Title: Understanding Cook Illinois Lease Agreement between Two Nonprofit Church Corporations Introduction: A lease agreement is a crucial legal contract that defines the terms and conditions for the use of a property between two parties. In the context of two nonprofit church corporations in Cook County, Illinois, the Cook Illinois Lease Agreement holds significant importance. This article will provide a detailed description of this type of lease agreement, outlining its key elements, processes, and relevant considerations. 1. Definition of Cook Illinois Lease Agreement: The Cook Illinois Lease Agreement between Two Nonprofit Church Corporations is a legally binding document outlining the terms and conditions under which one nonprofit church corporation (lessee) leases a property owned by another nonprofit church corporation (lessor) within Cook County, Illinois. This agreement serves as a framework for the arrangement of the lease, addressing various aspects to ensure a smooth and mutually beneficial relationship. 2. Key Elements of Cook Illinois Lease Agreement: a. Parties Involved: This section identifies the lessor (property owner) and lessee (renter) by providing their legal names and contact information. b. Property Description: Detailed information about the leased property, including address, boundaries, land area, and parking facilities, is included. c. Lease Term: Specifies the duration of the lease, including the start and end dates, and any provisions for renewal or termination. d. Lease Payments: Outlines the agreed-upon rental amount, payment frequency, and the preferred method of payment. e. Maintenance and Repairs: Defines the responsibilities of the lessor and lessee regarding property maintenance, repairs, and utility expenses. f. Use of Property: Establishes the permitted uses of the property, ensuring it aligns with the nonprofit church corporation's activities and complies with local zoning regulations and ordinances. g. Insurance and Liability: Outlines the insurance requirements for both parties and clarifies liability for damages, accidents, or losses that may occur on the leased premises. h. Indemnification Clause: Protects each party from bearing responsibility for the actions or negligence of the other party, ensuring legal liability is limited to their respective actions. i. Dispute Resolution: Provisions for resolving disagreements or disputes, including mediation, arbitration, or legal action, if necessary. 3. Types of Cook Illinois Lease Agreements Between Two Nonprofit Church Corporations: a. Short-Term Lease Agreement: A lease agreement with a relatively brief duration, usually for a few months to a year, often utilized for temporary space arrangements or specific events. b. Long-Term Lease Agreement: A lease agreement with an extended duration, typically ranging from multiple years to a couple of decades. Such agreements are suitable for long-term property usage and stability. c. Lease-to-Own Agreement: A specialized agreement where the lessor provides an option for the lessee to purchase the leased property after a specified period, combining elements of both a lease and a purchase agreement. Conclusion: The Cook Illinois Lease Agreement between Two Nonprofit Church Corporations is an essential legal tool governing the relationship between nonprofit church corporations in Cook County, Illinois. Adhering to this agreement ensures that both parties understand their rights, obligations, and expectations throughout the lease term. By considering the key elements and different types of lease agreements, nonprofit church corporations can enter into a lease arrangement that suits their specific needs and goals.

