San Diego California has specific bi-laws that govern non-profit church corporations operating within its jurisdiction. These bi-laws define the rights, responsibilities, and operational regulations for such entities. Understanding these bi-laws is crucial for churches seeking to establish and maintain their non-profit status in the region. The San Diego California bi-laws for non-profit church corporations encompass various key areas, including governance, tax-exemption requirements, board structure, fundraising, financial reporting, and compliance with state and federal laws. These regulations ensure transparency, accountability, and proper functioning of non-profit church corporations while safeguarding their mission and purpose. Different types of San Diego California bi-laws for non-profit church corporations may include: 1. Governance and Structure: These bi-laws typically outline the structure of the organization, including the roles and responsibilities of various stakeholders such as pastors, board members, and trustees. They might also address how decisions are made, elections, term limits, and meeting requirements. 2. Tax-Exemption Compliance: Non-profit church corporations in San Diego California must adhere to the tax-exempt status requirements outlined by the Internal Revenue Service (IRS) and California Franchise Tax Board (FT). This includes maintaining accurate financial records, filing annual reports, and ensuring proper use of funds in accordance with the organization's religious and charitable mission. 3. Financial Management and Accounting: Bi-laws may provide guidelines for budgeting, financial controls, and reporting practices. It may specify the process for financial audits, regular financial statements, and the establishment of a finance committee responsible for overseeing such matters. 4. Fundraising and Donations: San Diego California bi-laws for non-profit church corporations may address the acceptable methods of fundraising, including solicitation permits, grant applications, and compliance with donor and gift acceptance policies. These bi-laws often stipulate guidelines for accepting and managing charitable donations and grants. 5. Dissolution and Assets: In the event a non-profit church corporation ceases to exist, bi-laws typically outline the process for dissolution and the distribution of remaining assets to other non-profit organizations or entities with similar missions. This ensures that the community benefits from the remnants of the dissolved organization. It is essential for non-profit church corporations to consult legal professionals experienced in non-profit law to ensure their bi-laws align with San Diego California regulations and best practices. Maintaining compliance with these bi-laws not only allows non-profit church corporations to operate legally in the region but also provides a solid foundation for serving the community and fulfilling their religious and charitable objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Bi-leyes de una corporación eclesiástica sin fines de lucro - Bi-Laws of a Non-Profit Church Corporation

Description

How to fill out San Diego California Bi-leyes De Una Corporación Eclesiástica Sin Fines De Lucro?

