Harris Texas Employment Agreement between Church and Bookkeeper: A Comprehensive Guide In Harris, Texas, employment agreements between churches and bookkeepers play a crucial role in ensuring a transparent and harmonious working relationship. These agreements outline the terms and conditions of employment and establish a clear understanding between the church and the bookkeeper. They serve as legally binding documents that protect the rights and responsibilities of both parties. Keywords: Harris Texas, employment agreement, church, bookkeeper, terms and conditions, working relationship, transparent, harmonious, understanding, legally binding, rights, responsibilities. Types of Harris Texas Employment Agreement between Church and Bookkeeper: 1. Full-time Employment Agreement: This type of agreement is suitable when a church hires a bookkeeper on a full-time basis, typically for a steady workload of 40 hours per week. It lays out the terms regarding salary, benefits, work schedule, leave policies, and other employment conditions relevant to a full-time position. 2. Part-time or Contractual Employment Agreement: If a church requires a bookkeeper for fewer hours or only on a contract basis, a part-time or contractual employment agreement is appropriate. This agreement outlines the terms and conditions, including hourly or project-based pay rates, specific duties, and the duration of the contract. 3. Temporary Employment Agreement: When a church needs a bookkeeper to cover a temporary absence, such as maternity leave or extended sick leave, a temporary employment agreement is utilized. It clarifies the bookkeeper's role, duration of employment, and any additional benefits or adjustments during the temporary period. 4. Independent Contractor Agreement: In some cases, a church may choose to engage a bookkeeper as an independent contractor. This type of agreement establishes that the bookkeeper is not an employee but a self-employed individual providing services to the church. It specifies the terms of engagement, payment arrangements, and delineates the responsibilities of both parties. Regardless of the specific type of Harris Texas Employment Agreement between Church and Bookkeeper, these agreements typically cover common elements such as: A. Job Description and Duties: Clearly defining the bookkeeper's responsibilities, tasks, and expected outcomes. B. Compensation and Benefits: Outlining the bookkeeper's salary, payment structure (hourly, monthly, or annual), deductions, and any additional benefits (health insurance, retirement contributions, etc.). C. Work Schedule and Hours: Establishing the bookkeeper's regular work hours, including any flexibility or requirements for on-site or remote work. D. Leave Policies: Detailing the provisions for vacation, sick leave, personal days, and any other types of paid or unpaid leave. E. Termination and Severance: Describing the conditions and procedure for termination of the agreement, as well as any severance or notice requirements. F. Confidentiality and Non-Disclosure: Ensuring the protection of sensitive information and prohibiting the bookkeeper from sharing such information without authorization. G. Dispute Resolution: Outlining the process for resolving any conflicts or disputes that may arise between the church and the bookkeeper. H. Governing Law: Specifying which state laws govern the agreement, such as those specific to Harris, Texas. Crafting a well-structured and detailed Harris Texas Employment Agreement between Church and Bookkeeper is crucial to a smooth employment relationship, providing clarity, legal protection, and promoting mutual understanding and respect.

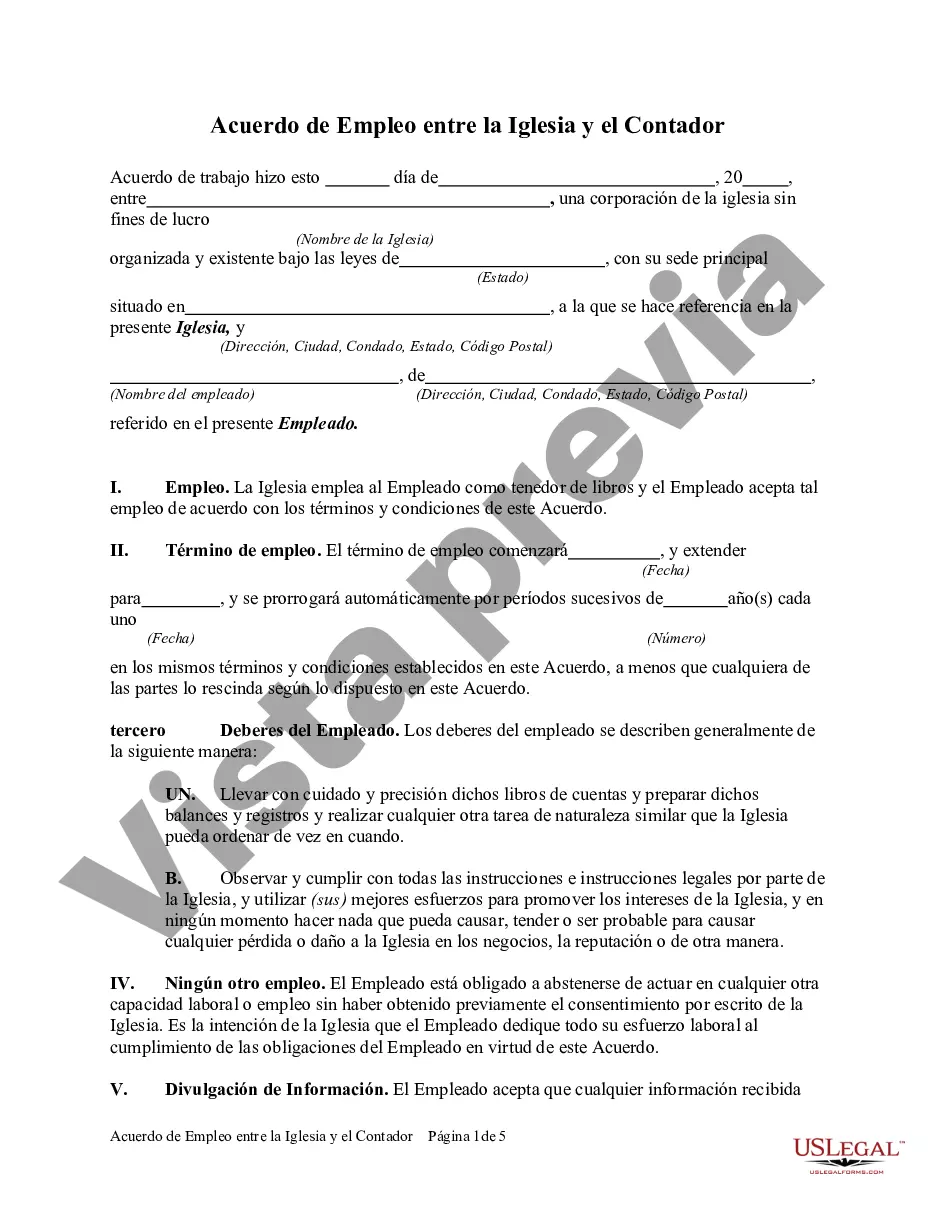

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Acuerdo de Empleo entre la Iglesia y el Contador - Employment Agreement between Church and Bookkeeper

Description

How to fill out Harris Texas Acuerdo De Empleo Entre La Iglesia Y El Contador?

How much time does it typically take you to draw up a legal document? Considering that every state has its laws and regulations for every life situation, finding a Harris Employment Agreement between Church and Bookkeeper suiting all local requirements can be stressful, and ordering it from a professional lawyer is often pricey. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. Apart from the Harris Employment Agreement between Church and Bookkeeper, here you can find any specific document to run your business or individual deeds, complying with your regional requirements. Experts verify all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can get the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Harris Employment Agreement between Church and Bookkeeper:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Harris Employment Agreement between Church and Bookkeeper.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!