A Wake North Carolina Stock Option Agreement between a Corporation and Officer or Key Employee is a legally binding contract that outlines the terms and conditions regarding the granting of stock options to the employee by the corporation. This agreement is commonly used as a way to incentivize and attract top talent, reward and motivate key employees, and align their interests with the success of the corporation. It helps create a sense of ownership and loyalty by providing employees with the opportunity to purchase or receive shares of the company's stock at a predetermined price or within a specified time frame. There are various types of Wake North Carolina Stock Option Agreements between a Corporation and its Officer or Key Employee, each tailored to meet specific circumstances and objectives. Some common types include: 1. Non-Qualified Stock Option (NO) Agreement: This agreement grants the employee the right to purchase company shares at a predetermined strike price, typically reflecting the market value at the time of grant. SOS are usually flexible and offer more control to the corporation in terms of granting, qualifying criteria, and taxation. 2. Incentive Stock Option (ISO) Agreement: SOS are typically offered to key employees and are subject to specific requirements outlined by the Internal Revenue Code. These agreements provide favorable tax treatment to the employee, allowing them to potentially benefit from long-term capital gains tax rates upon the sale of the underlying stock if certain holding period and other criteria are met. 3. Restricted Stock Unit (RSU) Agreement: Unlike stock options, RSS do not grant the employee the right to purchase shares but rather represent a promise to deliver shares at a future date. RSS typically have vesting schedules, which means that the employee becomes eligible to receive the shares after a specified period of service or achievement of predetermined performance milestones. 4. Performance Stock Option Agreement: These agreements are granted based on the achievement of specific performance targets or goals set by the corporation. Employees are given the opportunity to purchase shares or receive stock options only if these targets are met. This type of agreement is commonly used to align employee incentives with the corporate objectives. Regardless of the specific type of Wake North Carolina Stock Option Agreement, it is essential for both the corporation and the officer or key employee to clearly define the rights, obligations, terms, and conditions surrounding the stock options. This includes details on the exercise price, vesting schedule, expiration date, restrictions, transferability, taxation, termination events, and any other pertinent clauses agreed upon by both parties. Consulting legal and financial professionals is crucial to ensure compliance with applicable laws and regulations, as well as to protect the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Acuerdo de opción de compra de acciones entre la corporación y el funcionario o empleado clave - Stock Option Agreement between Corporation and Officer or Key Employee

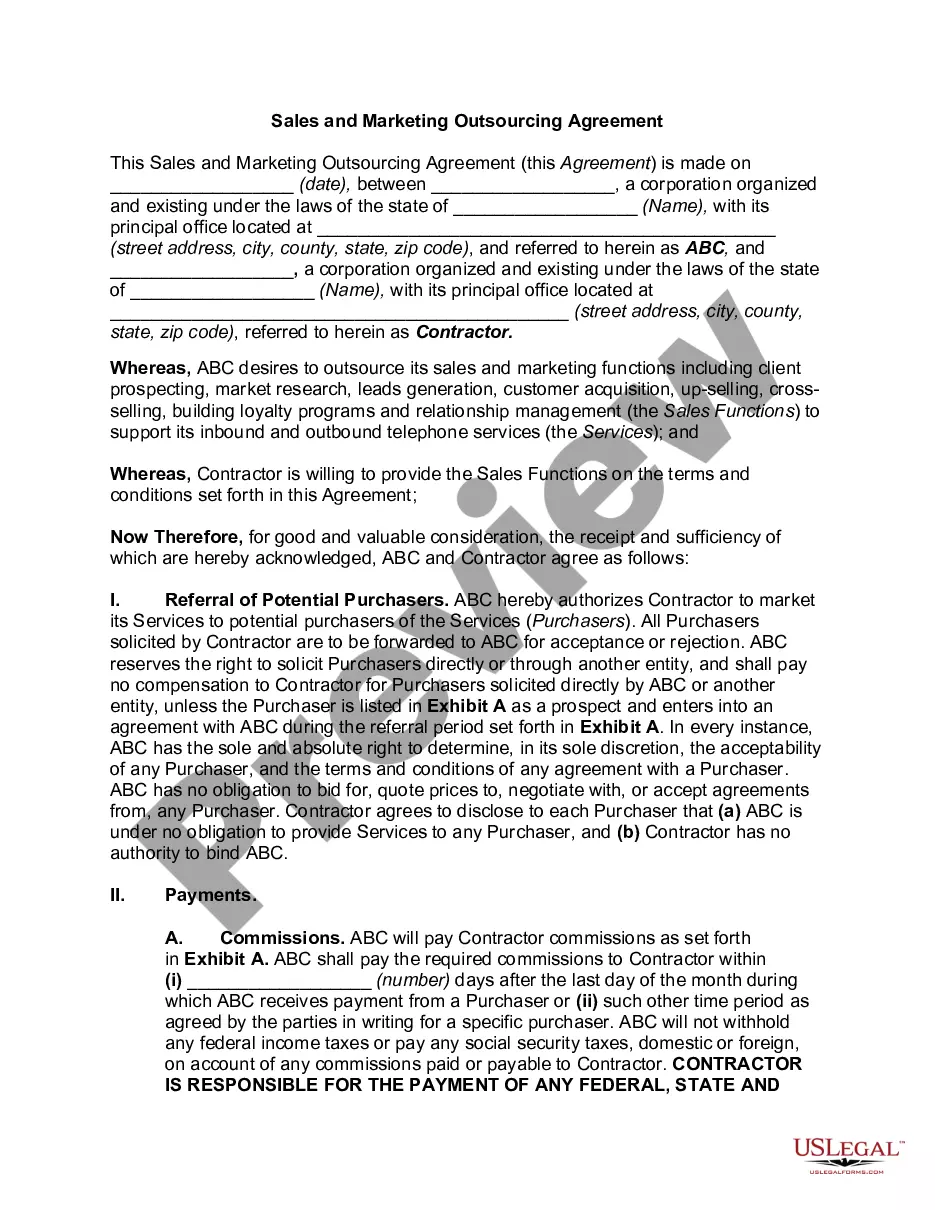

Description

How to fill out Wake North Carolina Acuerdo De Opción De Compra De Acciones Entre La Corporación Y El Funcionario O Empleado Clave?

If you need to find a reliable legal form provider to obtain the Wake Stock Option Agreement between Corporation and Officer or Key Employee, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed form.

- You can select from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, number of supporting resources, and dedicated support team make it easy to find and execute different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply select to search or browse Wake Stock Option Agreement between Corporation and Officer or Key Employee, either by a keyword or by the state/county the form is intended for. After locating needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply find the Wake Stock Option Agreement between Corporation and Officer or Key Employee template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be immediately ready for download once the payment is completed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less costly and more reasonably priced. Set up your first business, organize your advance care planning, draft a real estate agreement, or execute the Wake Stock Option Agreement between Corporation and Officer or Key Employee - all from the comfort of your home.

Join US Legal Forms now!