Alameda California Stock Option Agreement between Corporation and Officer or Key Employee is a legally binding document that outlines the terms and conditions for granting stock options to key personnel within a corporation in Alameda, California. This agreement serves as a means to attract and retain talented individuals by providing them with an opportunity to purchase company stock at a predetermined price in the future. The key elements of an Alameda California Stock Option Agreement may include: 1. Parties: Identifying the involved parties, i.e., the corporation and the officer or key employee. This section will detail the legal names and addresses of both parties. 2. Grant of Stock Options: This section will define the number of stock options being granted to the officer or key employee. It will specify whether the options are non-qualified stock options (Nests) or incentive stock options (SOS), as these types have distinct tax implications. 3. Exercise Price: The agreement will state the exercise or strike price, which is the price at which the officer or employee can buy the company's stock. This price is commonly set at the market price on the date of the grant or at a discounted rate. 4. Vesting Schedule: The agreement will establish a vesting schedule, detailing when the stock options become exercisable. This schedule may include milestone-based vesting (e.g., a certain percentage vested yearly) or a cliff vesting (e.g., all options vesting after a specific period of service). 5. Exercise Period: This section will outline the duration during which the officer or key employee has the right to exercise their stock options. Typically, this period extends beyond the vesting period and is subject to certain restrictions, such as termination of employment. 6. Termination of Stock Options: The agreement will specify the circumstances under which the stock options may be terminated, such as upon the employee's voluntary resignation, termination for cause, or in the event of the corporation's acquisition or merger. 7. Governing Law: This section will state that the agreement is governed by the laws of the state of California, particularly Alameda, and any disputes will be resolved in accordance with the state's legal system. 8. Confidentiality and Non-Disclosure: The agreement may contain provisions regarding the employee's obligation to maintain confidentiality of any non-public information obtained through the stock option agreement, safeguarding the corporation's trade secrets and proprietary information. Other types of Alameda California Stock Option Agreements between Corporation and Officer or Key Employee may include: 1. Restricted Stock Agreement: Instead of granting stock options, this type of agreement involves the direct issuance of company stock to the officer or employee, subject to certain restrictions and conditions. 2. Performance Stock Agreement: This agreement sets performance-based conditions that must be met for the stock options to vest. These conditions typically involve achieving specific financial goals or targets. 3. Stock Appreciation Rights Agreement: Instead of granting stock options, stock appreciation rights (SARS) entitle the officer or employee to receive the equivalent value of stock appreciation in cash or additional company stock. It is essential to consult with legal and financial professionals to ensure that any Alameda California Stock Option Agreement aligns with both state and federal laws, accounting standards, and the specific goals and circumstances of the corporation and the officer or key employee involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Acuerdo de opción de compra de acciones entre la corporación y el funcionario o empleado clave - Stock Option Agreement between Corporation and Officer or Key Employee

Description

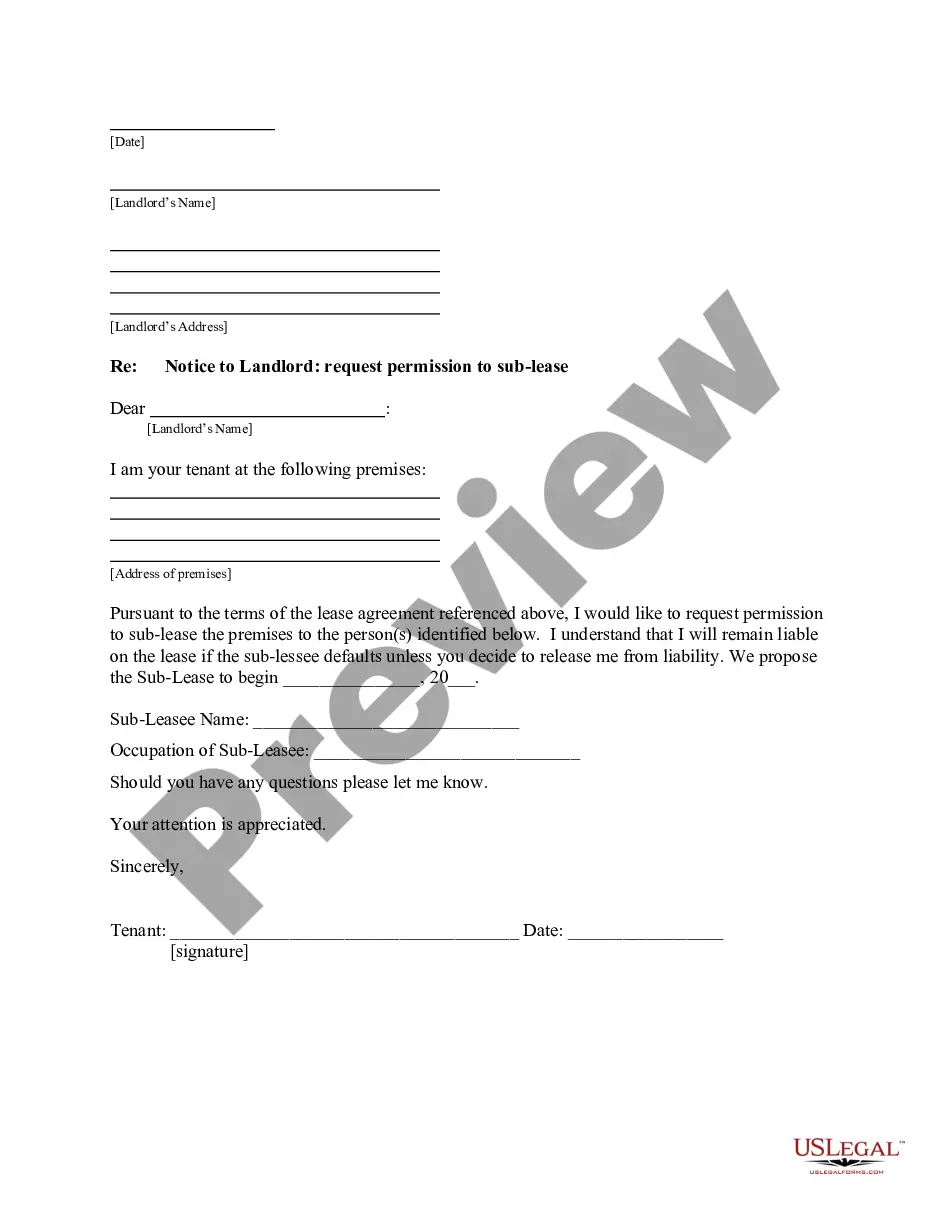

How to fill out Alameda California Acuerdo De Opción De Compra De Acciones Entre La Corporación Y El Funcionario O Empleado Clave?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare formal paperwork that varies from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any individual or business purpose utilized in your region, including the Alameda Stock Option Agreement between Corporation and Officer or Key Employee.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Alameda Stock Option Agreement between Corporation and Officer or Key Employee will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to get the Alameda Stock Option Agreement between Corporation and Officer or Key Employee:

- Ensure you have opened the correct page with your localised form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Alameda Stock Option Agreement between Corporation and Officer or Key Employee on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!