Salt Lake Utah Stock Option Agreement between Corporation and Officer or Key Employee A Salt Lake Utah Stock Option Agreement between a corporation and an officer or key employee is a legally binding agreement that grants the employee the right to purchase a specific number of shares of company stock at a predetermined price within a specified period of time. Keywords: Salt Lake Utah, Stock Option Agreement, Corporation, Officer, Key Employee Description: The Salt Lake Utah Stock Option Agreement is a common practice among corporations in the Salt Lake City area to incentivize officers and key employees by offering them an opportunity to participate in the company's growth through stock ownership. This agreement provides a mutually beneficial arrangement for both the corporation and the employee. The agreement outlines specific terms and conditions that must be met to exercise the stock options, including the number of shares, the exercise price, and the vesting schedule. These terms are usually negotiated between the corporation and the officer or key employee. There are several types of Salt Lake Utah Stock Option Agreements that can be established depending on the corporation's needs and goals: 1. Non-Qualified Stock Option (NO): This type of stock option does not qualify for special tax treatment and is usually offered to officers and key employees. SOS provide flexibility in terms of granting options and may have different exercise prices or expiration dates. 2. Incentive Stock Option (ISO): These stock options are intended to provide tax advantages to both the employee and the corporation. SOS must meet specific criteria outlined by the Internal Revenue Service (IRS) and are subject to certain limitations, such as annual exercise limitations and a requirement for the employee to hold the stock for a specified period of time. 3. Restricted Stock Units (RSS): RSS are a popular form of equity compensation where employees receive units that convert into shares of stock after a vesting period. Unlike stock options, RSS do not provide the right to purchase stock at a predetermined price, but rather grant the right to receive shares of the company's stock in the future. 4. Performance Stock Units (Plus): Similar to RSS, Plus are also granted based on performance criteria, typically tied to the company's financial or operational goals. Plus provide employees with the potential to receive additional shares of stock if specified performance targets are met. In conclusion, the Salt Lake Utah Stock Option Agreement between a corporation and an officer or key employee provides a mechanism for aligning the employee's interests with those of the company. By granting stock options or other equity-based incentives, the corporation can motivate key employees to contribute to the company's success while offering them the potential to share in its financial gains.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Acuerdo de opción de compra de acciones entre la corporación y el funcionario o empleado clave - Stock Option Agreement between Corporation and Officer or Key Employee

Description

How to fill out Salt Lake Utah Acuerdo De Opción De Compra De Acciones Entre La Corporación Y El Funcionario O Empleado Clave?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Salt Lake Stock Option Agreement between Corporation and Officer or Key Employee, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used many times: once you purchase a sample, it remains available in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Salt Lake Stock Option Agreement between Corporation and Officer or Key Employee from the My Forms tab.

For new users, it's necessary to make several more steps to get the Salt Lake Stock Option Agreement between Corporation and Officer or Key Employee:

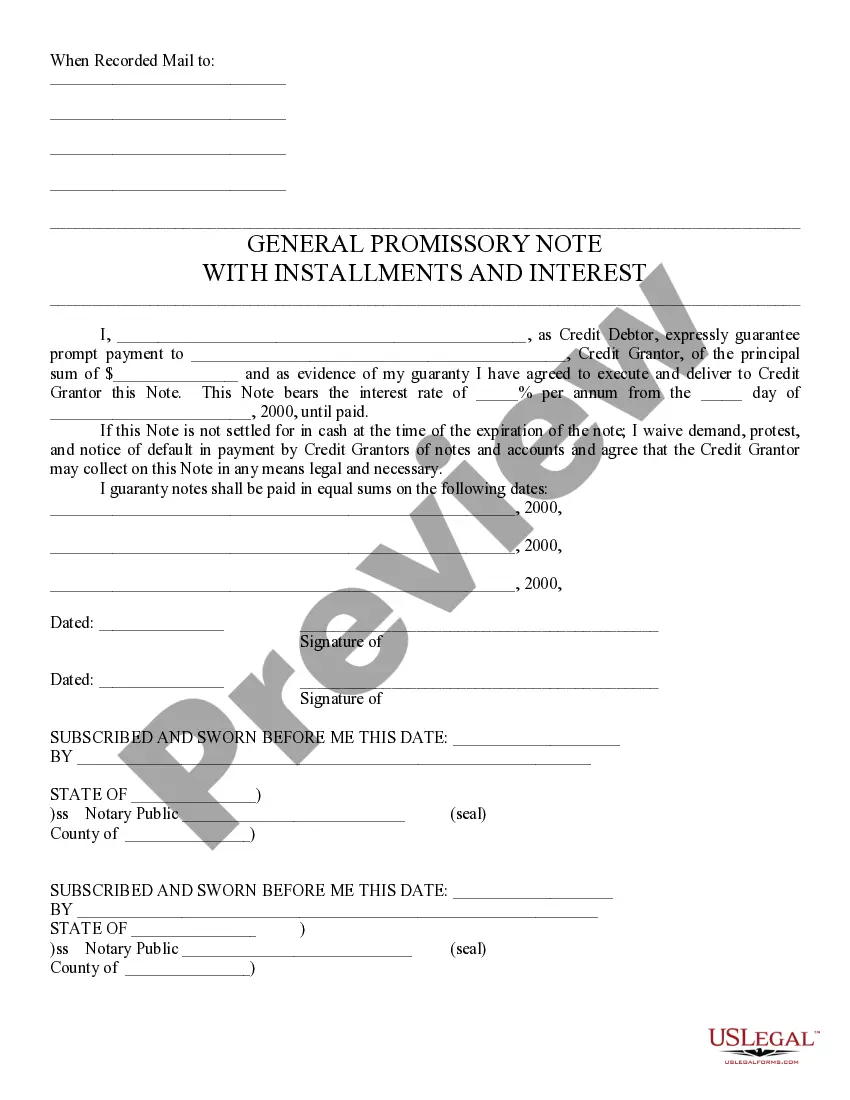

- Analyze the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!