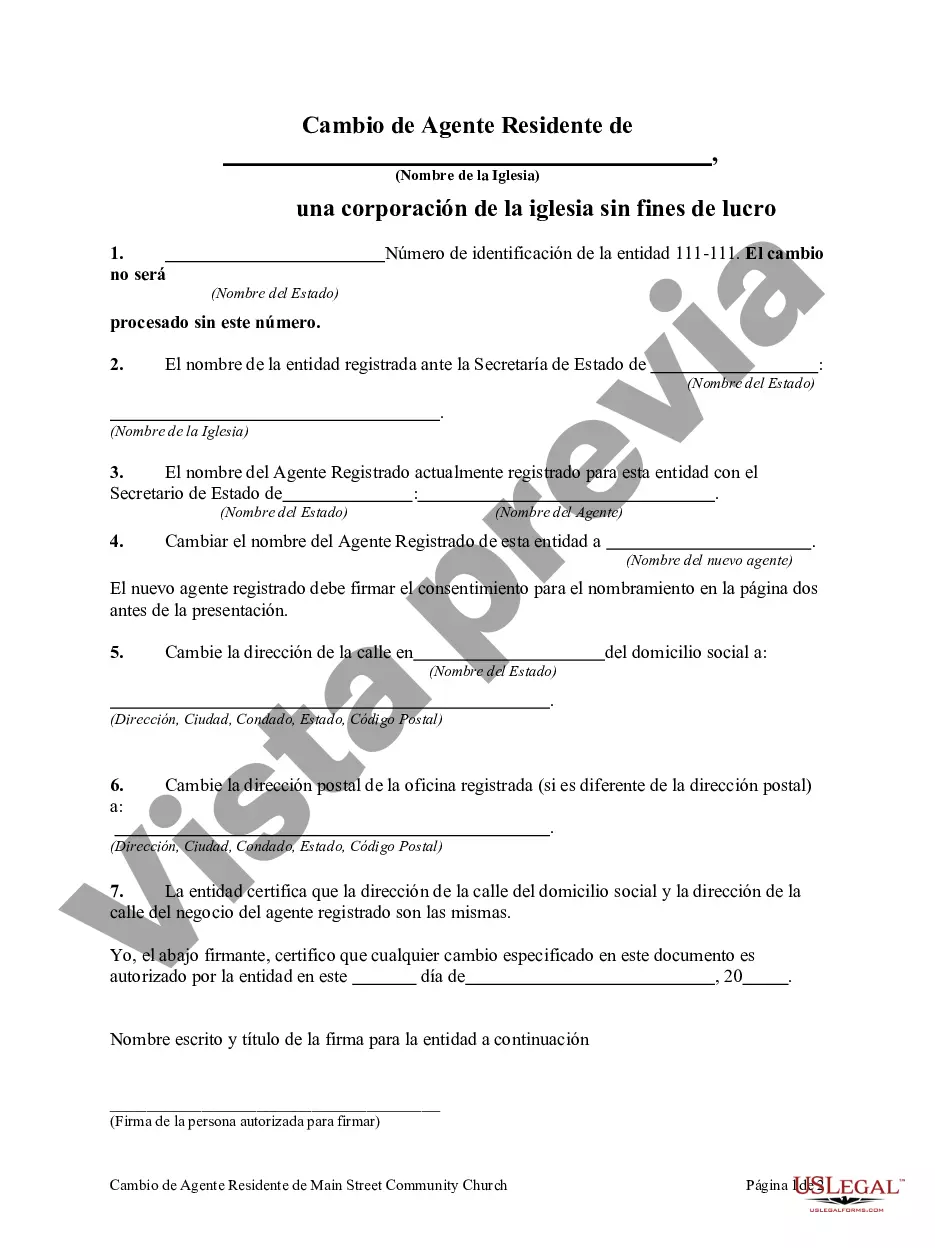

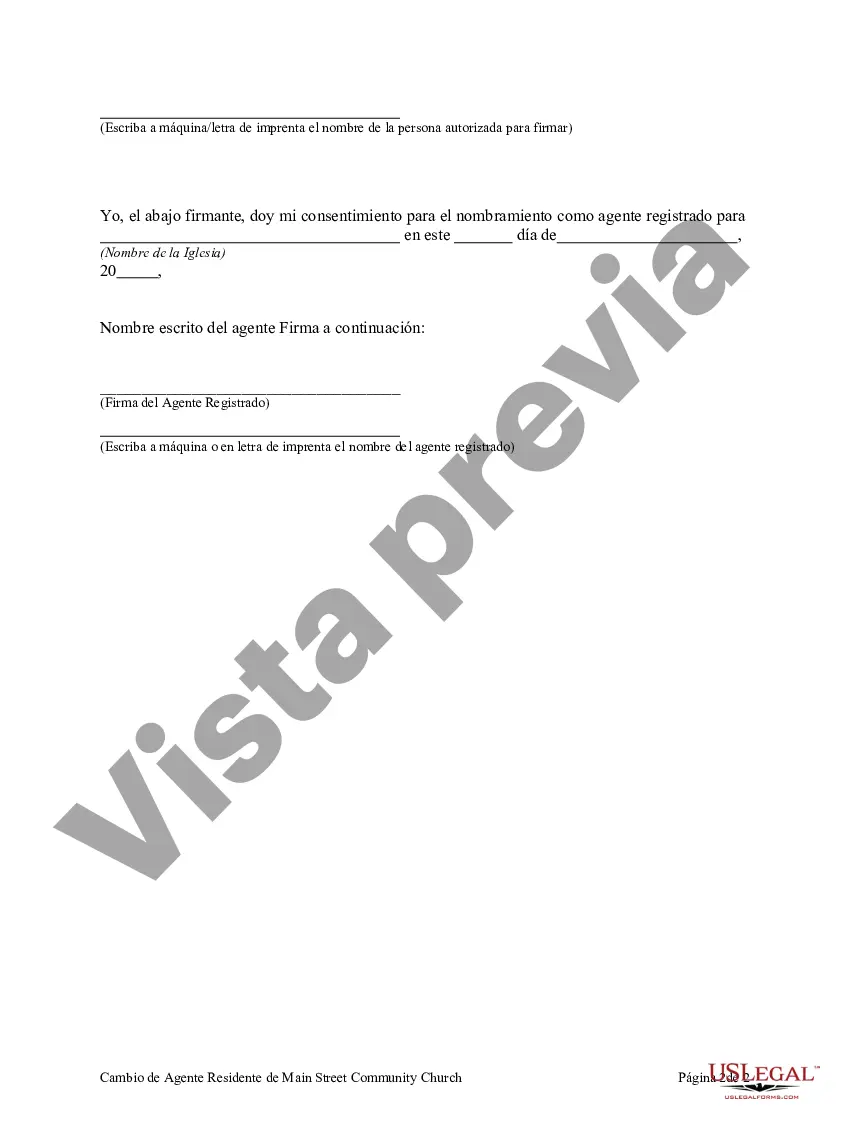

Bronx New York Change of Resident Agent of Non-Profit Church Corporation is a legal process that involves updating the registered agent information for a non-profit church corporation located in the Bronx, New York. The resident agent, also known as a registered agent, acts as the official point of contact between the non-profit church corporation and the state government. This process is crucial for maintaining compliance with state regulations and ensuring effective communication between the non-profit church corporation and government agencies. When a non-profit church corporation decides to change its resident agent, it must follow specific procedures outlined by the New York State Department of State. The change can occur due to various reasons, such as a change in the resident agent's address, resignation of the current agent, or appointment of a new agent. It is essential for non-profit church corporations to promptly update their resident agent information to avoid any disruptions in communication with state authorities and legal complications. To initiate the Change of Resident Agent process in Bronx, New York, the non-profit church corporation must file a specific form with the New York State Department of State. This form typically requires details such as the corporation's name, address, Internal Revenue Service (IRS) employer identification number, as well as the complete information of the new resident agent. It is crucial to provide accurate and up-to-date information to ensure a smooth transition and avoid potential legal issues. By completing the Change of Resident Agent process, the non-profit church corporation ensures that all important legal documents, such as tax notices, service of process, and other official correspondence, reach the right party promptly. The resident agent acts as a reliable and responsible representative who receives such documents on behalf of the non-profit church corporation and promptly forwards them to the appropriate parties within the organization. There are no specific types of Bronx New York Change of Resident Agent of Non-Profit Church Corporation. However, it is worth mentioning that this process can apply to any non-profit church corporation in the Bronx, regardless of its size, denomination, or religious affiliation. The New York State Department of State treats all non-profit church corporations equally when it comes