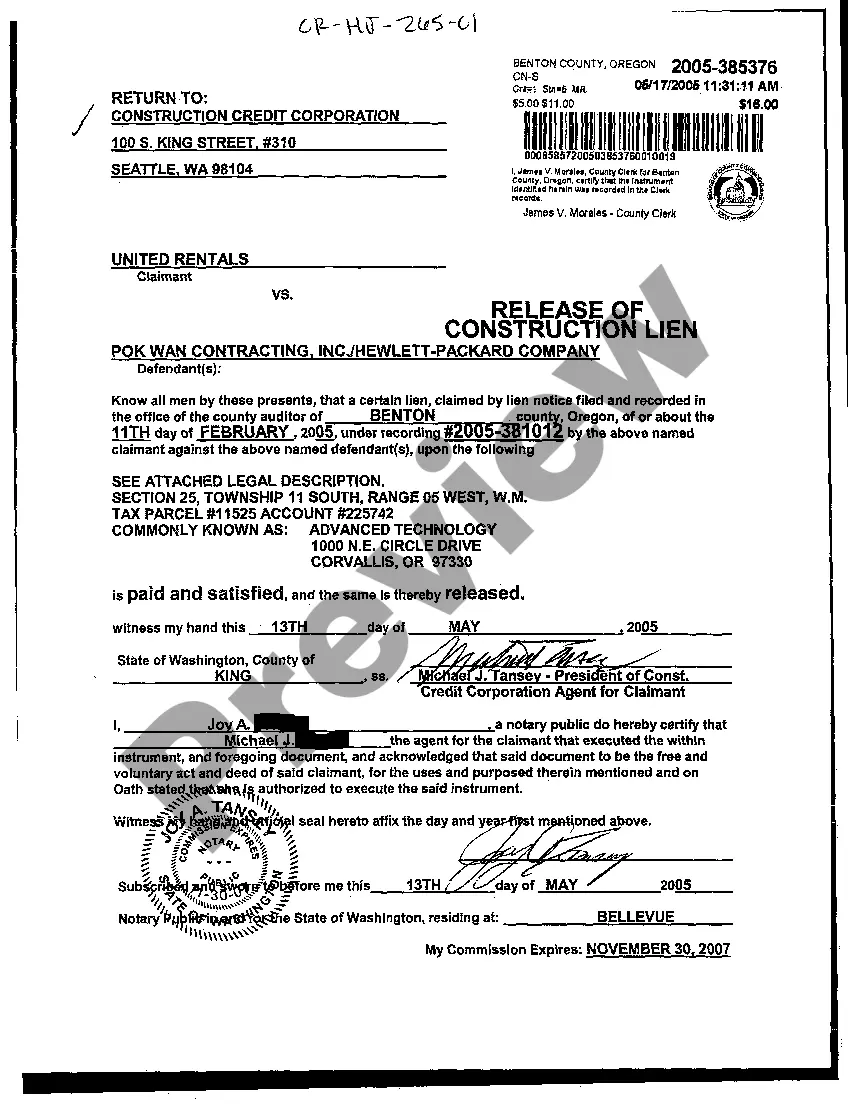

Allegheny Pennsylvania Bi-Laws of a Non-Profit Church Corporation The Bi-Laws of a Non-Profit Church Corporation in Allegheny, Pennsylvania serve as a set of guidelines and regulations that outline the structure and operation of a church organization. These Bi-Laws are crucial for ensuring transparency, accountability, and compliance with legal requirements. In Allegheny, there might be different types of Bi-Laws based on the specific needs and characteristics of the non-profit church corporation. Let's explore some of them: 1. Formation and Purpose: The Bi-Laws typically begin by defining the name, purpose, and mission of the non-profit church corporation. These sections outline the specific religious activities and services the church intends to provide to the community in Allegheny. 2. Membership: This section outlines the criteria, rights, and responsibilities of members within the church corporation. It may include requirements for membership, such as regular attendance, adherence to the church's beliefs, and participation in church activities. 3. Governance Structure: The Bi-Laws establish the governance structure of the non-profit church corporation. This can include the roles and responsibilities of directors, board members, pastors, and other leadership positions. It may also describe the process for electing or appointing these individuals and the terms of their service. 4. Meetings and Voting: Non-profit church corporations typically hold regular meetings to discuss important matters and make decisions. The Bi-Laws may outline the frequency and procedures for these meetings. It may also describe the voting process, including the number of votes needed to pass resolutions or make changes. 5. Finances and Accounting: As with any non-profit organization, the Bi-Laws of a non-profit church corporation in Allegheny, Pennsylvania address financial matters. This section often includes rules for budgeting, fundraising, use of funds, and financial reporting. It may also specify the process for auditing and reviewing the church's financial records. 6. Conflict Resolution: In case of disputes or conflicts within the church corporation, the Bi-Laws may outline a process for resolution. This can include mediation, arbitration, or other methods to address disagreements while maintaining unity and harmony within the church. 7. Amendments and Dissolution: Over time, it may become necessary to amend or update the Bi-Laws. This section describes the process for making changes to the By-Laws, ensuring that any amendments are legally valid. Additionally, it may include provisions for dissolving the non-profit church corporation, specifying how assets will be distributed or transferred if the organization ceases to exist. These are just a few key areas that are commonly addressed in the Bi-Laws of a Non-Profit Church Corporation in Allegheny, Pennsylvania. It is important for church leaders and members to carefully craft and abide by these regulations to ensure the organization's long-term success and compliance with state and federal laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Bi-leyes de una corporación eclesiástica sin fines de lucro - Bi-Laws of a Non-Profit Church Corporation

Description

How to fill out Allegheny Pennsylvania Bi-leyes De Una Corporación Eclesiástica Sin Fines De Lucro?

Whether you plan to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occasion. All files are collected by state and area of use, so picking a copy like Allegheny Bi-Laws of a Non-Profit Church Corporation is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to obtain the Allegheny Bi-Laws of a Non-Profit Church Corporation. Follow the instructions below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample when you find the proper one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Allegheny Bi-Laws of a Non-Profit Church Corporation in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!