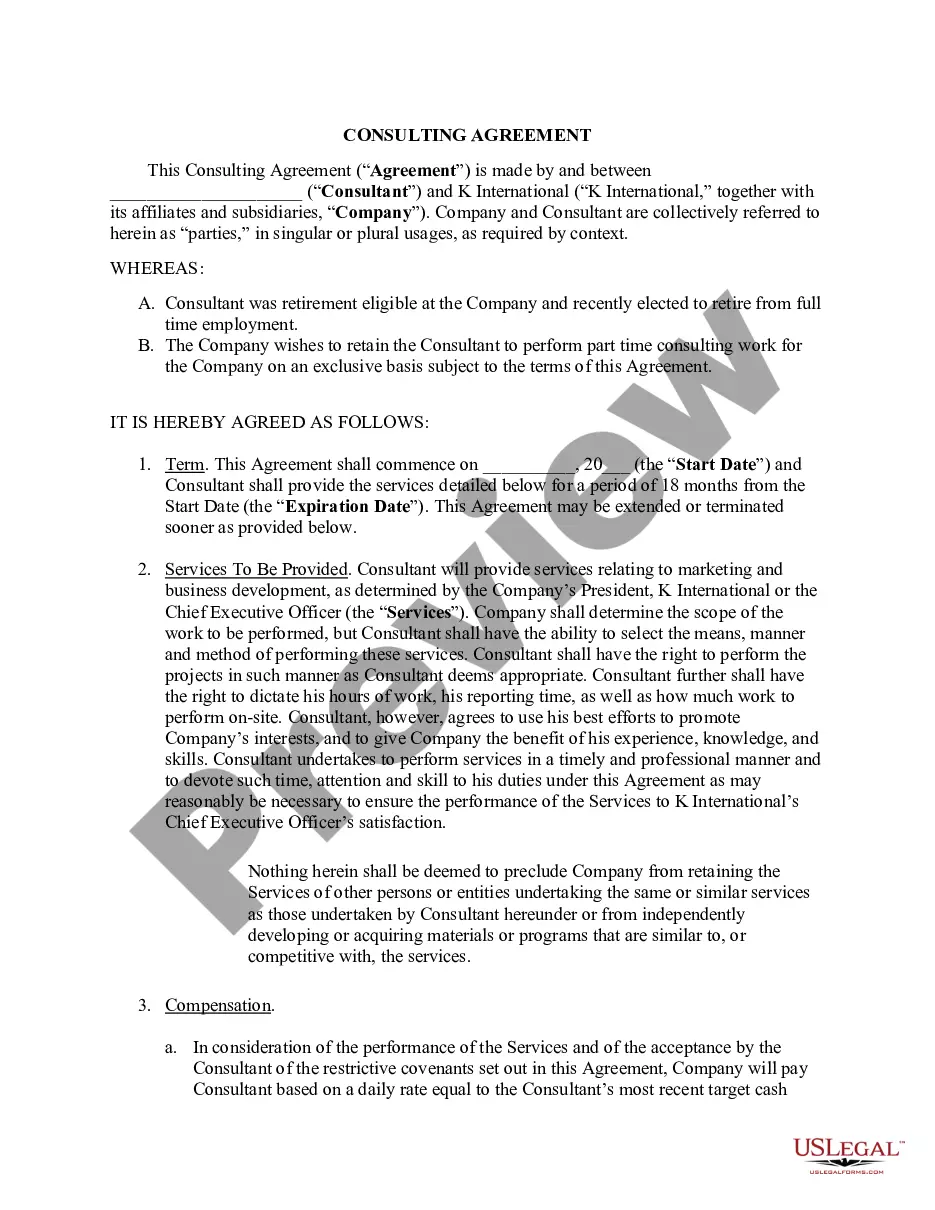

Lima Arizona Stock Option Agreement is a legally binding document that outlines the terms and conditions between a corporation and its officer or key employee regarding the issuance of stock options. This agreement serves as a means to incentivize and reward top-performing personnel, aligning their interests with the corporation's growth and success. The agreement typically includes essential details such as the grant date, exercise price, vesting schedule, expiration date, and the number of stock options granted to the officer or key employee. These options offer the right, but not the obligation, to purchase shares of the corporation's stock at a predetermined price, also known as the exercise price. There are different types of Lima Arizona Stock Option Agreements that corporations can offer to their officers or key employees, namely: 1. Non-Qualified Stock Options (SOS): SOS are a common type of stock option granted to officers or key employees. These options are generally subject to ordinary income tax on the difference between the exercise price and the fair market value of the stock on the exercise date. SOS offer more flexibility in terms of grant structure and eligibility criteria. 2. Incentive Stock Options (SOS): SOS are a tax-advantaged type of stock option primarily offered to key employees. These options provide potential tax benefits, as they are subject to long-term capital gains tax rates upon sale if specific holding requirements are met. However, SOS have more stringent conditions regarding eligibility, exercise price, and the maximum number of shares that can be granted. 3. Restricted Stock Units (RSS): RSS are an alternative form of equity compensation that corporations may offer in addition to, or instead of, stock options. Unlike stock options, RSS represent a promise to issue shares of stock in the future upon meeting certain conditions, such as employment continuation or achievement of specific performance goals. RSS may carry vesting schedules and other restrictions as determined by the corporation. 4. Performance-Based Stock Options: Some corporations may choose to offer performance-based stock options, which are granted based on the achievement of predetermined performance targets, such as revenue goals or stock price appreciation. These options motivate officers or key employees to drive the corporation's growth and success, often with increased rewards for exceptional performance. It is crucial for all parties involved to carefully review and understand the terms and provisions of the Lima Arizona Stock Option Agreement. Seeking professional legal and tax advice is highly recommended ensuring compliance with applicable laws and to maximize the benefits of stock options offered to officers or key employees.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Acuerdo de opción de compra de acciones entre la corporación y el funcionario o empleado clave - Stock Option Agreement between Corporation and Officer or Key Employee

Description

How to fill out Pima Arizona Acuerdo De Opción De Compra De Acciones Entre La Corporación Y El Funcionario O Empleado Clave?

Do you need to quickly create a legally-binding Pima Stock Option Agreement between Corporation and Officer or Key Employee or probably any other document to manage your own or corporate matters? You can go with two options: hire a professional to write a legal document for you or draft it entirely on your own. Luckily, there's another solution - US Legal Forms. It will help you get neatly written legal documents without paying sky-high fees for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-specific document templates, including Pima Stock Option Agreement between Corporation and Officer or Key Employee and form packages. We provide documents for a myriad of life circumstances: from divorce papers to real estate document templates. We've been out there for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed template without extra hassles.

- To start with, double-check if the Pima Stock Option Agreement between Corporation and Officer or Key Employee is adapted to your state's or county's laws.

- In case the form includes a desciption, make sure to check what it's intended for.

- Start the searching process again if the document isn’t what you were looking for by utilizing the search box in the header.

- Select the plan that best fits your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Pima Stock Option Agreement between Corporation and Officer or Key Employee template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to find and download legal forms if you use our services. Moreover, the documents we offer are updated by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!