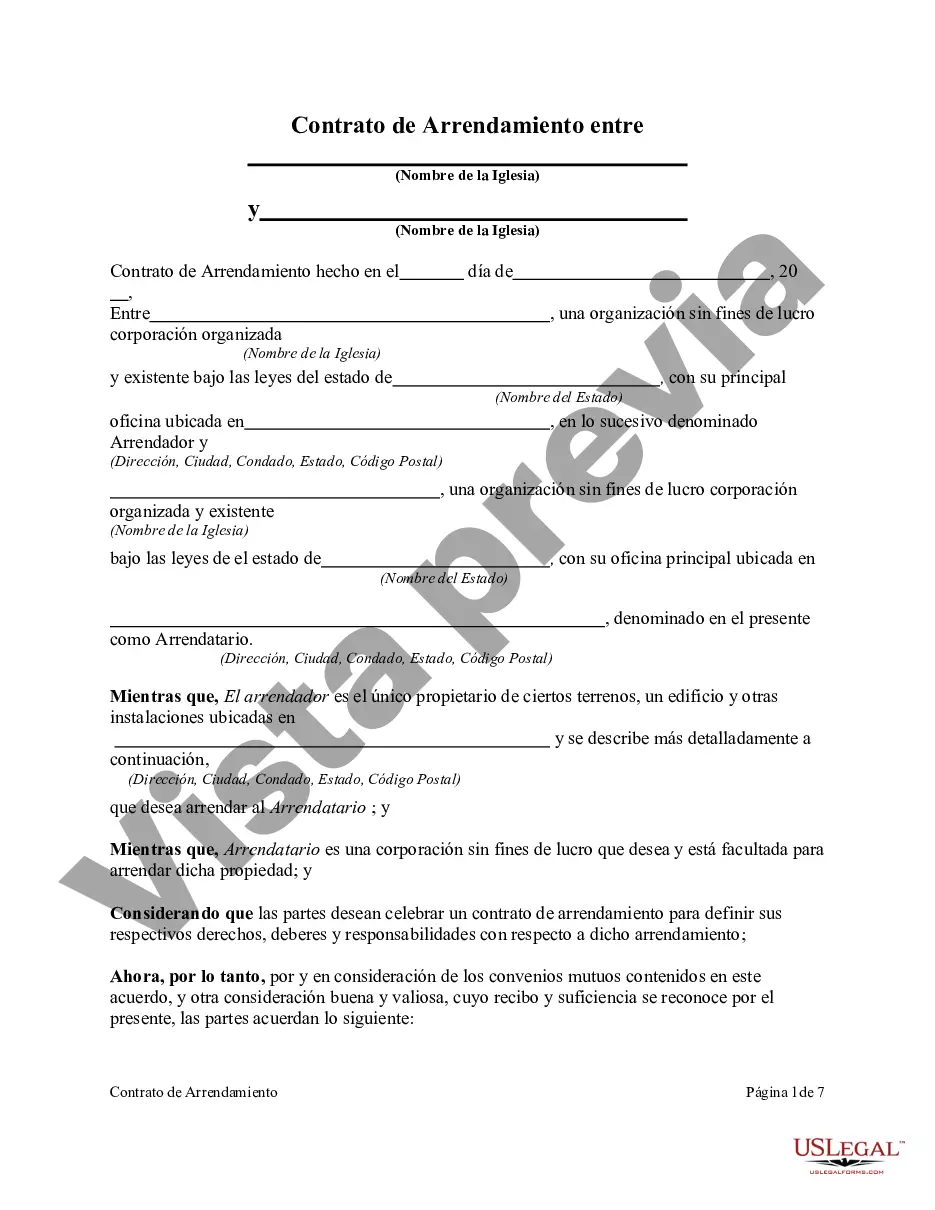

Title: Phoenix, Arizona Lease Agreement Between Two Nonprofit Church Corporations Introduction: In Phoenix, Arizona, a lease agreement between two nonprofit church corporations serves as a legally binding contract that outlines the terms and conditions for the rental of a property by one nonprofit church corporation to another. It provides a comprehensive framework to ensure a fair and mutually beneficial arrangement for both parties involved. Let's explore the key aspects and various types of Phoenix Arizona Lease Agreements Between Two Nonprofit Church Corporations: 1. Main Elements of a Phoenix Arizona Lease Agreement: — Parties: Clearly identify the two nonprofit church corporations involved in the agreement. — Property Description: Accurately describe the rented property, including its address, size, and any additional applicable details. — Term of Lease: Specify the duration of the lease agreement, such as a specific number of years or on a month-to-month basis. — Rent Payments: Outline the amount of rent, payment frequency, and acceptable payment methods. — Security Deposits: Define the required security deposit, its refund ability, and any specific conditions for its use. — Maintenance Responsibilities: Clarify the responsibilities of each party regarding property maintenance, repairs, and utility payments. — Insurance Obligations: Determine insurance requirements, such as liability coverage, fire insurance, and property damage policies. 2. Types of Phoenix Arizona Lease Agreements Between Two Nonprofit Church Corporations: — Long-term Lease Agreement: This type of agreement is suitable when the rental property will be used by the tenant nonprofit church corporation for an extended period, typically several years or more. It provides stability and commitment for both parties involved. — Short-term Lease Agreement: When a nonprofit church corporation intends to rent a property temporarily or for a specific event, a short-term lease agreement is appropriate. It generally covers shorter durations, ranging from weeks to a few months. — Sublease Agreement: In some instances, a nonprofit church corporation may sublease its property to another nonprofit church corporation. A sublease agreement outlines the terms and conditions governing such arrangements, including rental payment responsibility and liability. Conclusion: A Phoenix Arizona Lease Agreement Between Two Nonprofit Church Corporations is a vital document that ensures a transparent and amicable relationship between nonprofit church corporations engaged in property rental. It protects the interests of both parties by carefully outlining crucial aspects like property description, rental terms, maintenance responsibilities, insurance obligations, and more. Whether it's a long-term lease, short-term lease, or sublease agreement, these legal documents help establish a mutually beneficial rental arrangement for nonprofit church corporations in Phoenix, Arizona.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Contrato de arrendamiento entre dos corporaciones eclesiásticas sin fines de lucro - Lease Agreement Between Two Nonprofit Church Corporations

Description

How to fill out Phoenix Arizona Contrato De Arrendamiento Entre Dos Corporaciones Eclesiásticas Sin Fines De Lucro?

Draftwing documents, like Phoenix Lease Agreement Between Two Nonprofit Church Corporations, to manage your legal affairs is a difficult and time-consumming process. A lot of cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can acquire your legal issues into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms intended for a variety of cases and life circumstances. We ensure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Phoenix Lease Agreement Between Two Nonprofit Church Corporations form. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as straightforward! Here’s what you need to do before getting Phoenix Lease Agreement Between Two Nonprofit Church Corporations:

- Ensure that your document is specific to your state/county since the rules for creating legal paperwork may differ from one state another.

- Discover more information about the form by previewing it or reading a quick intro. If the Phoenix Lease Agreement Between Two Nonprofit Church Corporations isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to begin using our website and download the document.

- Everything looks good on your side? Click the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment information.

- Your template is good to go. You can try and download it.

It’s an easy task to find and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!