Houston Texas Lease Agreement Between Two Nonprofit Church Corporations: An In-Depth Overview Introduction: A Houston Texas Lease Agreement between two nonprofit church corporations is a legally binding contract that outlines the terms and conditions governing the lease of a property or space owned by one nonprofit church corporation to another nonprofit church corporation. This lease agreement aims to establish a fair and transparent framework for the use of the property, obligations of both parties, and any additional terms specific to the agreement. Types of Houston Texas Lease Agreements Between Two Nonprofit Church Corporations: 1. Long-Term Lease Agreement: A long-term lease agreement refers to a lease with a duration typically exceeding one year. This lease is suitable when the church corporation wishes to establish a stable, long-term relationship with the landlord church corporation for a substantial period. 2. Short-Term Lease Agreement: A short-term lease agreement is usually for a period of one year or less. This flexible lease option is preferable when the church corporation requires a temporary space or is uncertain about its long-term needs. Key Elements of a Houston Texas Lease Agreement Between Two Nonprofit Church Corporations: 1. Property Description: The lease agreement should include an accurate description of the property being leased, including the address, boundaries, and any relevant identifiers (e.g., Unit number or suite). 2. Lease Term: Clearly define the lease term, including the start and end date, with provisions for extensions or renewal if desired. 3. Rental Payment: Specify the rental amount to be paid by the tenant church corporation, the frequency of payment, and the accepted modes of payment. Additionally, outline any penalties or late fees for missed payments. 4. Maintenance and Repairs: Determine the responsibilities of both parties regarding property maintenance, repairs, and any associated costs. This includes regular maintenance, repairs due to natural wear and tear, and any damages caused by the tenant. 5. Utilities and Operating Costs: Outline which party will bear the costs associated with utilities, such as water, electricity, gas, or trash removal. Clearly define the obligations for payment and any proration method if the utilities are shared. 6. Alterations and Improvements: Detail the process of seeking approval for any alterations or improvements to the property and address who will bear the costs. Specify whether such alterations will be allowed to be made and whether they need to be restored upon lease termination. 7. Insurance: Specify the required insurance coverage for both the tenant and landlord church corporations, and any additional insured parties. Outline the minimum coverage amounts and the party responsible for obtaining and paying for the insurance policies. 8. Termination: Clearly state the conditions under which either party may terminate the lease agreement, including any notice period required. Specify the consequences of early termination, potential penalties, and the return of security deposits. Conclusion: A well-drafted Houston Texas Lease Agreement between two nonprofit church corporations is crucial for defining the rights and responsibilities of both parties involved. It allows for a smooth and accountable relationship between the tenant and landlord church corporations, ensuring that the property is appropriately utilized, maintained, and managed throughout the lease term.

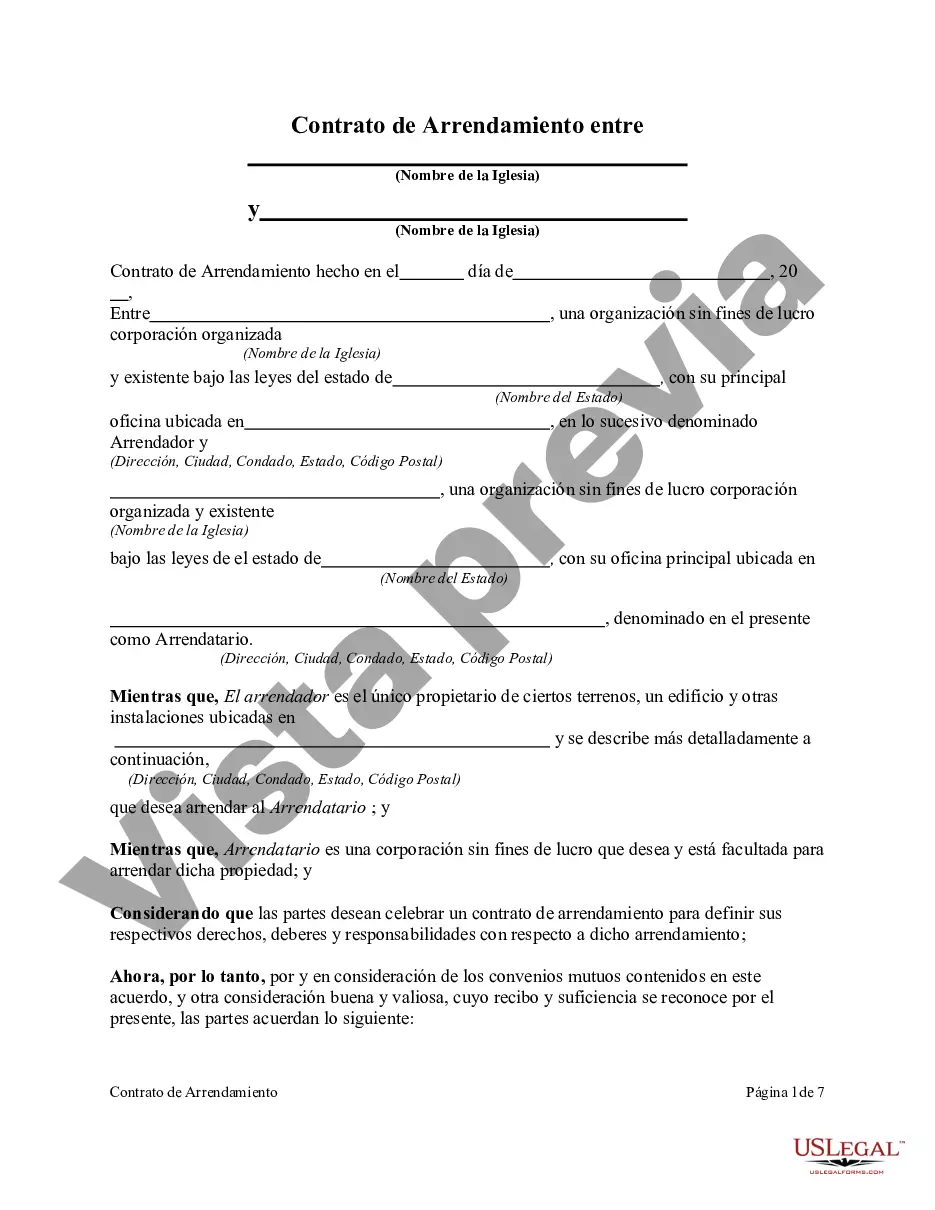

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Contrato de arrendamiento entre dos corporaciones eclesiásticas sin fines de lucro - Lease Agreement Between Two Nonprofit Church Corporations

Description

How to fill out Houston Texas Contrato De Arrendamiento Entre Dos Corporaciones Eclesiásticas Sin Fines De Lucro?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a lawyer to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Houston Lease Agreement Between Two Nonprofit Church Corporations, it may cost you a fortune. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario collected all in one place. Therefore, if you need the recent version of the Houston Lease Agreement Between Two Nonprofit Church Corporations, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Houston Lease Agreement Between Two Nonprofit Church Corporations:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Houston Lease Agreement Between Two Nonprofit Church Corporations and save it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!