A Chicago Illinois Purchase Agreement by a Corporation of Assets of a Partnership is a legal document that outlines the terms and conditions of a transaction where a corporation purchases the assets of a partnership in the city of Chicago, Illinois. This agreement is crucial in facilitating the transfer of ownership and rights from the partnership to the corporation. The purchase agreement typically includes various sections and provisions that detail the specific terms negotiated by the two parties. These may include: 1. Parties involved: The agreement will identify the corporation, acting as the buyer, and the partnership, acting as the seller. It will also state the legal names and addresses of all parties involved. 2. Asset description: The agreement will provide a comprehensive list of assets being transferred from the partnership to the corporation. This may include tangible assets (such as inventory, equipment, or real estate) as well as intangible assets (such as intellectual property, contracts, or goodwill). 3. Purchase price and payment terms: The agreement will specify the total purchase price for the assets and how it will be paid. This may involve a lump sum payment or installment payments, along with deadlines and any necessary adjustments, such as prorated amounts for specific assets. 4. Representations and warranties: Both the corporation and partnership may provide certain representations and warranties regarding their authority, ownership, and the condition of the assets. These statements ensure that both parties are aware of any potential issues or liabilities associated with the assets being sold. 5. Assumption of liabilities: The agreement will outline which liabilities, if any, the corporation will assume from the partnership. This may include outstanding debts, contractual obligations, or potential legal disputes. It is crucial to define the scope and limits of the corporation's assumption of liabilities. 6. Closing conditions: The agreement will specify the conditions that must be met before the transaction can be completed. This may include obtaining necessary approvals, permits, or consents from third parties or government entities, as well as the date and location of the closing. It is important to note that there can be different types of Chicago Illinois Purchase Agreements by a Corporation of Assets of a Partnership, depending on the specific nature of the transaction. For example, some agreements may involve the sale of all partnership assets, while others may only involve a partial sale or specific assets. Other variations may include agreements that emphasize intellectual property transfers, real estate acquisitions, or distressed asset sales. Each type of purchase agreement will have its own set of considerations, requirements, and industry-specific terms. In conclusion, a Chicago Illinois Purchase Agreement by a Corporation of Assets of a Partnership is a legally binding document that governs the transfer of assets from a partnership to a corporation in Chicago, Illinois. The agreement outlines the details of the transaction, including asset descriptions, purchase price, payment terms, representations and warranties, assumption of liabilities, and closing conditions. Different types of purchase agreements may exist based on the specific assets involved or the nature of the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Acuerdo de Compra por una Corporación de Activos de una Sociedad - Purchase Agreement by a Corporation of Assets of a Partnership

Description

How to fill out Chicago Illinois Acuerdo De Compra Por Una Corporación De Activos De Una Sociedad?

Whether you intend to start your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific documentation meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Chicago Purchase Agreement by a Corporation of Assets of a Partnership is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to get the Chicago Purchase Agreement by a Corporation of Assets of a Partnership. Follow the instructions below:

- Make sure the sample meets your personal needs and state law requirements.

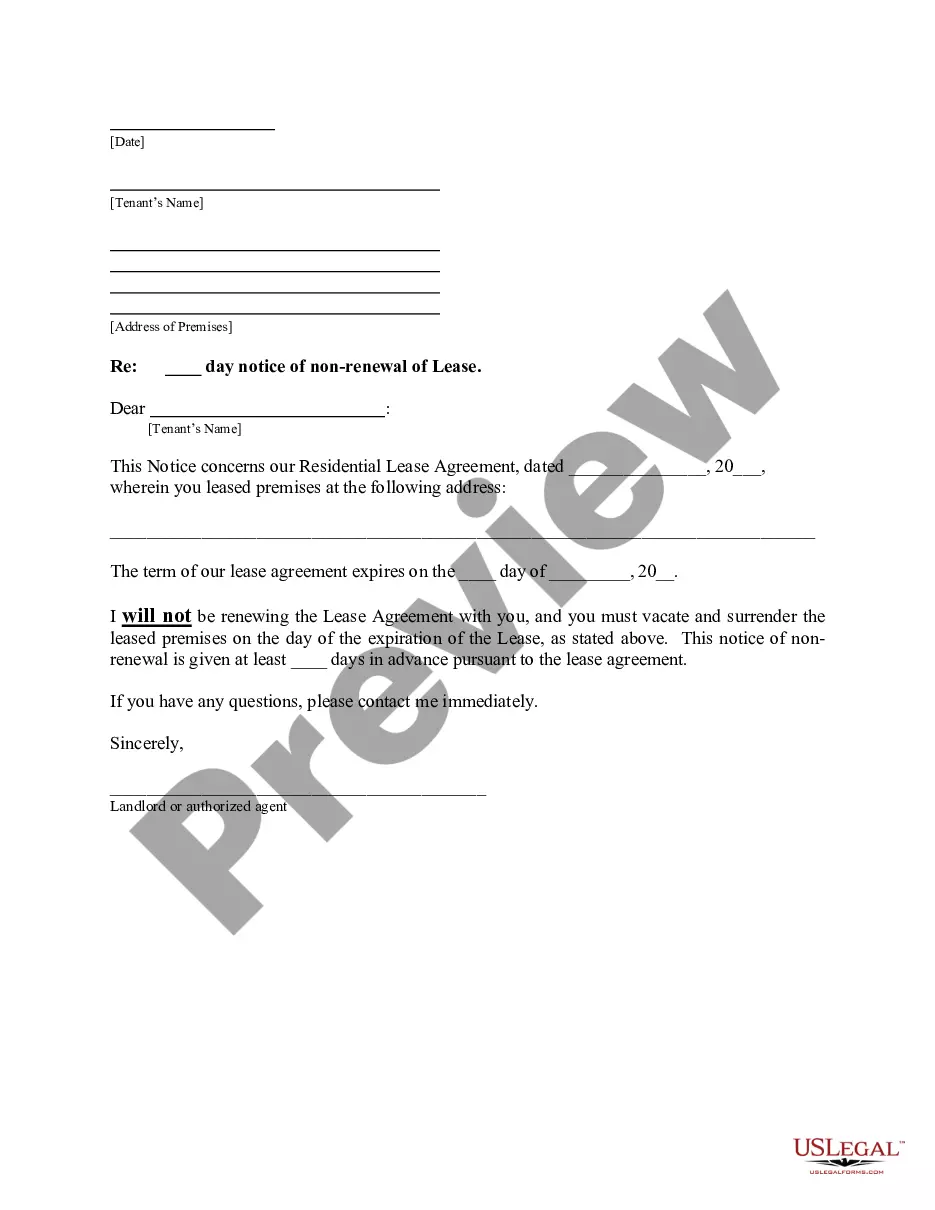

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample when you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Chicago Purchase Agreement by a Corporation of Assets of a Partnership in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!