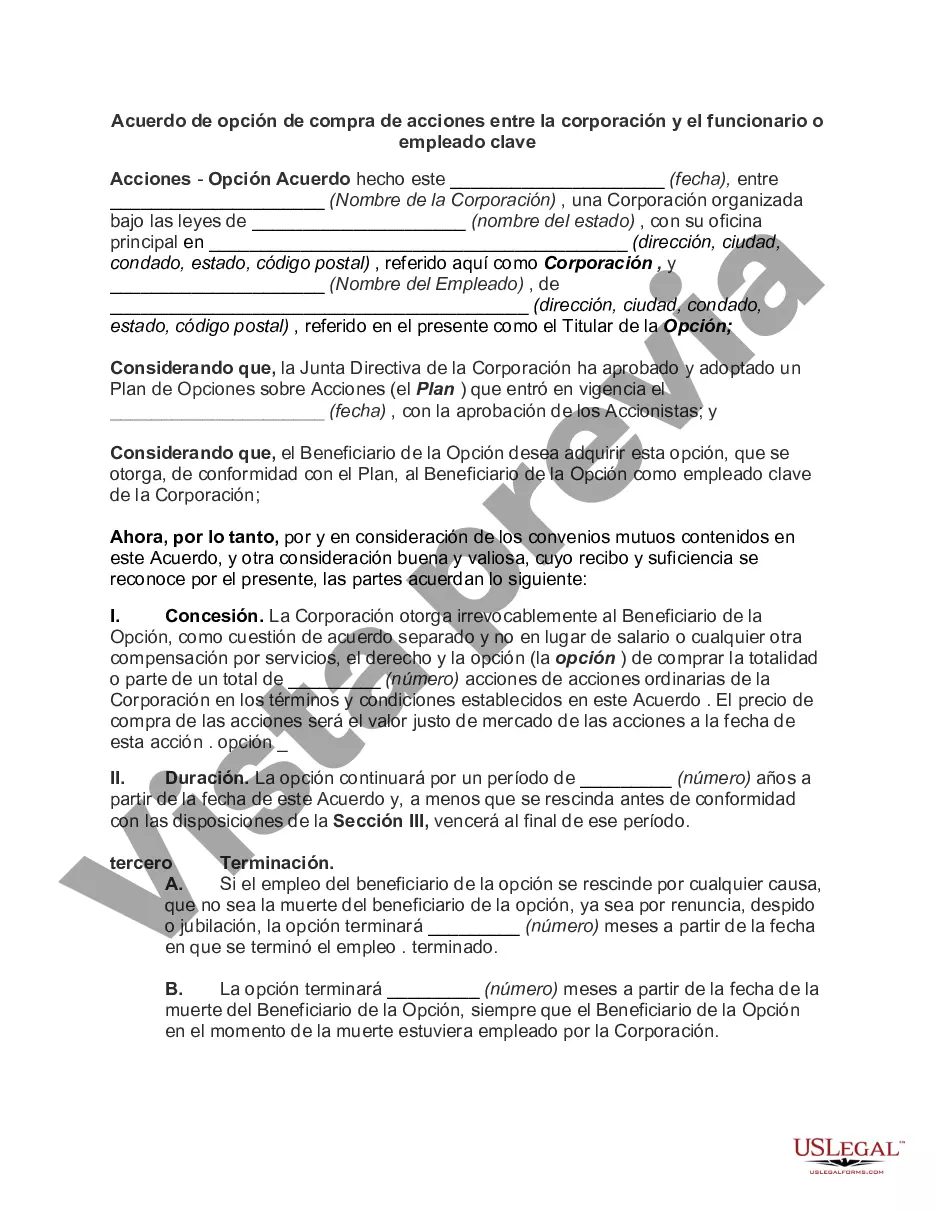

A Phoenix Arizona Stock Option Agreement between a corporation and an officer or key employee is a legally binding contract that outlines the terms and conditions under which the employee is granted the option to purchase company stock in the future. This agreement is commonly used as an incentive for attracting and retaining top talent within the organization. Key terms covered in the Phoenix Arizona Stock Option Agreement may include: 1. Grant of Stock Option: This section specifies the number of shares of company stock being granted to the employee. It also mentions the exercise price, which is the price at which the employee can purchase the stock. 2. Vesting Schedule: The agreement defines the vesting period during which the employee must remain with the company to earn the right to exercise the stock options. Vesting can happen over a certain number of years or in specific milestones. 3. Exercise Period: It states the period during which the employee can exercise their stock options. Generally, this period begins after the vesting period ends and may have an expiration date as well. 4. Payment for Stock: The agreement may describe the payment method for purchasing the stock options, such as cash, check, or bank transfer. 5. Tax Implications: This section provides information on the tax consequences associated with exercising the stock options and the employee's responsibility to fulfill any tax obligations. 6. Termination Provisions: If the employee's employment with the company is terminated, this portion covers the treatment of invested stock options and the employee's ability to exercise vested options within a specified timeframe. 7. Change of Control: In the event of a merger, acquisition, or other change in the control of the corporation, provisions may be outlined that protect the employee's stock options or alter their terms. 8. Governing Law: The agreement specifies that it is subject to Phoenix Arizona state laws and any legal disputes will be resolved through arbitration or litigation in the relevant courts in Phoenix, Arizona. Regarding different types of Phoenix Arizona Stock Option Agreements, they can vary based on factors such as the employee's position, level, or timing of stock option grants. Some examples include: 1. Non-Qualified Stock Option (NO): These are the most common form of stock options and do not qualify for special tax treatment. SOS have flexible terms and may be issued to officers, executives, or key employees. 2. Incentive Stock Option (ISO): These options are granted to employees with certain tax advantages. SOS have strict eligibility requirements, including a maximum limit on the number of shares and a required holding period before selling the stock. 3. Restricted Stock Units (RSS): While not technically options, RSS are another form of equity compensation frequently used. RSS grant the right to receive company stock at a future date upon meeting certain vesting conditions. In summary, a Phoenix Arizona Stock Option Agreement between a corporation and an officer or key employee is a valuable tool for incentivizing and rewarding top talent. By documenting the terms, conditions, and rights associated with stock options, the agreement helps ensure transparency and fair treatment for both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Acuerdo de opción de compra de acciones entre la corporación y el funcionario o empleado clave - Stock Option Agreement between Corporation and Officer or Key Employee

Description

How to fill out Phoenix Arizona Acuerdo De Opción De Compra De Acciones Entre La Corporación Y El Funcionario O Empleado Clave?

Drafting paperwork for the business or individual demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Phoenix Stock Option Agreement between Corporation and Officer or Key Employee without professional assistance.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Phoenix Stock Option Agreement between Corporation and Officer or Key Employee by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, follow the step-by-step guideline below to get the Phoenix Stock Option Agreement between Corporation and Officer or Key Employee:

- Examine the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that meets your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any use case with just a couple of clicks!