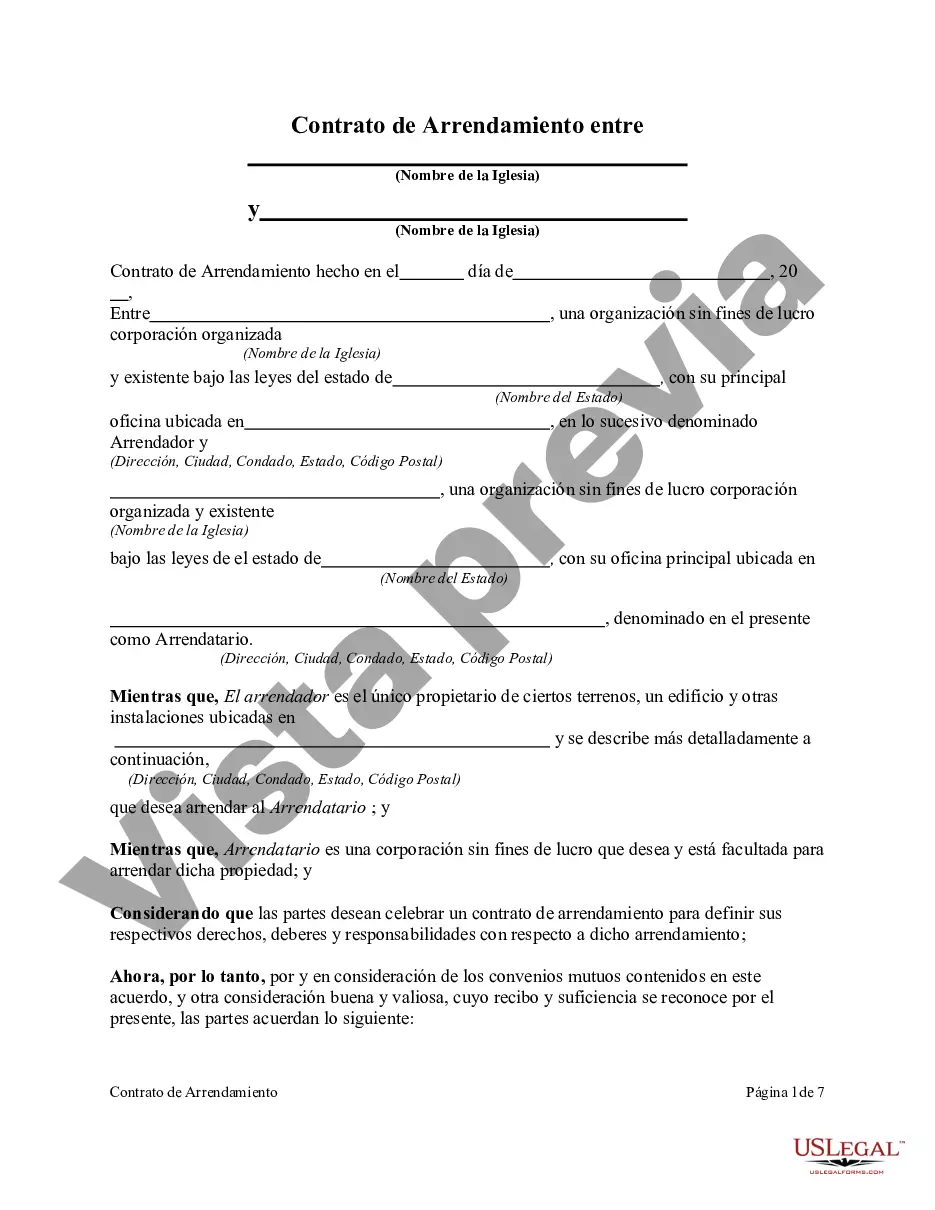

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Contrato de arrendamiento entre dos corporaciones eclesiásticas sin fines de lucro - Lease Agreement Between Two Nonprofit Church Corporations

Description

How to fill out Cook Illinois Contrato De Arrendamiento Entre Dos Corporaciones Eclesiásticas Sin Fines De Lucro?

Creating legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Cook Lease Agreement Between Two Nonprofit Church Corporations, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in different types varying from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching process less frustrating. You can also find detailed materials and guides on the website to make any tasks associated with document completion simple.

Here's how you can purchase and download Cook Lease Agreement Between Two Nonprofit Church Corporations.

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after downloading the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can affect the validity of some documents.

- Check the related forms or start the search over to find the right document.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy Cook Lease Agreement Between Two Nonprofit Church Corporations.

- Choose to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Cook Lease Agreement Between Two Nonprofit Church Corporations, log in to your account, and download it. Of course, our platform can’t replace a legal professional entirely. If you have to deal with an exceptionally challenging case, we advise using the services of an attorney to examine your form before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Join them today and get your state-specific documents effortlessly!