A Cook Illinois Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife is a legal arrangement established in Cook County, Illinois. This trust is designed to ensure that a deceased person's assets, known as the residue of their estate, are managed and distributed in a specific manner. The primary purpose of this testamentary trust is to provide financial security and support for the surviving wife. After the death of the testator (the individual who created the trust), any remaining assets not specifically allocated to other beneficiaries or purposes will be transferred into the trust. These assets may include property, investments, cash, or any other form of valuable possessions left behind by the deceased. The wife becomes the initial beneficiary of the trust, allowing her to receive income or utilize the trust's assets for her benefit during her lifetime. This provides her with financial stability and helps maintain her lifestyle even after the testator's death. The trust ensures that the wife is adequately cared for and protected. Once the wife passes away, the trust continues for the benefit of the children of the testator. The distribution of the assets can be carried out according to specific provisions established by the testator in the trust document. This may involve dividing the assets equally among the children or following any other instructions specified by the testator. The Cook Illinois Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife can be further categorized based on the unique terms and conditions set by the testator. Different types of these trust arrangements may include: 1. Irrevocable Trust: Once the trust is established, the testator cannot modify or revoke its terms. This type of trust provides a high level of asset protection and may have potential tax advantages. 2. Revocable Trust: The testator has the flexibility to alter or revoke the trust during their lifetime. However, upon their death, the trust becomes irrevocable and follows the predetermined provisions. 3. Discretionary Trust: The trustee has the discretion to determine the timing and amount of distributions to the beneficiaries, considering their individual needs and circumstances. This trust allows for flexible management of the assets. 4. Educational Trust: The testator may create provisions within the trust specifically aimed at providing funds for the education and advancement of the children, ensuring they have access to quality education. 5. Spendthrift Trust: This type of trust protects the assets from potential creditors or irresponsible spending by the beneficiaries. It limits their ability to access the trust's assets and ensures long-term financial security. In conclusion, a Cook Illinois Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife is a legal mechanism that provides for the financial well-being of a surviving spouse and ensures the continuation of these benefits for the children. The specific terms and conditions of the trust can vary depending on the testator's preferences and intentions.

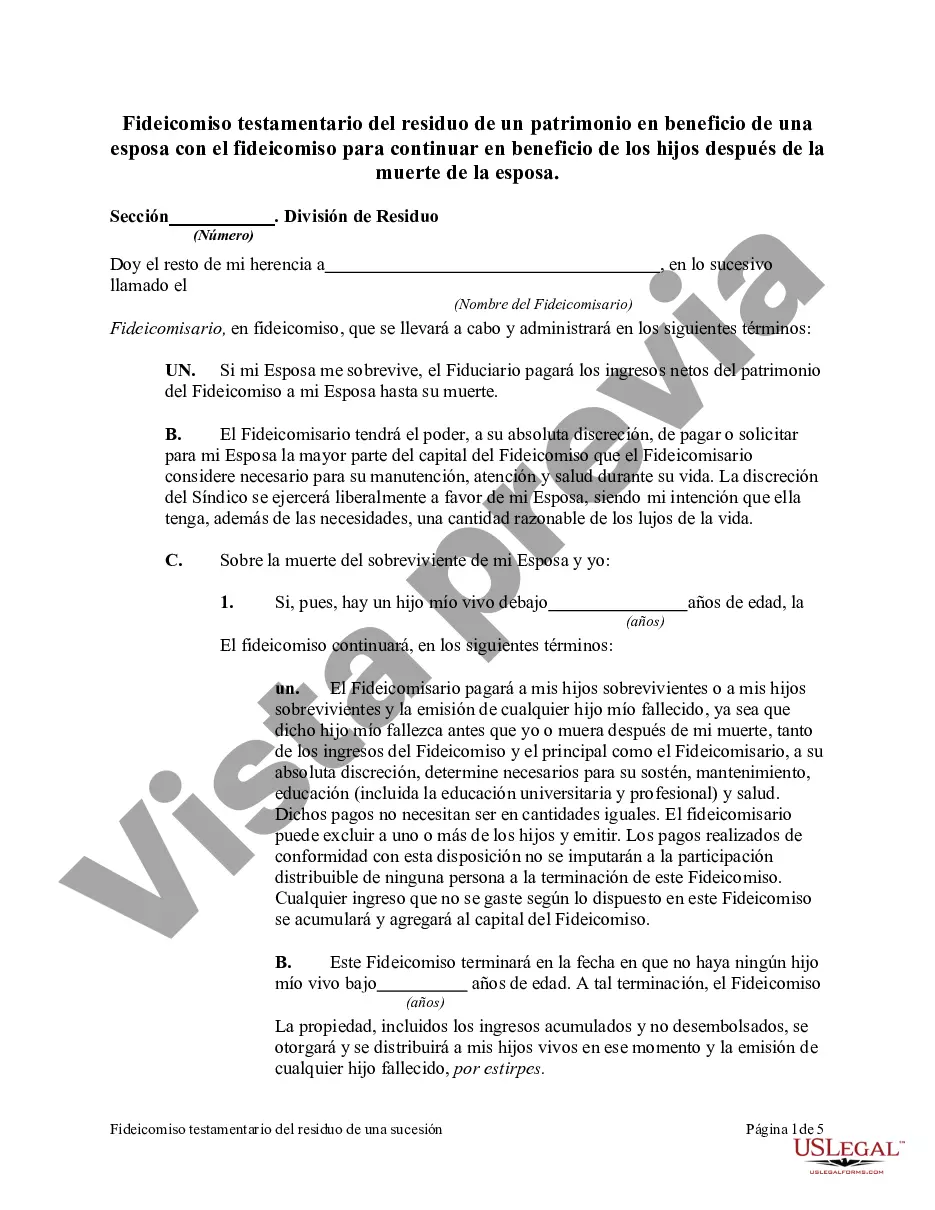

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Fideicomiso testamentario del residuo de un patrimonio en beneficio de una esposa con el fideicomiso para continuar en beneficio de los hijos después de la muerte de la esposa - Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife

Description

How to fill out Cook Illinois Fideicomiso Testamentario Del Residuo De Un Patrimonio En Beneficio De Una Esposa Con El Fideicomiso Para Continuar En Beneficio De Los Hijos Después De La Muerte De La Esposa?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from scratch, including Cook Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in different categories ranging from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching experience less challenging. You can also find information materials and guides on the website to make any activities associated with document completion straightforward.

Here's how you can locate and download Cook Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife.

- Take a look at the document's preview and outline (if available) to get a basic information on what you’ll get after getting the form.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the validity of some records.

- Check the related document templates or start the search over to find the appropriate document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Cook Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife.

- Choose to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Cook Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife, log in to your account, and download it. Needless to say, our website can’t replace a legal professional entirely. If you need to deal with an extremely difficult situation, we recommend getting a lawyer to examine your document before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Join them today and get your state-specific documents with ease!