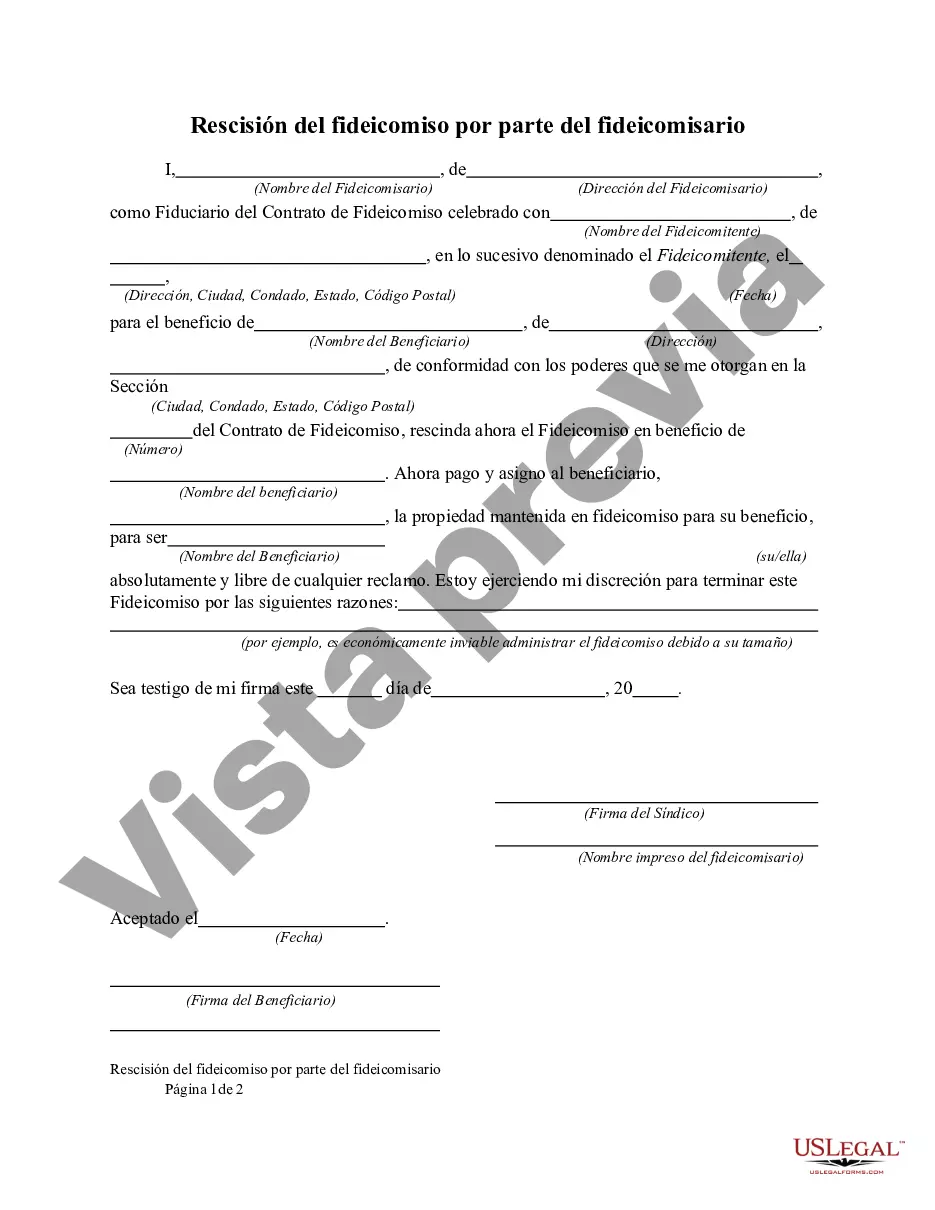

Riverside California Termination of Trust by Trustee refers to the legal process by which a trustee ends a trust in Riverside, California, following the specific guidelines and requirements set forth by the state's trust laws. Trust termination can occur for various reasons, including the fulfillment of the trust's purpose, expiration of the trust's term, a lack of assets, or the occurrence of an event specified in the trust agreement. In Riverside, California, there are primarily two types of trust termination by a trustee: revocation and termination based on the fulfillment of the trust's purposes. 1. Revocation: A trustee can terminate a trust by revoking it if the trust instrument permits such action. This type of termination usually occurs when the granter, who initially established the trust, exercises the right to revoke the trust either through a written revocation provision in the trust document or by executing a separate revocation instrument. 2. Fulfillment of Trust's Purposes: A trust can be terminated by a trustee when its predetermined purposes have been achieved or become impossible to fulfill. This termination can occur in cases where the beneficiaries have received their respective shares of the trust property, the trust's objectives have been accomplished, or the trust's specified event or condition has transpired or cannot be met. The termination process in Riverside, California, requires the trustee to adhere to specific legal protocols. Firstly, the trustee must provide written notice to all beneficiaries, informing them of the trustee's intent to terminate the trust. The notice should outline the reasons for termination, the assets involved, any impending distribution plans or arrangements, and the beneficiaries' rights to object to the proposed termination. Subsequently, if all beneficiaries do not object within a specified time frame, the trustee can proceed with the trust's termination. The trustee is responsible for distributing the trust assets in accordance with the trust instrument's terms, the applicable laws, and the beneficiaries' respective rights. It is crucial to note that the termination of a trust may have various tax and legal implications that should be addressed by consulting with an experienced attorney or tax advisor familiar with Riverside, California trust laws. In summary, Riverside California Termination of Trust by Trustee involves the legal process through which a trustee concludes a trust, either by revoking it or by fulfilling its intended purposes. The trustee must follow specific procedures, including providing notice to beneficiaries, and distribution of trust assets according to the trust agreement and relevant laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Rescisión del fideicomiso por parte del fideicomisario - Termination of Trust by Trustee

Description

How to fill out Riverside California Rescisión Del Fideicomiso Por Parte Del Fideicomisario?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to create some of them from the ground up, including Riverside Termination of Trust by Trustee, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various types varying from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find detailed resources and guides on the website to make any tasks associated with document completion simple.

Here's how to find and download Riverside Termination of Trust by Trustee.

- Go over the document's preview and description (if provided) to get a basic information on what you’ll get after getting the form.

- Ensure that the template of your choice is specific to your state/county/area since state laws can impact the legality of some documents.

- Examine the related document templates or start the search over to locate the appropriate document.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment method, and purchase Riverside Termination of Trust by Trustee.

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Riverside Termination of Trust by Trustee, log in to your account, and download it. Needless to say, our platform can’t replace a lawyer entirely. If you need to cope with an exceptionally challenging situation, we recommend getting a lawyer to review your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Join them today and purchase your state-specific documents effortlessly!