation involves filling out specific forms provided by the Secretary of State's office. These forms typically require the organization's name, address, legal structure, and the new agent's information. Additionally, a filing fee is usually required to process the change. It's important to note that the exact terminology and forms required may vary depending on the specific state regulations and guidelines. Alameda California, for example, may have additional specific instructions or requirements to follow when changing the resident agent for a non-profit church corporation. In conclusion, Alameda California Change of Resident Agent of Non-Profit Church Corporation refers to the process of updating the resident agent for a non-profit church corporation located in Alameda, California. This involves submitting the necessary paperwork and notifying the appropriate state agency to ensure compliance with legal requirements. By following the correct procedures, a non-profit church corporation can successfully change its resident agent and maintain good standing with the state authorities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Cambio de Agente Residente de Non-Profit Church Corporation - Change of Resident Agent of Non-Profit Church Corporation

Description

How to fill out Alameda California Cambio De Agente Residente De Non-Profit Church Corporation?

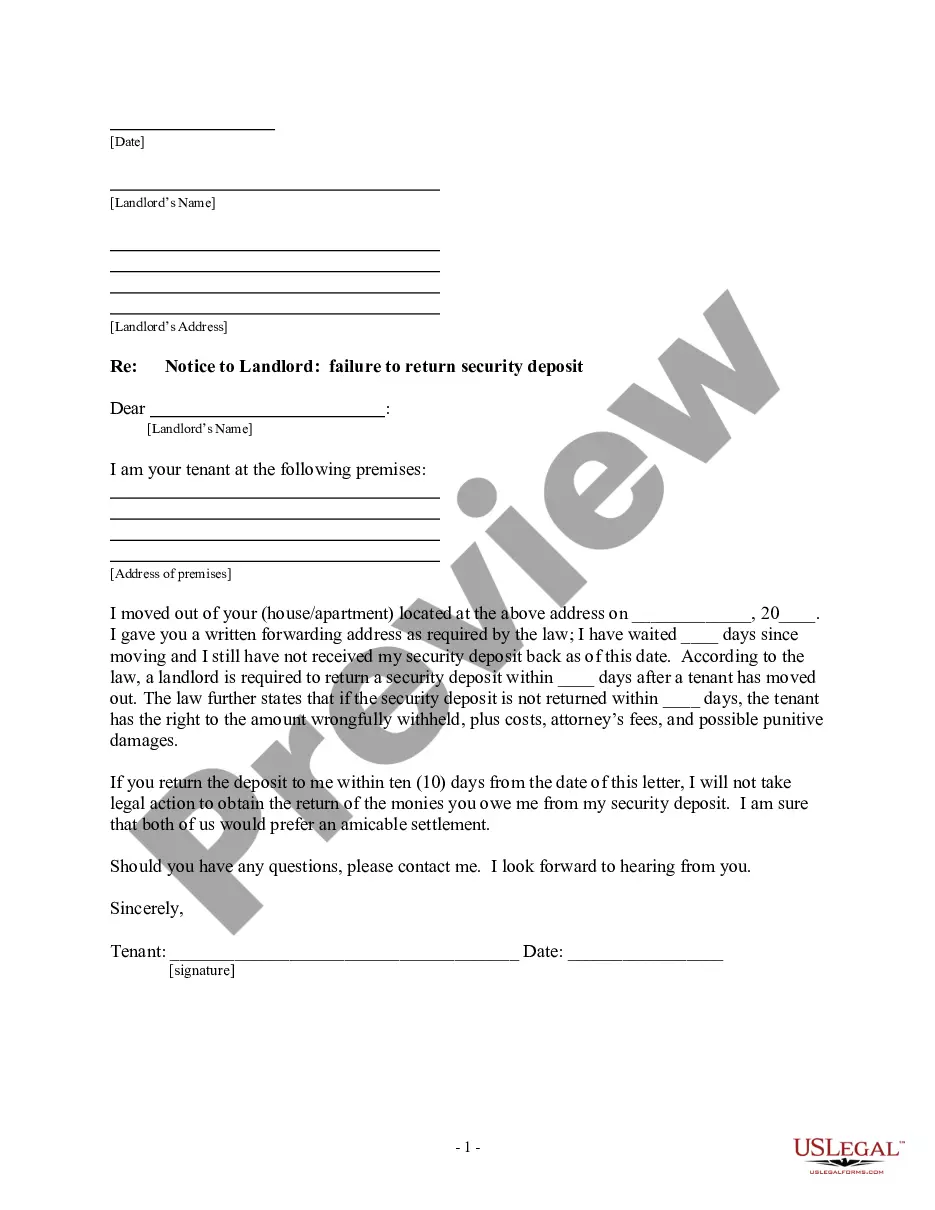

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare formal paperwork that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any personal or business purpose utilized in your county, including the Alameda Change of Resident Agent of Non-Profit Church Corporation.

Locating templates on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Alameda Change of Resident Agent of Non-Profit Church Corporation will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to get the Alameda Change of Resident Agent of Non-Profit Church Corporation:

- Ensure you have opened the proper page with your localised form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Alameda Change of Resident Agent of Non-Profit Church Corporation on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

Understanding nonprofit The difference between nonprofit and not-for-profit is that the nonprofit has no benefit to members, directors, nor beneficiaries, and income is never distributed to members or officers of its organization, but used to meet their targets and operate if required.

Differences Between Nonprofit Corporations and Unincorporated Nonprofits. While unincorporated nonprofit associations are formed simply by two or more people coming together with the common goal of providing a public good or service, nonprofit corporations are separate legal entities.

What Does Not for Profit Mean? Not-for-profit organizations do not earn profits for their owners. All of the money earned by or donated to a not-for-profit organization is used in pursuing the organization's objectives and keeping it running; income is not distributed to the group's members, directors, or officers. 1.

profit organization is a group organized for purposes other than generating profit and in which no part of the organization's income is distributed to its members, directors, or officers.

The most significant difference between nonprofits and for-profit organizations lies in their purpose: nonprofits have a social mission, while for-profits aim to offer products and services that are valuable to consumers and generate revenue. Nonprofits also receive certain tax breaks.

A nonprofit organization is one that qualifies for tax-exempt status by the IRS because its mission and purpose are to further a social cause and provide a public benefit. Nonprofit organizations include hospitals, universities, national charities and foundations. You're invited to join a private network of CEOs.

Follow these steps to form your own nonprofit 501(c)(3) corporation. Choose a name.File articles of incorporation.Apply for your IRS tax exemption.Apply for a state tax exemption.Draft bylaws.Appoint directors.Hold a meeting of the board.Obtain licenses and permits.

A nonprofit is an organization operating to further a social cause or support a shared mission. Nonprofits are tax-exempt by the IRS as their organizations are a benefit to the public, and they're required to keep financial information public to ensure donations are only for the nonprofit's further advancement.

A nonprofit is a type of corporation whose structure and purposes differ from a business corporation. The description of the organization as a business or nonprofit can drive whether the participants wish to become a corporation and the actions needed to bring the corporation to life.

Benefits of forming a nonprofit corporation Separate entity status. A nonprofit corporation (or LLC) has its own separate existence.Perpetual existence.Limited liability protection.Tax-exempt status.Access to grants.US Postal Service discounts.Credibility.Professional registered agent.