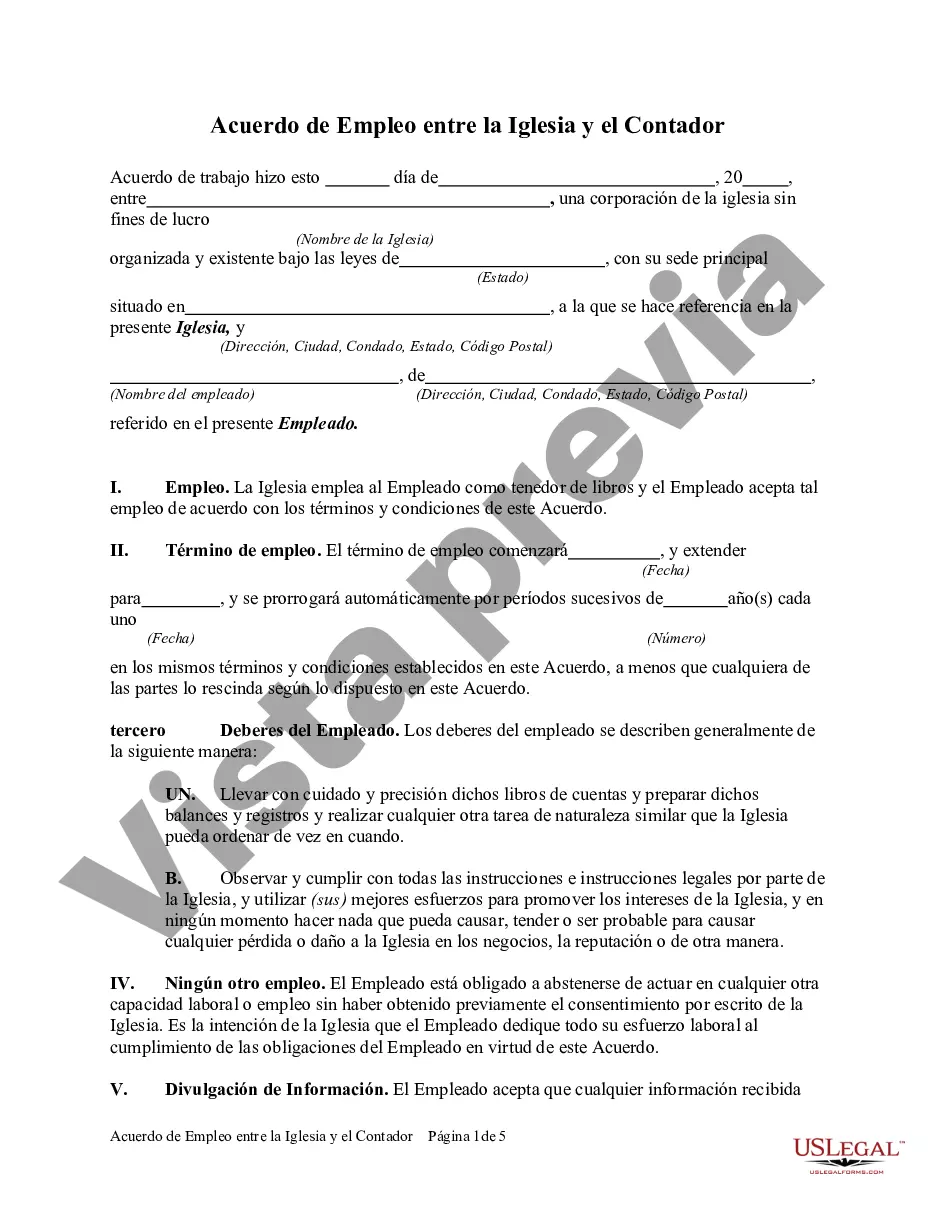

A Cuyahoga Ohio Employment Agreement between a Church and Bookkeeper is a legally binding document that outlines the terms and conditions of employment between the church and the bookkeeper. This agreement sets forth the rights and responsibilities of both parties involved, ensuring clarity and protection for both sides. Keywords: Cuyahoga Ohio, employment agreement, church, bookkeeper, terms and conditions, rights and responsibilities, clarity, protection. Different types of Cuyahoga Ohio Employment Agreements between Church and Bookkeeper may include: 1. Full-Time Employment Agreement: This type of agreement is suitable when the bookkeeper is expected to work a standard 40-hour workweek for the church and receive full-time benefits. 2. Part-Time Employment Agreement: In cases where the bookkeeping tasks are not extensive, a part-time agreement can be used. This agreement specifies the number of hours per week the bookkeeper will work and outlines the corresponding pay and benefits. 3. Temporary or Seasonal Employment Agreement: When the church requires a bookkeeper for a specific period, such as during tax seasons or special events, a temporary or seasonal agreement can be utilized. This agreement includes the start and end dates of employment, as well as any specific terms applicable during the temporary period. 4. Independent Contractor Agreement: In some cases, a church may hire a bookkeeper as an independent contractor rather than an employee. This agreement clarifies the bookkeeper's role as an independent contractor and outlines the terms, including payment structure, duration of engagement, and responsibilities. Regardless of the type of agreement, it is crucial to include the following essential components: a. Job Description and Duties: Clearly define the bookkeeper's role, responsibilities, and expectations within the church's financial operations. b. Compensation and Benefits: Specify the bookkeeper's salary, payment terms, benefits (if applicable), and any bonuses or incentives. c. Working Hours: Outline the bookkeeper's work schedule, including any flexibility or expectations regarding overtime, weekend work, or holidays. d. Confidentiality and Non-Disclosure: Address the confidentiality of church financial information and any non-disclosure requirements. e. Termination Clause: Establish the grounds and procedures for terminating the agreement for both the church and bookkeeper, including notice periods and severance, if applicable. f. Dispute Resolution: Include a process for resolving any disputes or conflicts that may arise during the employment term, such as mediation or arbitration. g. Governing Law: Specify the laws of Cuyahoga Ohio that will govern the agreement to ensure compliance with local regulations. h. Amendments and Modifications: Explain how the agreement can be modified or amended, ensuring any changes are mutually agreed upon and documented in writing. In summary, a Cuyahoga Ohio Employment Agreement between a Church and Bookkeeper is a vital document that establishes the terms of engagement, protects both parties' rights, and ensures a clear understanding of expectations between the church and the bookkeeper.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Acuerdo de Empleo entre la Iglesia y el Contador - Employment Agreement between Church and Bookkeeper

Description

How to fill out Cuyahoga Ohio Acuerdo De Empleo Entre La Iglesia Y El Contador?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any individual or business purpose utilized in your county, including the Cuyahoga Employment Agreement between Church and Bookkeeper.

Locating templates on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Cuyahoga Employment Agreement between Church and Bookkeeper will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to obtain the Cuyahoga Employment Agreement between Church and Bookkeeper:

- Ensure you have opened the right page with your localised form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Cuyahoga Employment Agreement between Church and Bookkeeper on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!