Travis Texas Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncom petition Provisions is a legal document designed to outline the terms and conditions for buying and selling stock within a close corporation located in Travis County, Texas. This agreement serves to protect the interests of shareholders while ensuring a smooth transition of ownership. The Travis Texas Shareholders Buy Sell Agreement includes noncom petition provisions, which restrict shareholders from engaging in activities that may compete with the corporation's business. This provision helps safeguard the corporation's competitive advantage and prevents conflicts of interest. There are various types of Travis Texas Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncom petition Provisions, depending on the specific needs and circumstances of the shareholders. Some common variations include: 1. Standard Buy-Sell Agreement: This type of agreement establishes a standard set of provisions for buying and selling stock within a close corporation, including noncom petition clauses. 2. Shotgun Buy-Sell Agreement: With this agreement, one shareholder initiates the process by setting a price and condition for the sale of their shares. The other shareholders can then choose between buying the shares at that price or selling their own shares at the same price. 3. Wait-and-See Buy-Sell Agreement: This type of agreement allows shareholders to wait and see if specific events, such as the death, disability, or retirement of a shareholder, trigger the buy-sell provisions. It provides flexibility and allows for a more fluid transition of ownership. 4. Cross-Purchase Buy-Sell Agreement: In this agreement, shareholders have the right, but not the obligation, to purchase the shares of a departing shareholder. It promotes control and allows shareholders to maintain proportional ownership. 5. Stock Redemption Buy-Sell Agreement: With this agreement, the corporation itself has the obligation to repurchase the shares of a departing shareholder. It provides a simplified process for buyouts while maintaining control within the corporation. When entering into a Travis Texas Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncom petition Provisions, it is essential to consult with legal professionals experienced in corporate law to ensure compliance with state and federal laws. This agreement plays a vital role in protecting the interest of shareholders and facilitating a smooth transition of ownership in a close corporation setting.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Accionistas Acuerdo de compra venta de acciones en una corporación cerrada con disposiciones de no competencia - Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions

Description

How to fill out Travis Texas Accionistas Acuerdo De Compra Venta De Acciones En Una Corporación Cerrada Con Disposiciones De No Competencia?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a legal professional to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Travis Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions, it may cost you a lot of money. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario gathered all in one place. Consequently, if you need the latest version of the Travis Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Travis Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions:

- Glance through the page and verify there is a sample for your region.

