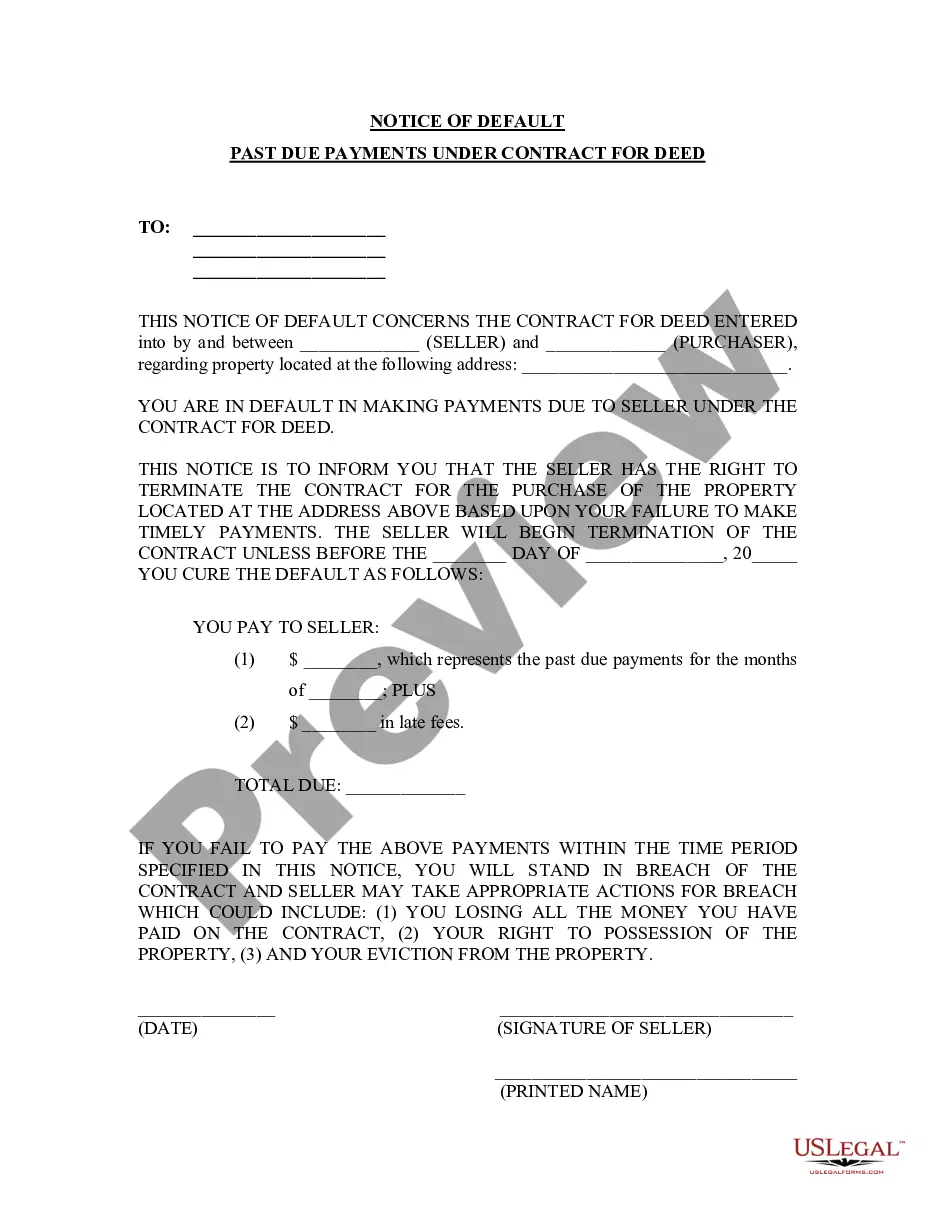

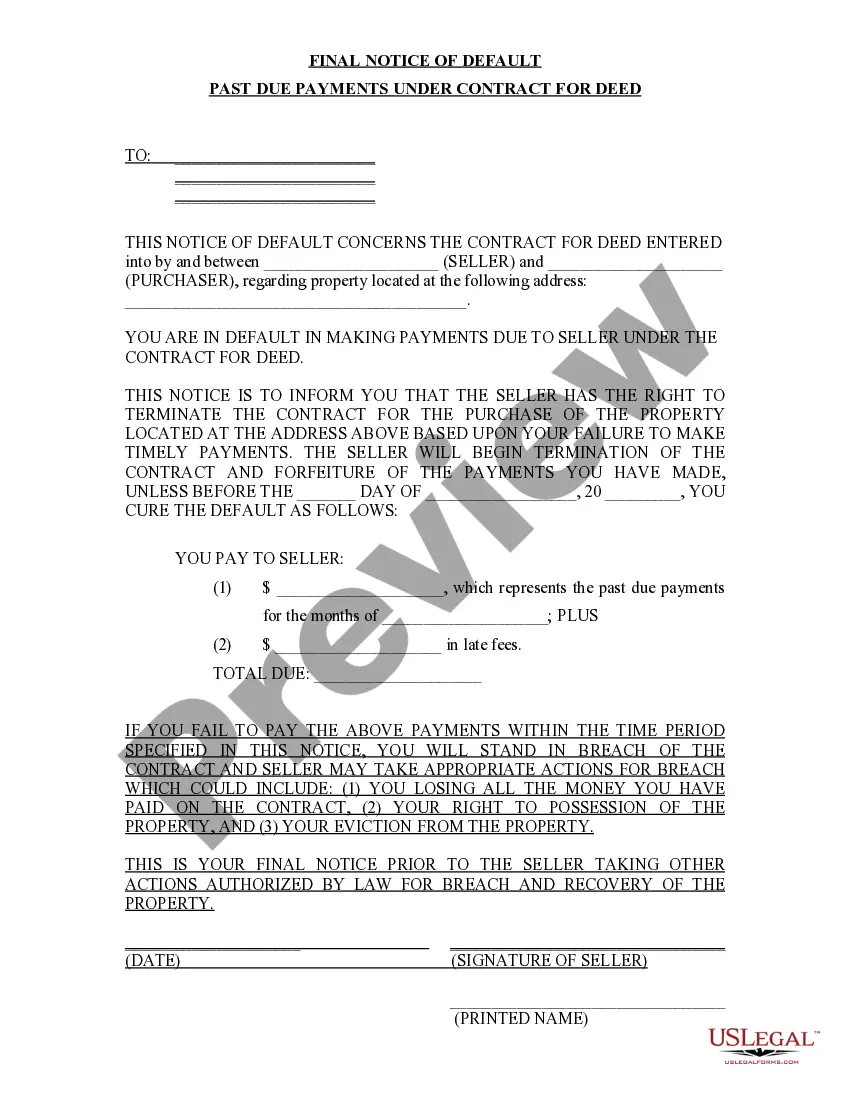

Philadelphia, Pennsylvania, Employment Agreement between Church and Bookkeeper: A Comprehensive Overview In Philadelphia, Pennsylvania, the employment agreement between a church and bookkeeper establishes the terms and conditions of employment and serves as a legally binding document to protect the rights and responsibilities of both parties involved. This agreement outlines crucial aspects such as compensation, working hours, job duties, confidentiality, termination, and other terms relevant to the successful functioning of the church and the bookkeeper's role within it. 1. Compensation and Benefits: This section details the bookkeeper's salary or hourly wage, payment frequency, and any additional compensation such as bonuses, retirement plans, or health benefits. It further outlines the process for salary reviews and possible increases based on performance. 2. Position and Responsibilities: This portion clearly defines the bookkeeper's role within the church. It includes a detailed job description, listing specific tasks, responsibilities, and expectations related to financial record-keeping, budgeting, payroll processing, accounts payable and receivable, and other related administrative tasks. 3. Working Hours and Schedule: This section establishes the bookkeeper's working hours, providing clarity on the regular schedule and any variations that may arise due to specific circumstances or seasons. 4. Confidentiality and Non-Disclosure: Given the sensitive nature of financial information, this clause ensures that the bookkeeper maintains strict confidentiality regarding all financial matters obtained during their employment. It also prohibits the bookkeeper from disclosing any sensitive church information to unauthorized individuals or competitors. 5. Termination and Severance: This section outlines the conditions that may lead to the termination of the employment agreement, including voluntary resignation, dismissal with or without cause, retirement, or other circumstances. It clarifies the notice period required by either party and discusses any severance package or benefits entitled to the bookkeeper upon termination. 6. Intellectual Property: This clause addresses ownership of any intellectual property created by the bookkeeper during their employment, ensuring that any material, invention, or work produced remains the property of the church. 7. Non-Compete Agreement: If applicable, this section restricts the bookkeeper from engaging in similar employment or providing related services within a specified radius of the church for a certain time period following termination of the agreement. Types of Philadelphia, Pennsylvania, Employment Agreements between Church and Bookkeeper: 1. Full-Time Employment Agreement: This agreement is designed for bookkeepers who work on a full-time basis, typically 40 hours per week, with benefits and a fixed salary. 