A Mecklenburg North Carolina Demand Letter — Repayment of Promissory Note is a legal document used to request payment and resolution when one party fails to repay a promissory note in Mecklenburg County, North Carolina. This letter formally notifies the borrower, usually a debtor or borrower of a loan, that they are in default and must fulfill their financial obligation according to the promissory note's terms and conditions. The purpose of the Mecklenburg North Carolina Demand Letter — Repayment of Promissory Note is to demand immediate repayment of the outstanding balance, including any accrued interest or penalties. The letter must clearly state the amount owed, the due date, and relevant details about the promissory note, such as the loan agreement's reference number and date of origination. Keywords related to Mecklenburg North Carolina Demand Letter — Repayment of Promissory Note: 1. Debt repayment: Explaining the necessity of repaying the outstanding loan balance. 2. Promissory note: Highlighting the legally binding document as evidence of the debtor's obligation. 3. Default: Describing the borrower's failure to fulfill their repayment responsibilities. 4. Demand letter: The communication tool used to formally request payment. 5. Mecklenburg North Carolina: Specifying the jurisdiction where the demand letter is issued. 6. Legal document: Emphasizing the seriousness and enforceability of the demand letter. 7. Terms and conditions: Stipulating the agreed-upon terms of the promissory note and the repercussions for non-compliance. 8. Accrued interest: Discussing any interest that has accumulated on the outstanding balance. 9. Penalties: Noting any additional charges or fines for defaulting on the promissory note. 10. Repayment timeline: Detailing how quickly the debtor must respond and fulfill their repayment obligation. 11. Notice of action: Informing the debtor of potential legal consequences if they fail to comply. 12. Debt resolution: Expressing the intention to resolve the matter without going to court, if possible. 13. Personal information: Including the debtor's name, contact details, and any other relevant identifying information. 14. Supporting documents: Encouraging the debtor to provide any evidence that supports their inability to repay or disputes the claim. 15. Legal representation: Advising the debtor to seek legal advice if uncertain about the situation or to negotiate repayment terms. While the phrasing may vary, types of Mecklenburg North Carolina Demand Letters could include: 1. Initial demand letter: The first notice sent to the debtor requesting immediate payment. 2. Follow-up demand letter: A subsequent letter sent when the debtor fails to respond or comply with the initial demand. 3. Final demand letter: The last formal demand before initiating legal action to recoup the debt. 4. Cease and desist demand letter: A letter demanding the debtor to stop any harassment or unfair debt collection practices, typically sent by the debtor's legal representation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Carta de demanda - Reembolso del pagaré - Demand Letter - Repayment of Promissory Note

Description

How to fill out Mecklenburg North Carolina Carta De Demanda - Reembolso Del Pagaré?

Draftwing documents, like Mecklenburg Demand Letter - Repayment of Promissory Note, to manage your legal matters is a challenging and time-consumming task. Many cases require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can take your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms intended for different cases and life circumstances. We make sure each document is in adherence with the laws of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Mecklenburg Demand Letter - Repayment of Promissory Note form. Simply log in to your account, download the form, and customize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as straightforward! Here’s what you need to do before getting Mecklenburg Demand Letter - Repayment of Promissory Note:

- Ensure that your document is compliant with your state/county since the rules for writing legal documents may vary from one state another.