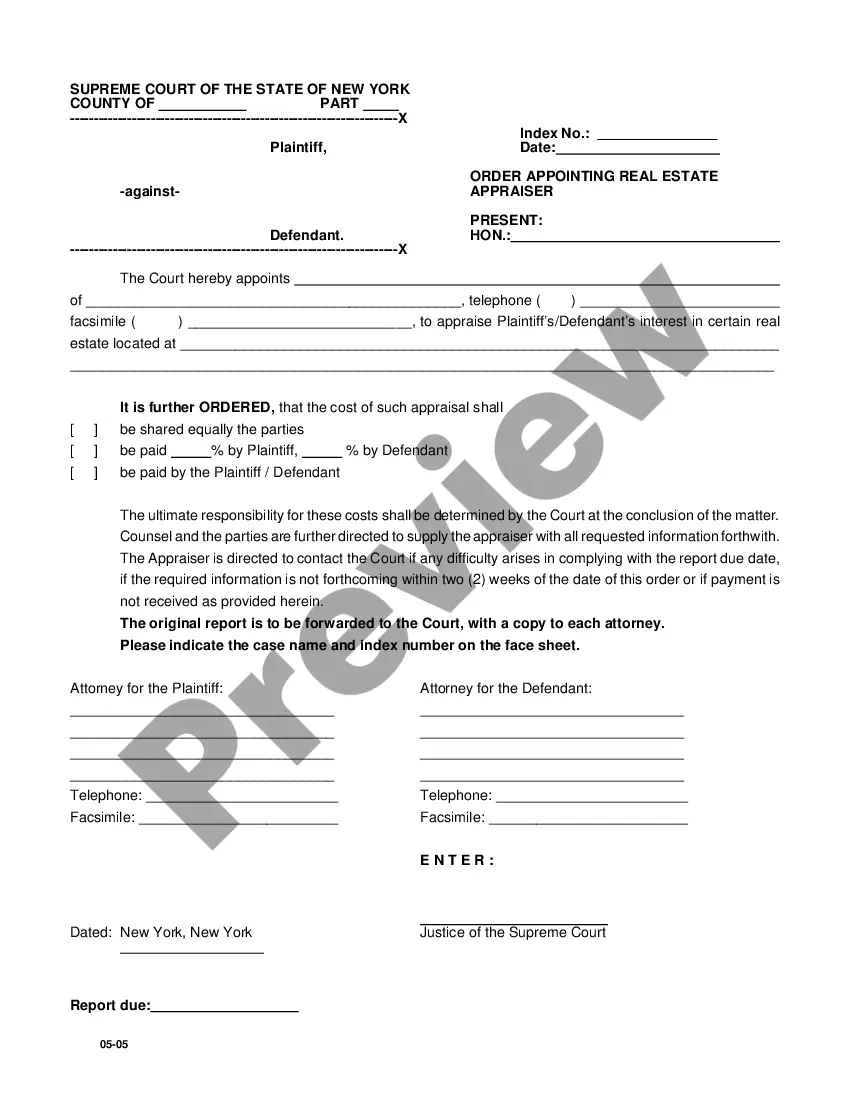

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Travis Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions and save it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

El pacto (en latin: pactum) es un convenio o tratado solemne, estricto y condicional entre dos o mas partes en que se establece una obediencia a cumplir uno o varios acapites establecidos en un contrato formal y en que ambas partes se comprometen a ejecutar ciertas acciones y a recibir retribuciones de la otra parte

Los acuerdos de accionistas pueden definirse como cualquier pacto, diferente de los estatutos sociales, en virtud del cual todos o algunos de los accionistas de una sociedad regulan sus relaciones dentro de una sociedad.

Un acuerdo de accionistas es un pacto establecido entre los miembros de una sociedad mercantil. Sirve para la toma de decisiones, el ejercicio de distintos derechos societarios, o como anticipacion a un problema externo.

El pacto social podra hacerse constar por medio de escritura publica, o en otra forma, siempre que sea atestado por un Notario Publico o por cualquiera otro funcionario que este autorizado para hacer atestaciones en el lugar del otorgamiento.

Para hacer un pacto de socios, basta con la firma de un documento cuyo contenido cuente con la conformidad de todos los socios. Este acuerdo no debe confundirse con los estatutos societarios, los cuales deben ser recogidos en escritura publica ante notario.

Para que un acuerdo de accionistas sea exigible respecto de la sociedad y de los accionistas suscriptores y no suscriptores, este debe contener estipulaciones licitas, debe constar por escrito, debe ser depositado en las oficinas de administracion de la sociedad y su termino de duracion no puede exceder de 10 anos (que

El objetivo de un pacto de socios es dejar por escrito las normas del juego para el buen funcionamiento de la empresa y en el caso de situaciones de conflicto saber como hay que proceder.

En terminos generales, los acuerdos de accionistas pueden versar sobre cualquier tema o contenido que los accionistas consideren relevante, entre otros, regulacion de sus relaciones, eleccion de organos administrativos de la sociedad, administracion y control de la sociedad, etc.

El pacto social basicamente es el documento que da origen al acto constitutivo de la empresa, es la columna vertebral de todo el acto constitutivo de la empresa. En dicho documento se identifican a los socios fundadores y se acuerdan clausulas como nombramiento de administradores y estatutos.

El pacto (en latin: pactum) es un convenio o tratado solemne, estricto y condicional entre dos o mas partes en que se establece una obediencia a cumplir uno o varios acapites establecidos en un contrato formal y en que ambas partes se comprometen a ejecutar ciertas acciones y a recibir retribuciones de la otra parte