Wake North Carolina Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift is an important legal document that serves as proof of the church's gratitude and formal acknowledgment for a received gift from a donor. This document is crucial for both the church and the donor to maintain transparency and compliance with the IRS regulations. There are several types of Wake North Carolina Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift documents that can be used depending on the nature of the gift: 1. Cash Donations: This acknowledgment is used when a donor contributes money to the church. It includes the church's name, address, and tax identification number, along with the donor's name, the amount of the donation, the date it was received, and a statement indicating that no goods or services were exchanged for the gift. 2. In-kind Donations: When a donor presents non-cash items or services, this type of acknowledgment is utilized. It includes similar information as the cash donation acknowledgment, but also specifies the description of the donated item or service, with an estimated fair market value as required by the IRS. 3. Stock or Securities Donations: In cases where a donor gifts stocks, bonds, or securities, this acknowledgment is used. It includes details such as the name of the donor, the number of shares or securities transferred, their fair market value on the date of the gift, and any specific conditions attached to the donation. 4. Real Estate Donations: If a donor contributes real estate property to the nonprofit church corporation, a more complex acknowledgment is necessary. It includes the donor's name, a description of the property, its fair market value, and an indication of whether there are any restrictions or conditions associated with the gift. The Wake North Carolina Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift is crucial for both the church and the donor. For the donor, it serves as a receipt to claim tax deductions, while for the church, it plays a crucial role in maintaining compliance with IRS regulations and retaining its nonprofit status. By promptly providing these acknowledgments, the church ensures transparency and fosters trust with its donors, ultimately strengthening its relationships within the community.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Acuse de recibo de una donación por parte de una corporación eclesiástica sin fines de lucro - Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift

Description

How to fill out Wake North Carolina Acuse De Recibo De Una Donación Por Parte De Una Corporación Eclesiástica Sin Fines De Lucro?

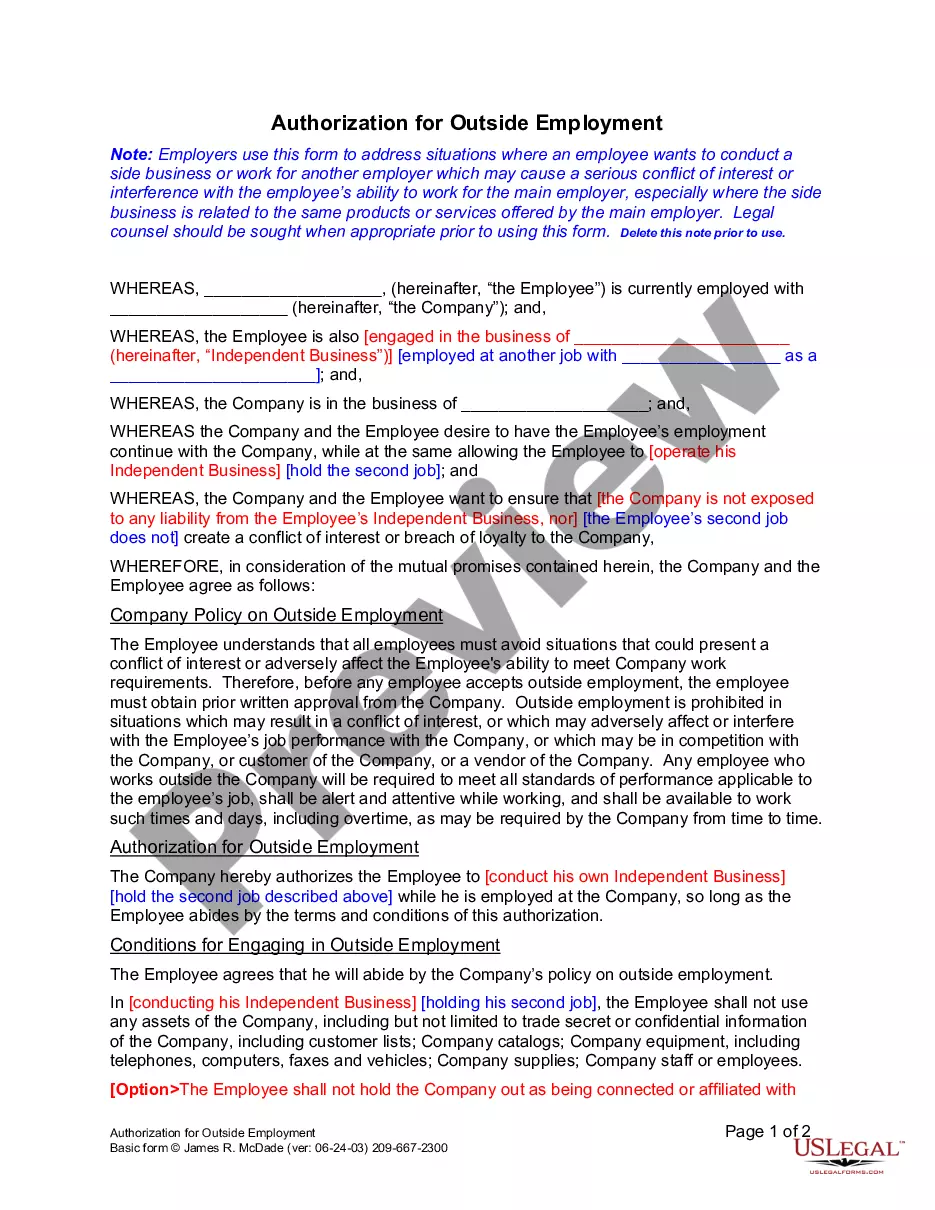

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask a legal professional to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Wake Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario collected all in one place. Therefore, if you need the latest version of the Wake Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Wake Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Wake Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift and save it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!