A Harris Texas Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife is a specific type of trust established under the Texas Probate Code. This trust provides a comprehensive and structured plan for the distribution of a person's estate assets after their death. The key feature of this trust is that it primarily benefits the surviving wife during her lifetime. It ensures that she has access to financial resources and support necessary for her well-being. The trust's purpose is to provide the wife with a steady income or financial assistance while preserving the remaining assets for the ultimate benefit of the children upon her death. Here are some important aspects related to the Harris Texas Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife: 1. Residue of the estate: This trust focuses on the remaining assets of the deceased person's estate after specific bequests, debts, and taxes have been addressed. It ensures that all remaining assets are appropriately managed within the trust structure. 2. Lifetime benefits for the wife: The trust provides the surviving wife with financial security during her lifetime. It can include provisions for a regular income, payment of specific expenses, or any other financial assistance necessary for her well-being and lifestyle maintenance. 3. Lifetime powers for the wife: The trust document may grant the surviving wife certain powers to manage, control, or dispose of trust assets during her lifetime. This allows her to be actively involved in the administration and decision-making process. 4. Child beneficiaries: After the wife's death, the trust continues for the benefit of the children. The trust terms specify how the assets will be distributed among the children and may include guidelines regarding their education, healthcare, and general welfare. 5. Successor trustee: The trust document appoints a successor trustee who takes over the administration of the trust upon the wife's death. The successor trustee ensures that the trust's provisions are followed, and assets are distributed according to the trust terms. Variations of this trust could include: 1. Harris Texas Testamentary Trust for the Benefit of a Wife and Children Equally: This type of trust ensures equal distribution of trust assets between the wife and children after the wife's death. 2. Harris Texas Testamentary Trust Prioritizing Wife with Limited Benefits for Children: In this trust, the primary focus is on providing substantial benefits and support to the surviving wife, with limited distributions for the children. The intent is to ensure the wife's financial security first. 3. Harris Texas Testamentary Trust Primarily for Education and Support of Children: This trust places a significant emphasis on providing funds for the education, healthcare, and general support of the children after the wife's death. The trustee ensures these funds are properly allocated and utilized for the benefit of the children. Understanding the intricacies and legalities of the Harris Texas Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife is crucial when creating an estate plan. Seeking assistance from an experienced attorney specializing in estate planning is highly recommended ensuring compliance with the Texas Probate Code and the specific needs of your estate and beneficiaries.

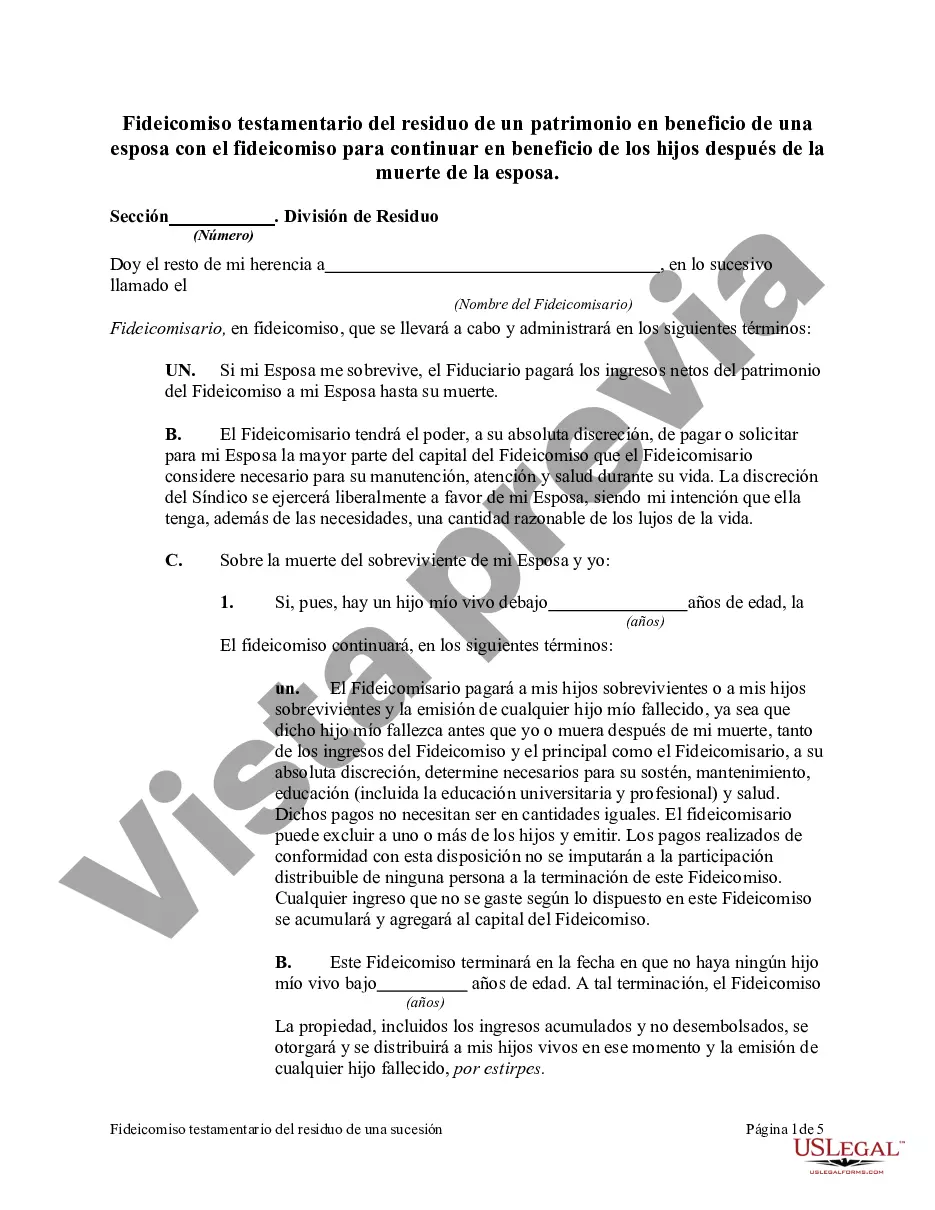

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Fideicomiso testamentario del residuo de un patrimonio en beneficio de una esposa con el fideicomiso para continuar en beneficio de los hijos después de la muerte de la esposa - Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife

Description

How to fill out Harris Texas Fideicomiso Testamentario Del Residuo De Un Patrimonio En Beneficio De Una Esposa Con El Fideicomiso Para Continuar En Beneficio De Los Hijos Después De La Muerte De La Esposa?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a lawyer to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Harris Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife, it may cost you a lot of money. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case collected all in one place. Consequently, if you need the latest version of the Harris Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Harris Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Harris Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife and save it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!