Chicago, Illinois is a bustling metropolis located in the state of Illinois, United States. It is renowned for its architectural marvels, vibrant cultural scene, rich history, and diverse community. Being the third most populous city in the United States, Chicago offers a multitude of attractions, such as world-class museums, iconic landmarks, renowned sports teams, and a thriving culinary scene. This detailed description will focus on the Chicago Illinois Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift. When a nonprofit church corporation receives a gift, it is crucial for them to acknowledge the donation properly. The acknowledgment serves as proof that the gift was received, and it establishes the organization's gratitude towards the donor. The Chicago Illinois Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift typically includes important information such as: 1. Nonprofit Church Corporation Details: The acknowledgment letter would mention the name of the nonprofit church corporation, its address, and contact information. It may also include the organization's tax-exempt status identification, such as their Tax ID or EIN (Employer Identification Number). 2. Donor Information: The acknowledgment should contain the complete name and address of the donor. It is vital to ensure accuracy in spelling and contact details to maintain clear communication and facilitate any future correspondence. 3. Gift Description: The acknowledgment letter would specify the nature of the gift received. This could include cash donations, in-kind contributions, securities, property, or any other valuable assets. It is crucial to provide a detailed description to avoid any confusion regarding the donation. 4. Donation Date and Value: The nonprofit church corporation needs to mention the date on which the gift was received. Additionally, it is important to include the fair market value of the gift, especially for tax purposes. However, it is essential to consult with a tax professional or attorney to determine the exact reporting requirements based on the nature of the gift. 5. Disclosure Statement: In compliance with federal tax regulations, the acknowledgment letter may include a disclosure statement, informing the donor whether they received any goods or services in exchange for their gift. This disclosure is particularly necessary when the donor expects a tax deduction for their contribution. 6. Expression of Gratitude: The nonprofit church corporation acknowledges the generosity of the donor by expressing gratitude within the letter. This section demonstrates the organization's appreciation for the donation and its impact on their mission. It sets the tone for a continued relationship and fosters a sense of goodwill between the church and the donor. Different types of Chicago Illinois Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift may vary based on specific requirements or preferences of the nonprofit church. Variation could occur in the format or template used for the acknowledgment letter, or in additional elements like personalization or signatures. However, the core elements described above typically remain consistent in all types. In conclusion, Chicago, Illinois is a vibrant city, and the Chicago Illinois Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift plays an essential role in maintaining transparency and showing appreciation for the valuable contributions made by donors. This acknowledgment letter ensures a clear record-keeping process, fosters goodwill, and adheres to legal and tax requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Acuse de recibo de una donación por parte de una corporación eclesiástica sin fines de lucro - Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift

Description

How to fill out Chicago Illinois Acuse De Recibo De Una Donación Por Parte De Una Corporación Eclesiástica Sin Fines De Lucro?

Whether you intend to start your company, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Chicago Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to get the Chicago Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift. Follow the guidelines below:

- Make certain the sample meets your individual needs and state law regulations.

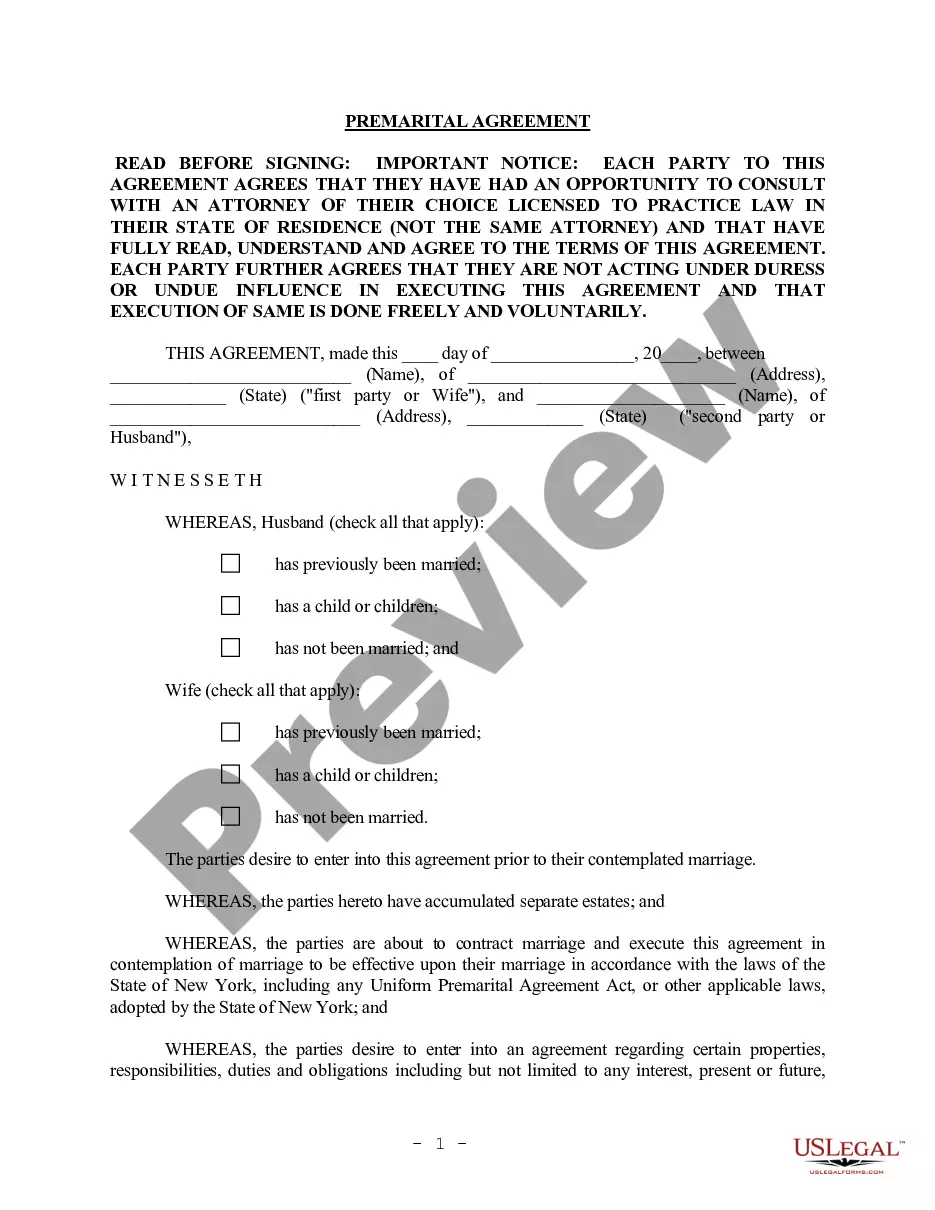

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the file once you find the proper one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Chicago Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!