to the Change of Resident Agent process, ensuring fairness and consistency in legal procedures. In conclusion, Bronx New York Change of Resident Agent of Non-Profit Church Corporation is a crucial procedure that allows non-profit church corporations to update their resident agent information. By doing so, they ensure compliance with state regulations and maintain effective communication with government agencies. Promptly completing the necessary paperwork and providing accurate information is vital to ensure a smooth transition and uninterrupted flow of important legal documents.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bronx New York Cambio de Agente Residente de Non-Profit Church Corporation - Change of Resident Agent of Non-Profit Church Corporation

Description

How to fill out Bronx New York Cambio De Agente Residente De Non-Profit Church Corporation?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to create some of them from the ground up, including Bronx Change of Resident Agent of Non-Profit Church Corporation, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in different types ranging from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching process less frustrating. You can also find detailed materials and tutorials on the website to make any tasks related to document execution straightforward.

Here's how to purchase and download Bronx Change of Resident Agent of Non-Profit Church Corporation.

- Go over the document's preview and description (if available) to get a general information on what you’ll get after downloading the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the legality of some records.

- Check the related forms or start the search over to locate the correct file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment gateway, and purchase Bronx Change of Resident Agent of Non-Profit Church Corporation.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Bronx Change of Resident Agent of Non-Profit Church Corporation, log in to your account, and download it. Of course, our website can’t take the place of an attorney entirely. If you have to deal with an exceptionally complicated situation, we advise using the services of an attorney to review your form before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and get your state-compliant paperwork effortlessly!

Form popularity

FAQ