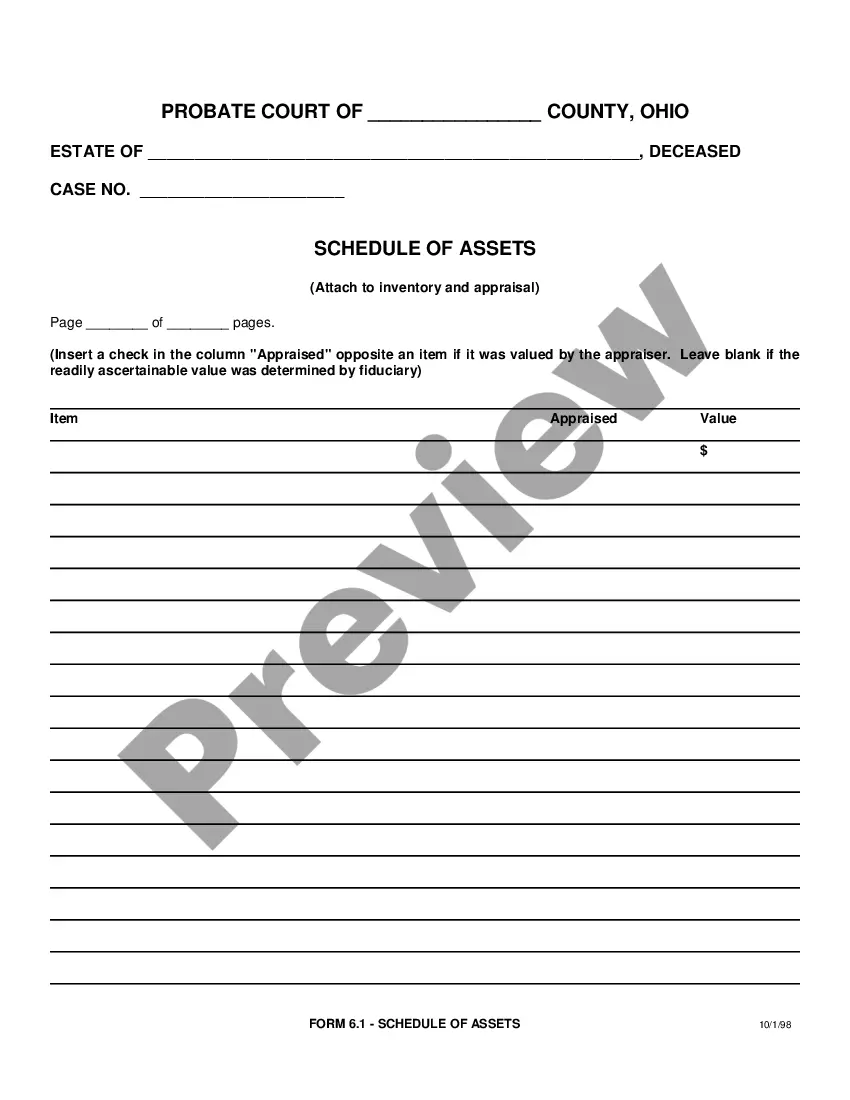

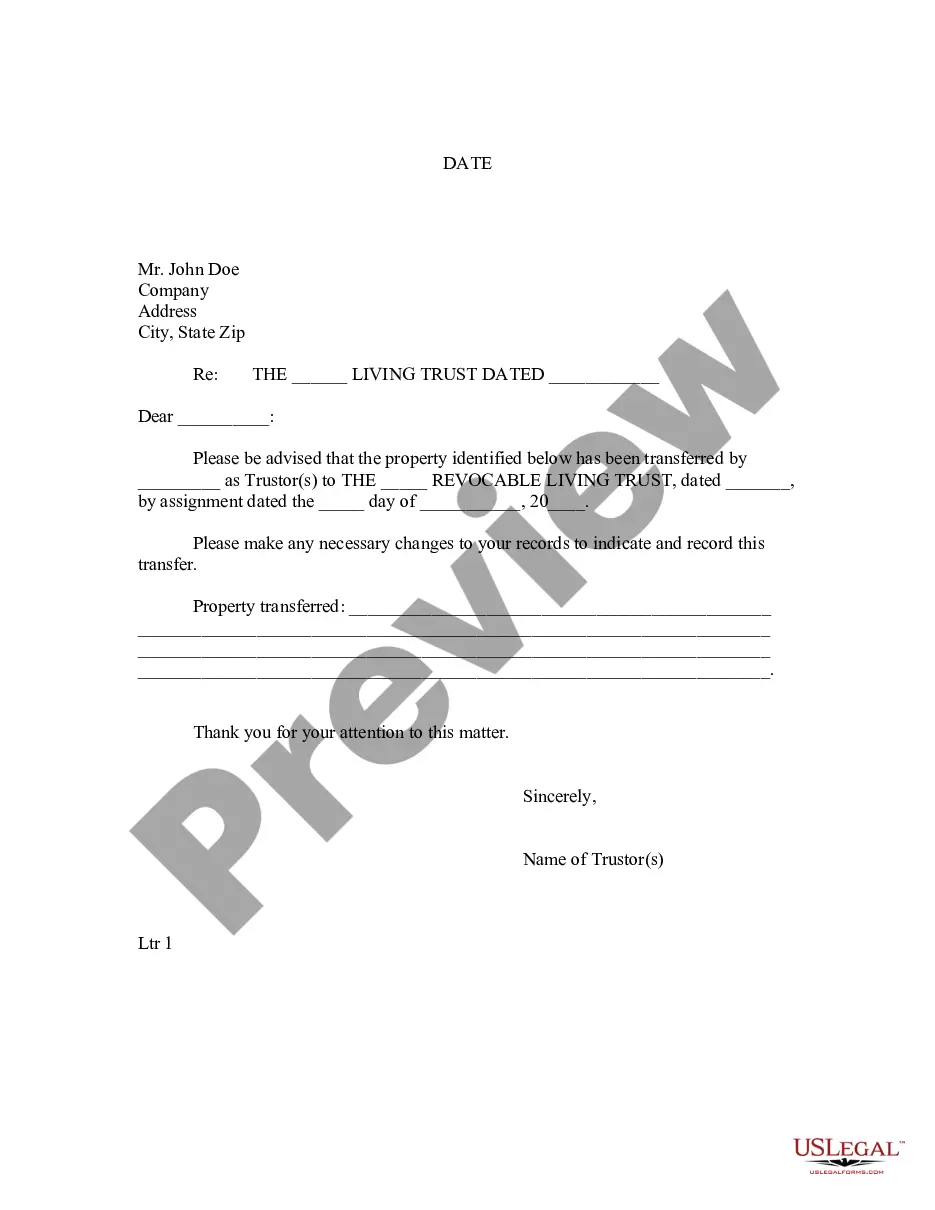

- Find out more about the form by previewing it or reading a brief intro. If the Mecklenburg Demand Letter - Repayment of Promissory Note isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start using our service and get the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your form is all set. You can go ahead and download it.

It’s easy to find and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!