Queens, New York is a vibrant borough located in the eastern part of New York City. It is home to a diverse community and a wide range of cultural and recreational opportunities. If you are seeking information on the change of resident agent for a non-profit church corporation in Queens, New York, there are several important aspects you should consider. When a non-profit church corporation operates in Queens, New York, it is required to have a resident agent who acts as a point of contact between the corporation and the state government. The resident agent is responsible for receiving legal notifications, such as lawsuit documents and tax forms, on behalf of the church corporation. However, there may be instances where the resident agent needs to be changed, and this process is known as a change of resident agent. There are different types of change of resident agent for non-profit church corporations in Queens, New York, depending on the specific circumstances. Some of these types may include: 1. Change of Resident Agent due to Relocation: If your church corporation is moving to a new location within Queens or outside the borough, you will need to change the resident agent to reflect the new address. It is important to update this information promptly to ensure effective communication with the state government. 2. Change of Resident Agent due to Personnel Change: In the event of a change in leadership within the non-profit church corporation, such as a new board member or pastor, the resident agent may also need to be updated. This is crucial to maintain accurate contact information for legal purposes. 3. Change of Resident Agent due to Dissolution: If the non-profit church corporation in Queens, New York is dissolved or ceases its operations, the resident agent will need to be changed accordingly. This ensures that any outstanding legal matters are properly addressed and concluded. To initiate a change of resident agent for a non-profit church corporation in Queens, New York, certain steps need to be followed. These may include filing the appropriate forms with the New York Department of State, updating the corporation's records, and notifying other relevant parties, such as the Internal Revenue Service (IRS) and any applicable state agencies. It is vital to comply with all the legal requirements and deadlines associated with changing the resident agent to avoid any potential penalties or legal complications. Seeking professional advice or consulting an attorney who specializes in non-profit law can be beneficial in navigating this process effectively. Overall, Queens, New York offers a rich and diverse environment for non-profit church corporations. By understanding the process of changing the resident agent and fulfilling the necessary requirements, organizations can ensure smooth and compliant operations within the borough.

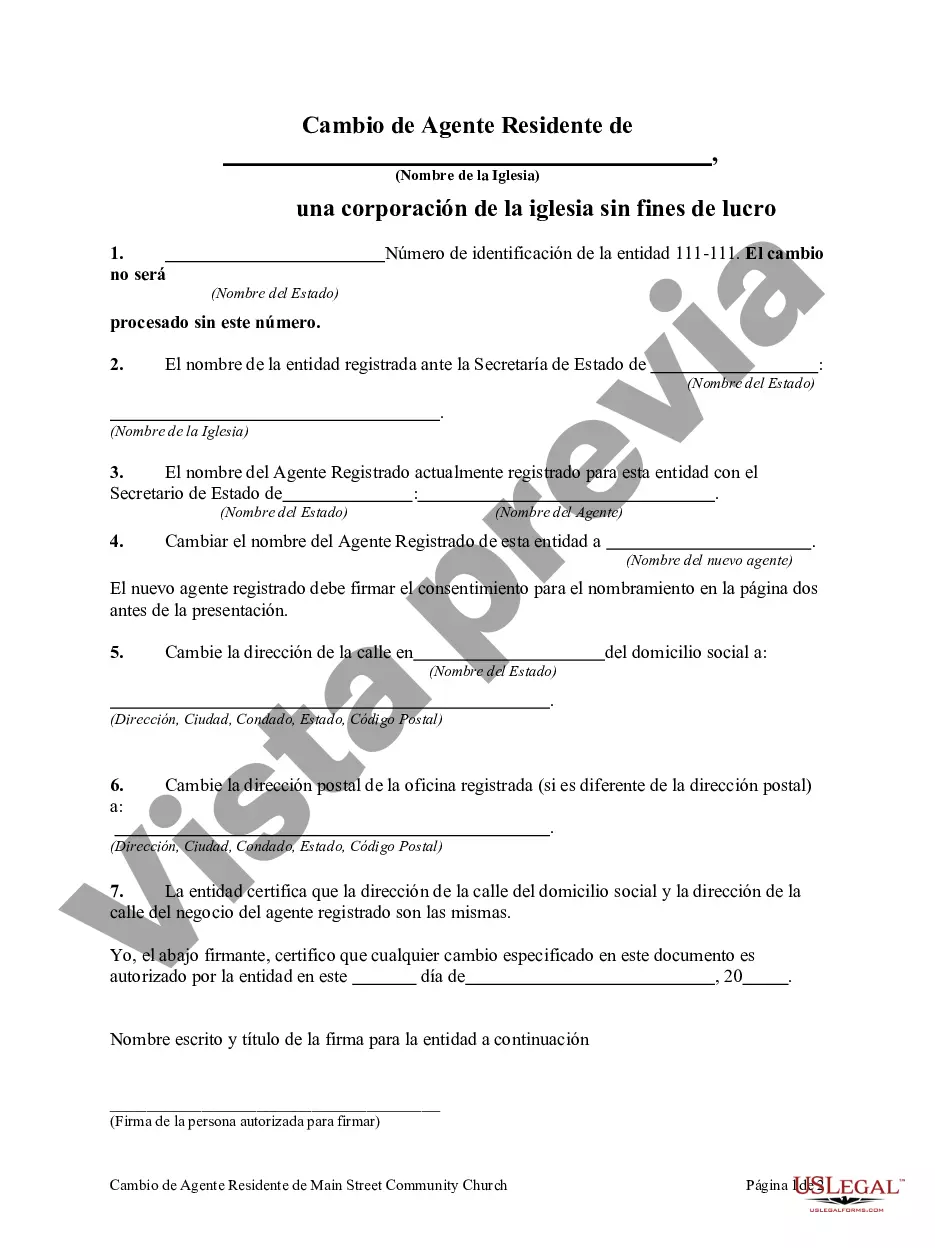

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Cambio de Agente Residente de Non-Profit Church Corporation - Change of Resident Agent of Non-Profit Church Corporation

Description

How to fill out Queens New York Cambio De Agente Residente De Non-Profit Church Corporation?

If you need to find a trustworthy legal paperwork provider to get the Queens Change of Resident Agent of Non-Profit Church Corporation, consider US Legal Forms. No matter if you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can browse from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, variety of learning resources, and dedicated support team make it simple to locate and complete different papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply type to look for or browse Queens Change of Resident Agent of Non-Profit Church Corporation, either by a keyword or by the state/county the document is created for. After finding the necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Queens Change of Resident Agent of Non-Profit Church Corporation template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be immediately ready for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes these tasks less costly and more affordable. Create your first business, arrange your advance care planning, create a real estate contract, or execute the Queens Change of Resident Agent of Non-Profit Church Corporation - all from the convenience of your sofa.

Join US Legal Forms now!