Mecklenburg, North Carolina is a county located in the south-central part of the state. It is one of the 100 counties in North Carolina and is home to the city of Charlotte, which is the largest city in the state. Mecklenburg County encompasses a diverse range of communities, including urban areas, suburban neighborhoods, and rural landscapes. As a hub for economic growth and cultural diversity, Mecklenburg County offers a wide array of attractions and amenities. Residents and visitors can enjoy world-class dining, shopping, and entertainment options, as well as access to beautiful parks, green ways, and recreational facilities. In terms of nonprofits, Mecklenburg County hosts numerous charitable organizations and churches. Nonprofit Church Corporations play a significant role in the community, providing spiritual guidance, support, and social services to individuals in need. These organizations rely heavily on the support and generosity of their congregation and the wider community. When a nonprofit church corporation receives a gift, it is important to acknowledge the receipt of the donation. An acknowledgment serves as a formal recognition of the gift and demonstrates gratitude towards the donor. This process ensures transparency and fosters trust between the church and its supporters. Different types of Mecklenburg, North Carolina Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift include: 1. Cash Donation Acknowledgment: When individuals or organizations provide monetary contributions, a nonprofit church corporation must issue a written acknowledgment to confirm the donation's receipt. The acknowledgment usually includes the donor's name, the amount of the gift, the date received, and any applicable tax-deductible information. 2. In-Kind Donation Acknowledgment: Nonprofits often receive non-cash gifts such as goods or services. When a nonprofit church corporation accepts such donations, they should provide the donor with a written acknowledgment that details the nature of the gift and its estimated value. 3. Stock or Securities Donation Acknowledgment: Some individuals choose to donate stocks, bonds, or other securities to nonprofit church corporations. In these cases, the organization must handle the transfer and subsequently provide an acknowledgment to the donor, including details of the security donated, its value, and any tax-related information. 4. Property or Real Estate Donation Acknowledgment: Nonprofit church corporations may also receive gifts of property or real estate. Acknowledgments for such donations typically outline the donated property's description, fair market value, and any conditions or restrictions attached to the gift. 5. Planned Giving Acknowledgment: Planned giving refers to donations made as part of an individual's estate planning or through trust arrangements. Nonprofit church corporations must acknowledge these gifts separately, providing donors with a comprehensive acknowledgment outlining the specific terms and purpose of the planned gift. Acknowledgments are crucial for donors to claim tax deductions, as they serve as documentation of charitable contributions. It is vital for nonprofit church corporations in Mecklenburg, North Carolina to ensure accuracy, compliance with tax regulations, and timely issuance of these acknowledgments to foster positive donor relationships and maintain transparency within the community.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Acuse de recibo de una donación por parte de una corporación eclesiástica sin fines de lucro - Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift

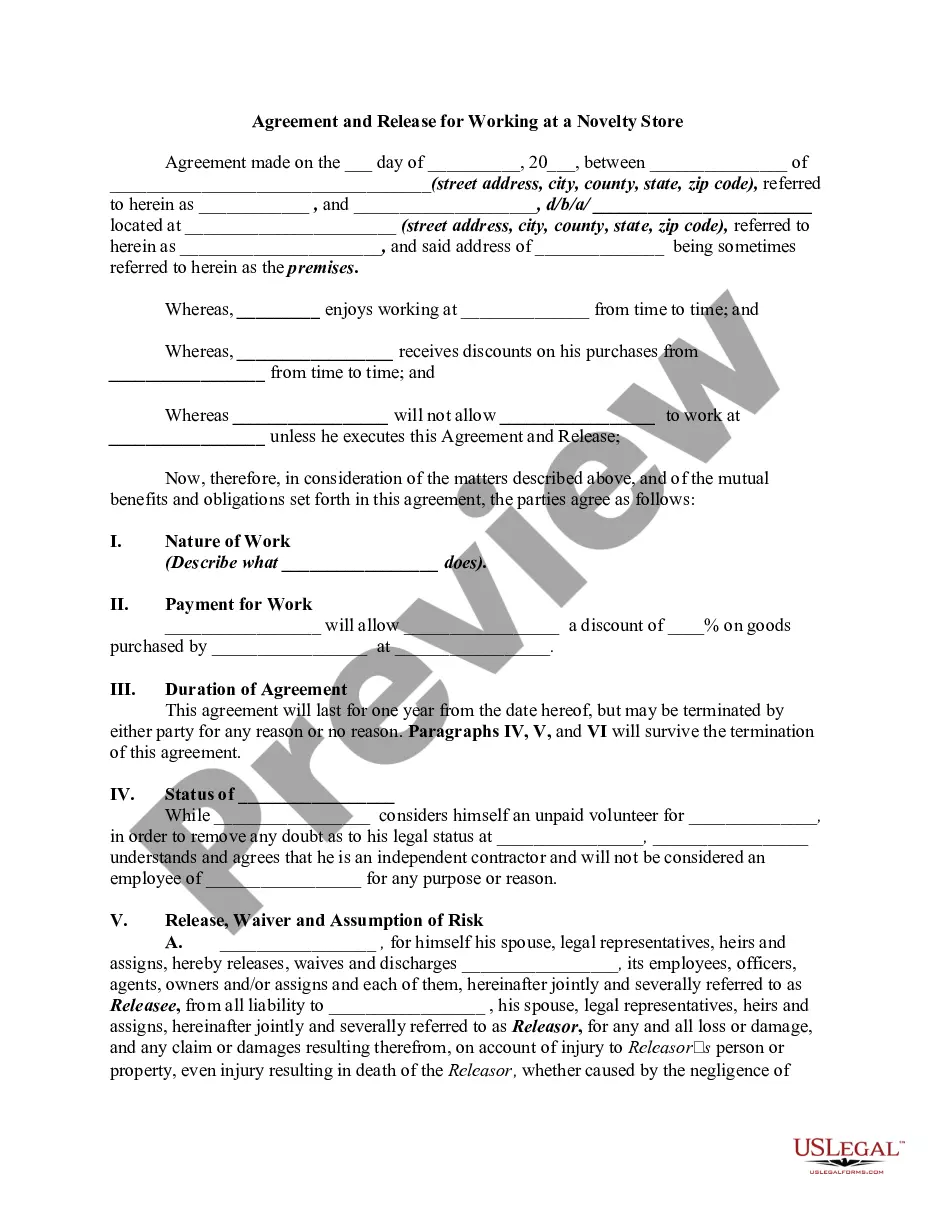

Description

How to fill out Mecklenburg North Carolina Acuse De Recibo De Una Donación Por Parte De Una Corporación Eclesiástica Sin Fines De Lucro?

Drafting papers for the business or personal demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to draft Mecklenburg Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift without professional assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Mecklenburg Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift by yourself, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, adhere to the step-by-step guide below to get the Mecklenburg Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift:

- Look through the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that fits your needs, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any use case with just a couple of clicks!