With the resolution in hand, California law provides for voluntary dissolution in one of three ways: by majority approval of your nonprofit's members. by action of your directors followed by a vote or other consent of the members; or. if your nonprofit does not have members, by a vote of the directors.

forProfit organization is a group, which is organized for the purpose of social, religious, charitable, educational, athletic, literary, political or other such activities. Although there are many different kinds of NotForProfit organizations they all have one thing in common.

profit organization is a group organized for purposes other than generating profit and in which no part of the organization's income is distributed to its members, directors, or officers.

Steps to Dissolving a Nonprofit File a final form. In this type of dissolution, the IRS mandates that the board of directors of the nonprofit organization complete certain requirements to "dissolve," or shut down, the 501(c)(3).Vote for dissolution.File Form 990.File the paperwork.

Understanding nonprofit The difference between nonprofit and not-for-profit is that the nonprofit has no benefit to members, directors, nor beneficiaries, and income is never distributed to members or officers of its organization, but used to meet their targets and operate if required.

profit organization is a group organized for purposes other than generating profit and in which no part of the organization's income is distributed to its members, directors, or officers.

A few well known non-profit organizations include Habitat for Humanity, Red Cross, and United Way. The most common type of non-profit is a 501(c)3.

The one common condition is not paying out profits (no part of the organization's net earnings can inure to the benefit of any private shareholder or individual); hence the term, nonprofit. Section 501(c)(3) of the tax code refers to public charities (also known as charitable nonprofits) and private foundations.

With the resolution in hand, California law provides for voluntary dissolution in one of three ways: by majority approval of your nonprofit's members. by action of your directors followed by a vote or other consent of the members; or. if your nonprofit does not have members, by a vote of the directors.

Nonprofits receive much of their income through donations. These donations cover operational expenses and help nonprofits achieve their missions. Individual giving made up 68% of all charitable giving in 2018. 8feff Corporate and foundation giving are usually much smaller fractions of that philanthropic endeavor.