Title: Understanding Hennepin, Minnesota Acknowledgment by Nonprofit Church Corporation for Receipt of Gifts Introduction: In Hennepin, Minnesota, nonprofit church corporations play a vital role in serving the community and rely on the generous support of individuals and organizations. Whenever a donation or gift is received by a nonprofit church corporation, it is crucial to acknowledge and express gratitude to the donor or organization properly. This article provides a detailed description of Hennepin, Minnesota Acknowledgment by a Nonprofit Church Corporation of Receipt of Gifts, highlighting its importance, procedure, and potential variations. 1. Importance of Acknowledgment: Acknowledging the receipt of a gift is more than just a formality. It serves as an opportunity for nonprofit church corporations to express their gratitude, strengthen their relationship with donors, and comply with legal obligations. Acknowledgment letters also allow donors to verify their gift and provide them with documentation for tax-deductible purposes. 2. Procedure for Acknowledgment: a. Gift Acknowledgment Letter: Nonprofit church corporations in Hennepin, Minnesota typically send a formal letter of acknowledgment to donors or organizations who contribute. The letter should include the organization's contact information, date of receipt of the gift, description of the gift, and an expression of gratitude. It should also provide any necessary tax-deductible information and outline any additional actions, such as a receipt or tax acknowledgment. b. Format and Timing: The acknowledgment letter should be printed on the organization's letterhead, signed by an authorized individual, and sent promptly. The timing of acknowledgment is crucial to show appreciation and maintain donor relations effectively. c. IRS Requirements: To comply with the Internal Revenue Service (IRS) regulations, nonprofit church corporations must include specific information in their acknowledgment letters, such as stating whether the organization provided any goods or services in exchange for the gift and a statement regarding the tax-deductible status of the donation. 3. Types of Acknowledgment: a. General Acknowledgment: This type of acknowledgment is suitable for any regular gift received by a nonprofit church corporation, whether it's monetary, in-kind, or property. It expresses appreciation and provides documentation for tax purposes. b. Gift-In-Kind Acknowledgment: Non-cash contributions, such as donated equipment, supplies, or services, require a specific acknowledgment that describes the item or service received and provides its fair market value. It gives both the donor and the corporation a record of the non-monetary gift. c. Recurring or Pledged Gift Acknowledgment: When donors commit to regular or recurring donations, the acknowledgment should include the total expected contributions or the duration of the commitment. This type of acknowledgment reassures the donors about their commitment and expresses the nonprofit's gratitude for their ongoing support. d. Endowment or Legacy Gift Acknowledgment: Nonprofit church corporations may receive significant gifts, including bequests, which require special acknowledgment. This acknowledgment emphasizes the long-term impact of the gift and how it will be used to support the church's mission for years to come. Conclusion: Hennepin, Minnesota Acknowledgment by a Nonprofit Church Corporation of Receipt of Gifts is a crucial process for expressing gratitude, maintaining donor relationships, and ensuring compliance with legal requirements. By understanding the importance, procedure, and different types of acknowledgments, nonprofit church corporations can effectively recognize and foster their ongoing support from generous donors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Acuse de recibo de una donación por parte de una corporación eclesiástica sin fines de lucro - Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift

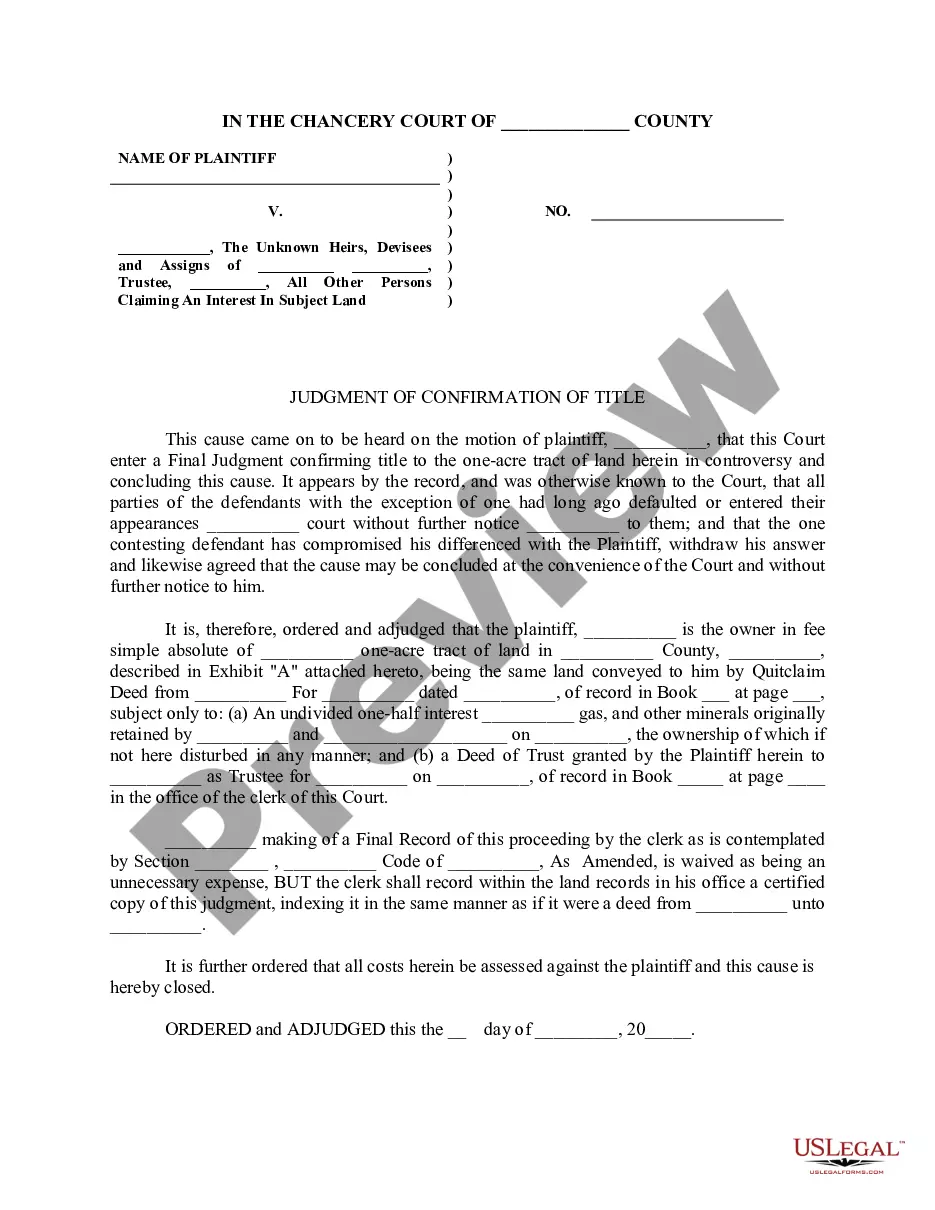

Description

How to fill out Hennepin Minnesota Acuse De Recibo De Una Donación Por Parte De Una Corporación Eclesiástica Sin Fines De Lucro?

Whether you intend to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Hennepin Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to obtain the Hennepin Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift. Follow the instructions below:

- Make sure the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Hennepin Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!