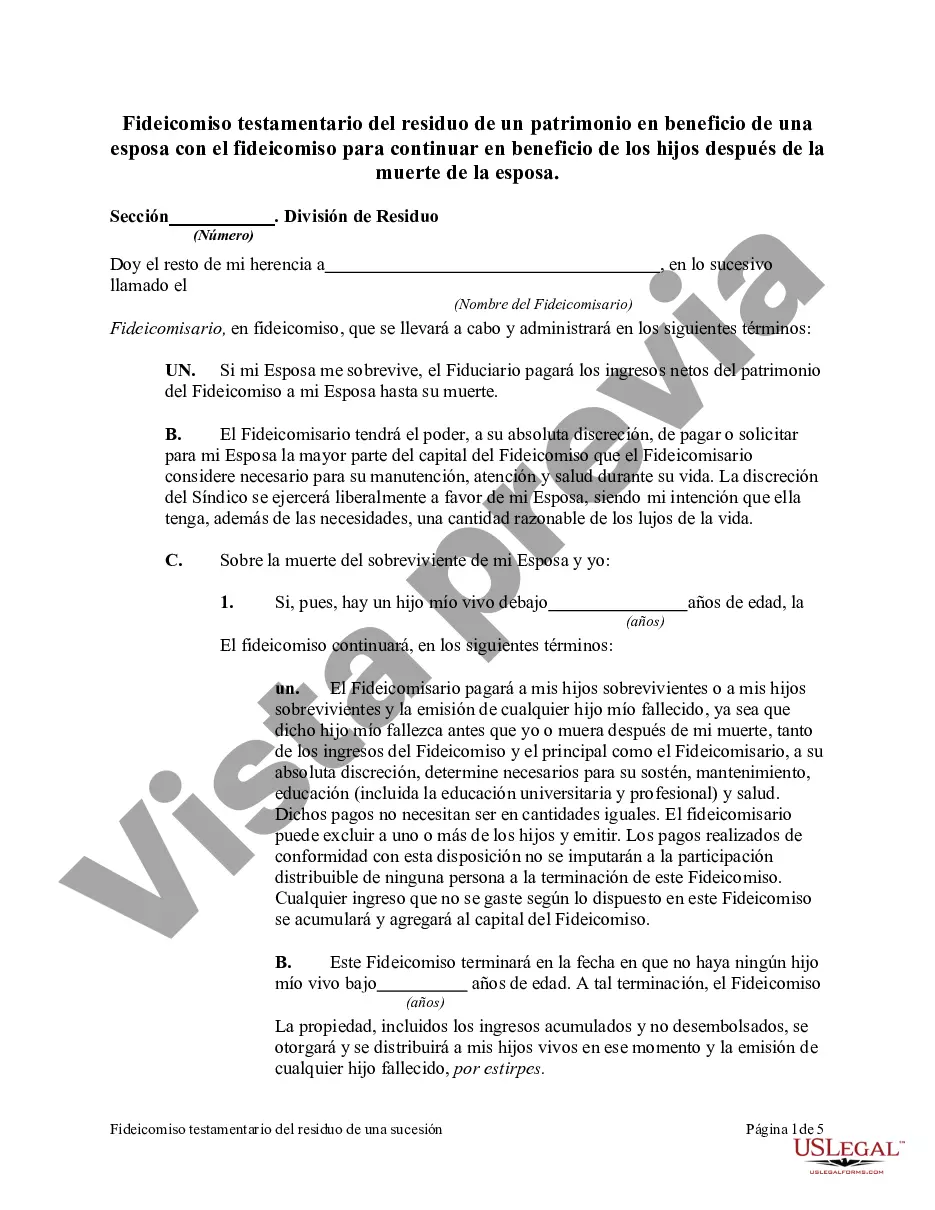

A Bronx New York Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife is a specific type of legal arrangement created to protect and distribute the remaining assets and properties of a deceased individual's estate. This type of trust is specifically designed for the benefit of a surviving spouse, with the intention of ensuring their financial stability and providing for the future needs of any children involved. The Testamentary Trust is established within the framework of the deceased person's will, with specific instructions on how the remaining assets, also known as the residue of the estate, should be managed and distributed. The creation of this trust allows for the assets to be held and administered by a trustee, who acts as a fiduciary and ensures that the assets are managed in accordance with the wishes of the deceased. The primary purpose of this trust is to provide ongoing financial support and security for the surviving wife. This includes responsibilities such as managing investment portfolios, collecting income, paying bills, and providing for the wife's general welfare. The trustee is entrusted with the financial management of the trust, making prudent investment decisions and ensuring the wife's needs are met. Upon the death of the wife, the trust then continues to function for the benefit of the children. At this point, the trustee's role expands to encompass the care and financial support of the children, as outlined by the terms of the trust. This may include funding education, healthcare expenses, and any other provisions specified within the trust document. Apart from the primary Bronx New York Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife, there might be different variations or subtypes that cater to individual circumstances and desires. Some possible variations may include: 1. Testamentary Trust with Discretionary Powers: This type of trust gives the trustee discretionary authority to determine how and when distributions are made to the surviving wife and children, providing flexibility in handling changing circumstances or unforeseen needs. 2. Testamentary Special Needs Trust: This trust is designed for the benefit of a surviving spouse with special needs or disabilities. It ensures that the spouse's disability benefits are not disrupted while still providing for their financial needs. 3. Contingent Testamentary Trust: This trust comes into effect only if a certain condition specified in the will is met. For example, it may become active only if the surviving wife reaches a certain age or remarries. 4. Testamentary Charitable Trust: In some cases, the residual assets of an estate may be directed towards charitable causes or organizations, benefiting them after the death of the wife. In conclusion, a Bronx New York Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife is a legal arrangement established to protect and distribute assets for the welfare and financial support of a surviving spouse and their children after the death of the wife. Different variations and subtypes may exist to cater to specific circumstances and preferences of the deceased individual.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bronx New York Fideicomiso testamentario del residuo de un patrimonio en beneficio de una esposa con el fideicomiso para continuar en beneficio de los hijos después de la muerte de la esposa - Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife

Description

How to fill out Bronx New York Fideicomiso Testamentario Del Residuo De Un Patrimonio En Beneficio De Una Esposa Con El Fideicomiso Para Continuar En Beneficio De Los Hijos Después De La Muerte De La Esposa?

If you need to get a trustworthy legal paperwork provider to obtain the Bronx Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife, consider US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can browse from more than 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of learning resources, and dedicated support make it simple to locate and complete different documents.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply type to look for or browse Bronx Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife, either by a keyword or by the state/county the form is created for. After locating required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Bronx Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife template and take a look at the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Create an account and select a subscription plan. The template will be instantly available for download as soon as the payment is completed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes this experience less costly and more affordable. Create your first business, arrange your advance care planning, draft a real estate agreement, or execute the Bronx Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife - all from the convenience of your home.

Join US Legal Forms now!