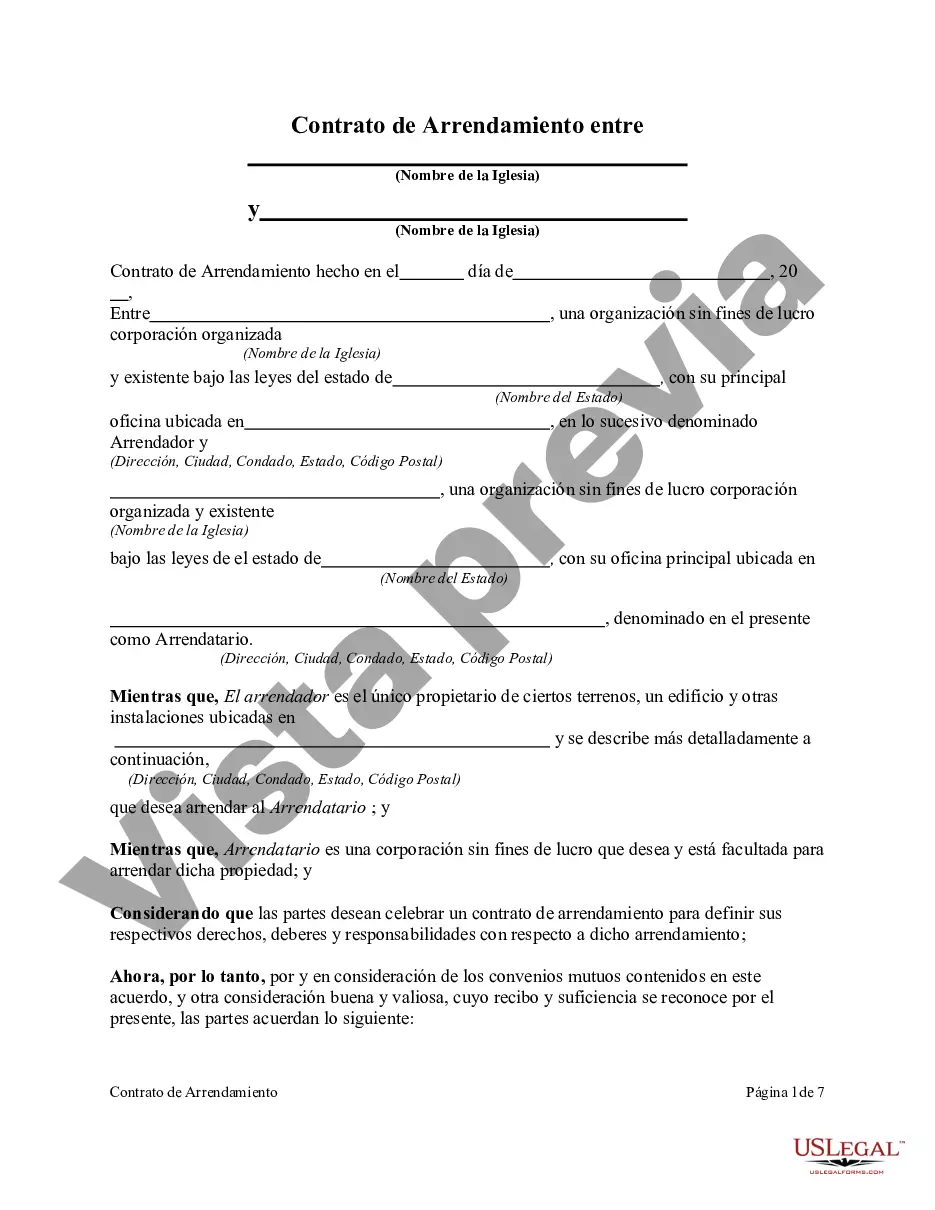

A Maricopa Arizona Lease Agreement Between Two Nonprofit Church Corporations is a legally binding contract that outlines the terms and conditions under which one nonprofit church corporation leases a property or space to another nonprofit church corporation located in Maricopa, Arizona. This lease agreement provides a comprehensive understanding of the terms, rights, responsibilities, and obligations of both parties involved. The agreement typically includes the identification of the participating nonprofit church corporations, their legal names, addresses, and contact information. It outlines the purpose for which the leased property or space will be used, such as conducting religious services, holding meetings or events, or other church-related activities. Key components of a Maricopa Arizona Lease Agreement Between Two Nonprofit Church Corporations may include: 1. Lease Term: Clearly defining the start and end dates of the lease period. It can be a fixed-term lease or a month-to-month agreement, depending on the parties' preferences and needs. 2. Rent and Security Deposit: Stipulating the amount of rent, the frequency of payments, and the method of payment. Additionally, it may specify the security deposit amount and conditions for its return or adjustment. 3. Use of Property: Clearly outlining what the leased property can be used for, ensuring alignment with the church corporation's non-profit purpose. It may include specific restrictions or permissions related to certain activities or alterations. 4. Maintenance and Repairs: Assigning responsibilities for the maintenance and repairs of the property. It clarifies which party is responsible for routine maintenance tasks and any structural repairs that may arise during the lease term. 5. Utilities and Expenses: Specifying who will bear the costs for utilities, such as electricity, water, gas, and any other expenses related to the leased property, like property taxes or insurance. 6. Indemnification: Stating that both nonprofit church corporations agree to indemnify and hold each other harmless from any claims, damages, liabilities, or expenses arising from the use of the leased property. 7. Insurance: Requiring both parties to carry adequate insurance coverage throughout the term of the lease, including general liability insurance, property insurance, and any other type of insurance required by law or mutually agreed upon. 8. Termination: Describing the conditions and procedures for early termination of the lease agreement, such as notice period, penalty fees, or specific circumstances leading to termination (e.g., sale of the property). Types of Maricopa Arizona Lease Agreement Between Two Nonprofit Church Corporations may include: 1. Multi-year Lease: A lease agreement with a fixed term of multiple years, providing both parties with stability and security over an extended period. 2. Month-to-Month Lease: An agreement that allows the parties to renew or terminate the lease on a monthly basis, offering more flexibility for short-term arrangements or uncertain needs. 3. Exclusive Use Lease: A lease agreement granting the tenant nonprofit church corporation exclusive rights to use the leased property, ensuring no other parties can occupy or utilize the space during the agreed-upon period. In conclusion, a Maricopa Arizona Lease Agreement Between Two Nonprofit Church Corporations ensures a clear understanding of the rights, responsibilities, and terms involved in the leasing of a property or space between nonprofit church corporations in Maricopa, Arizona. It helps establish a mutually beneficial arrangement that aligns with the church's nonprofit mission and provides guidelines for a harmonious tenancy.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Contrato de arrendamiento entre dos corporaciones eclesiásticas sin fines de lucro - Lease Agreement Between Two Nonprofit Church Corporations

Description

How to fill out Maricopa Arizona Contrato De Arrendamiento Entre Dos Corporaciones Eclesiásticas Sin Fines De Lucro?

How much time does it usually take you to create a legal document? Given that every state has its laws and regulations for every life scenario, locating a Maricopa Lease Agreement Between Two Nonprofit Church Corporations meeting all local requirements can be exhausting, and ordering it from a professional attorney is often expensive. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. Aside from the Maricopa Lease Agreement Between Two Nonprofit Church Corporations, here you can get any specific document to run your business or personal deeds, complying with your county requirements. Professionals check all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can get the file in your profile at any time in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Maricopa Lease Agreement Between Two Nonprofit Church Corporations:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Maricopa Lease Agreement Between Two Nonprofit Church Corporations.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!