Cuyahoga County, Ohio, located in the northeastern part of the state, is home to various nonprofit church corporations that rely on the support and generosity of their community to carry out their missions. One essential aspect of sustaining these organizations is properly acknowledging and recognizing the receipt of gifts from individuals or other entities. In this context, the Cuyahoga Ohio Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift plays a crucial role. An acknowledgment is a formal document or letter issued by a nonprofit church corporation to express gratitude and provide evidence of the donation received. It serves multiple purposes, including maintaining transparency, complying with legal regulations, and enabling donors to claim tax deductions for their contributions. By providing detailed descriptions of the received gift, the acknowledgment ensures that the transaction is accurately recorded and documented. There are different types of Cuyahoga Ohio Acknowledgments by a Nonprofit Church Corporation of Receipt of Gift, tailored to suit various types of donations. Here are some common variations: 1. Monetary Gift Acknowledgment: This type of acknowledgment is used when the donation made to the nonprofit church corporation is in the form of cash, check, or electronic funds transfer. It includes specific details such as the amount donated, date of the gift, and the name of the donor. 2. In-Kind Gift Acknowledgment: In cases where individuals or organizations provide non-monetary contributions, such as goods, services, or property, an in-kind gift acknowledgment is used. It contains a description of the donated item, its estimated value, and any relevant restrictions or conditions associated with the gift. 3. Stock/Securities Gift Acknowledgment: Donations made in the form of stocks, bonds, or other securities require a specialized acknowledgment. Alongside the standard elements like the name of the donor, it typically includes the name and quantity of the security donated, its estimated value at the time of the gift, and a statement confirming its unrestricted use unless stated otherwise by the donor. 4. Vehicle Donation Acknowledgment: When individuals contribute vehicles to a nonprofit church corporation, a vehicle donation acknowledgment is employed. It generally contains identifying information about the vehicle, including its make, model, year, and Vehicle Identification Number (VIN), along with a statement confirming whether any goods or services were provided in exchange for the donation as required by the Internal Revenue Service (IRS). It is important that nonprofit church corporations in Cuyahoga County maintain accurate records of all acknowledgments to ensure compliance with tax laws and provide transparency to their donors and the public. Utilizing different types of Cuyahoga Ohio Acknowledgments by a Nonprofit Church Corporation of Receipt of Gift allows these organizations to tailor their acknowledgments to the specific nature of each contribution, thereby enhancing their stewardship and strengthening the bonds with their supporters.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Acuse de recibo de una donación por parte de una corporación eclesiástica sin fines de lucro - Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift

Description

How to fill out Cuyahoga Ohio Acuse De Recibo De Una Donación Por Parte De Una Corporación Eclesiástica Sin Fines De Lucro?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Cuyahoga Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Cuyahoga Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Cuyahoga Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift:

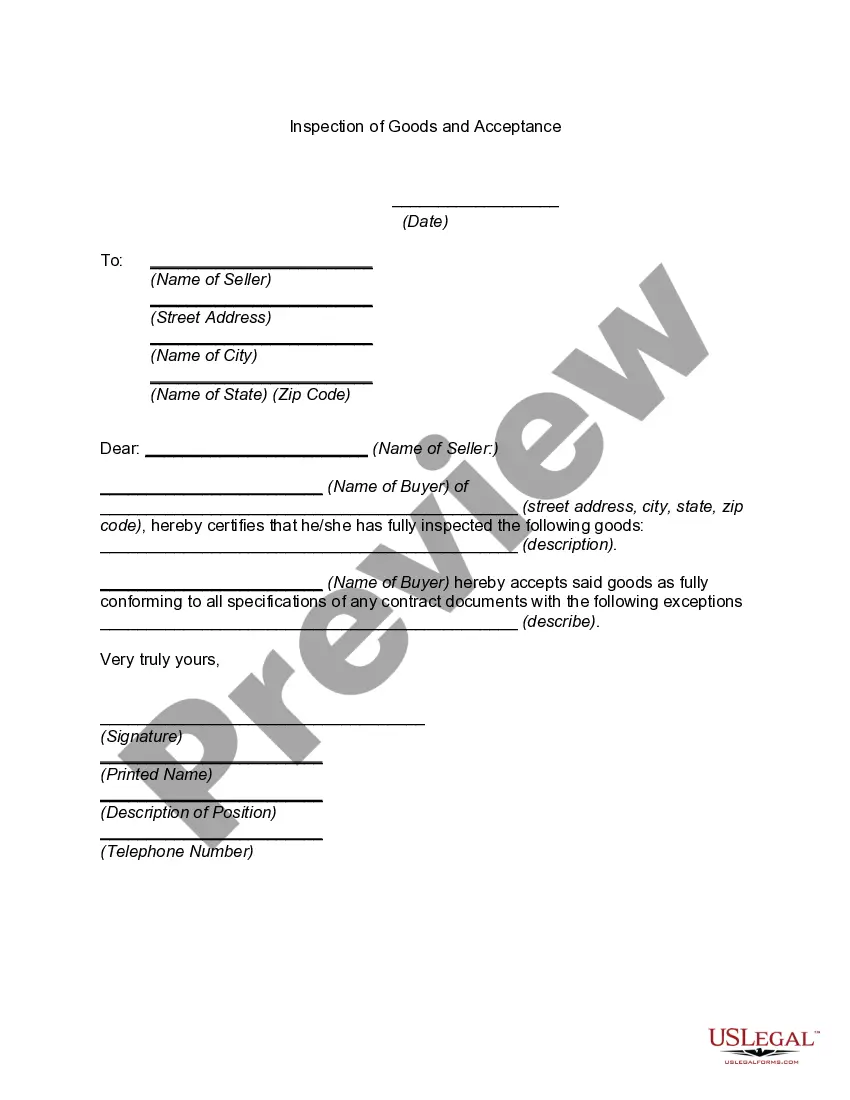

- Analyze the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!