2. Part-Time Employment Agreement: Suitable for bookkeepers with reduced working hours, this agreement outlines the specific working schedule, hourly wage, and any applicable benefits based on the number of hours worked. 3. Contract/Consulting Agreement: This contract-based agreement is employed when a bookkeeper is engaged for a specific project or a pre-determined duration. It outlines the scope of work, payment terms, and project deadlines, without entailing a traditional employer-employee relationship. In conclusion, the Philadelphia, Pennsylvania, Employment Agreement between a church and bookkeeper ensures a transparent and mutually beneficial working relationship. By clearly defining rights and responsibilities, this agreement serves as a foundation for smooth operations and effective financial management within the church.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Acuerdo de Empleo entre la Iglesia y el Contador - Employment Agreement between Church and Bookkeeper

Description

How to fill out Philadelphia Pennsylvania Acuerdo De Empleo Entre La Iglesia Y El Contador?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from the ground up, including Philadelphia Employment Agreement between Church and Bookkeeper, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various types varying from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find detailed materials and tutorials on the website to make any activities associated with paperwork execution simple.

Here's how you can purchase and download Philadelphia Employment Agreement between Church and Bookkeeper.

- Go over the document's preview and description (if provided) to get a general information on what you’ll get after getting the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can impact the legality of some documents.

- Examine the similar forms or start the search over to find the right file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment method, and buy Philadelphia Employment Agreement between Church and Bookkeeper.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Philadelphia Employment Agreement between Church and Bookkeeper, log in to your account, and download it. Needless to say, our platform can’t replace a lawyer entirely. If you have to cope with an extremely complicated case, we recommend using the services of an attorney to check your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Become one of them today and get your state-compliant documents effortlessly!