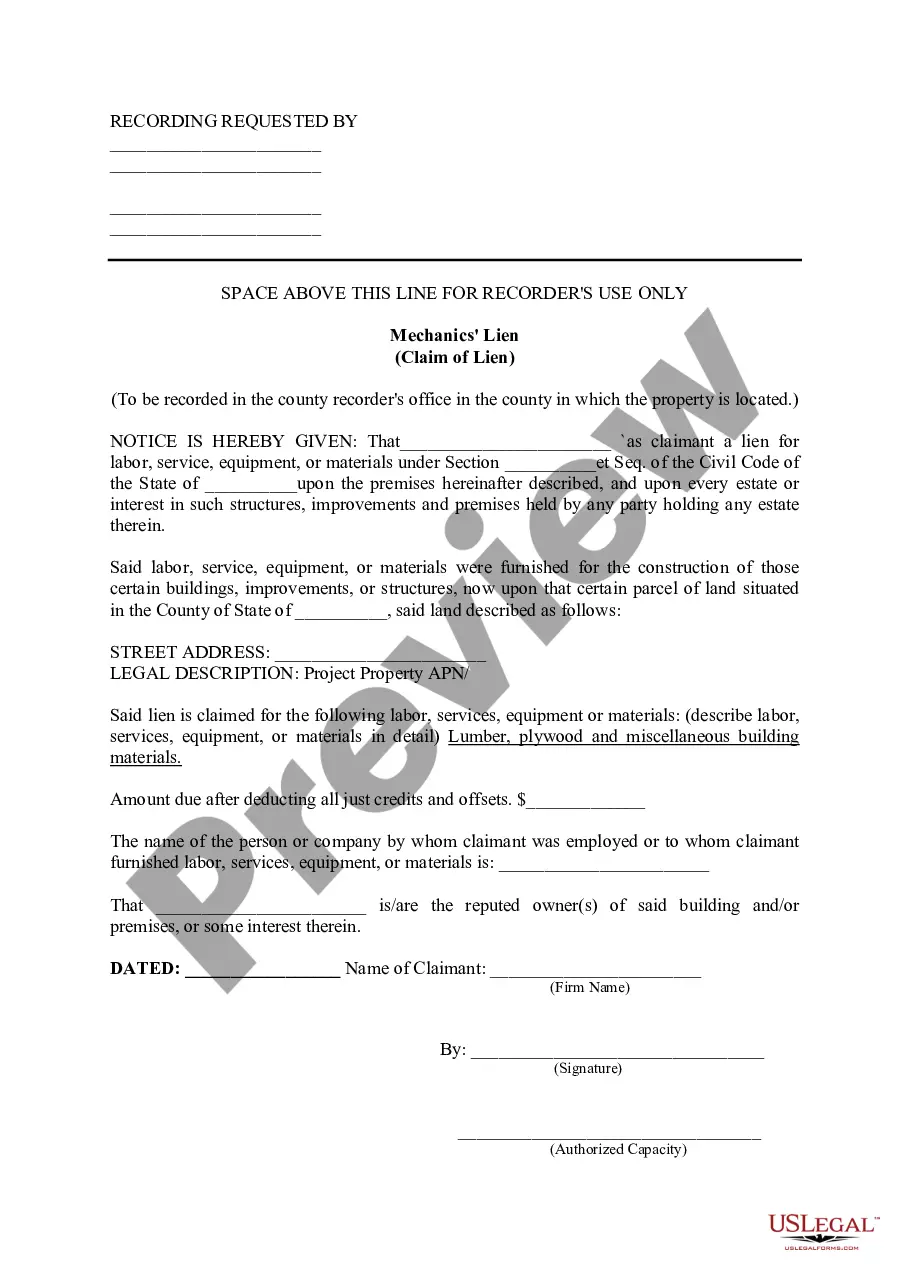

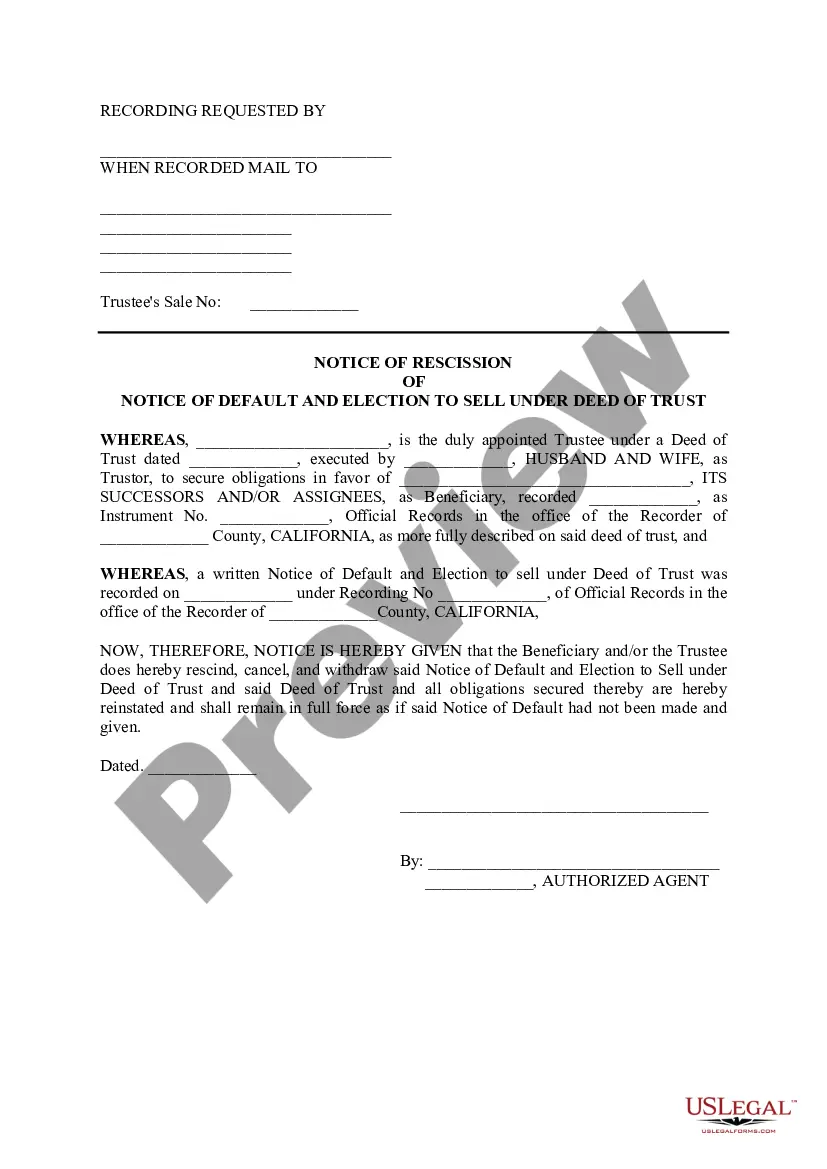

How much time does it typically take you to draft a legal document? Given that every state has its laws and regulations for every life sphere, finding a San Diego Bi-Laws of a Non-Profit Church Corporation suiting all local requirements can be stressful, and ordering it from a professional lawyer is often pricey. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. In addition to the San Diego Bi-Laws of a Non-Profit Church Corporation, here you can find any specific form to run your business or individual deeds, complying with your regional requirements. Experts verify all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can pick the document in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your San Diego Bi-Laws of a Non-Profit Church Corporation:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the San Diego Bi-Laws of a Non-Profit Church Corporation.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!