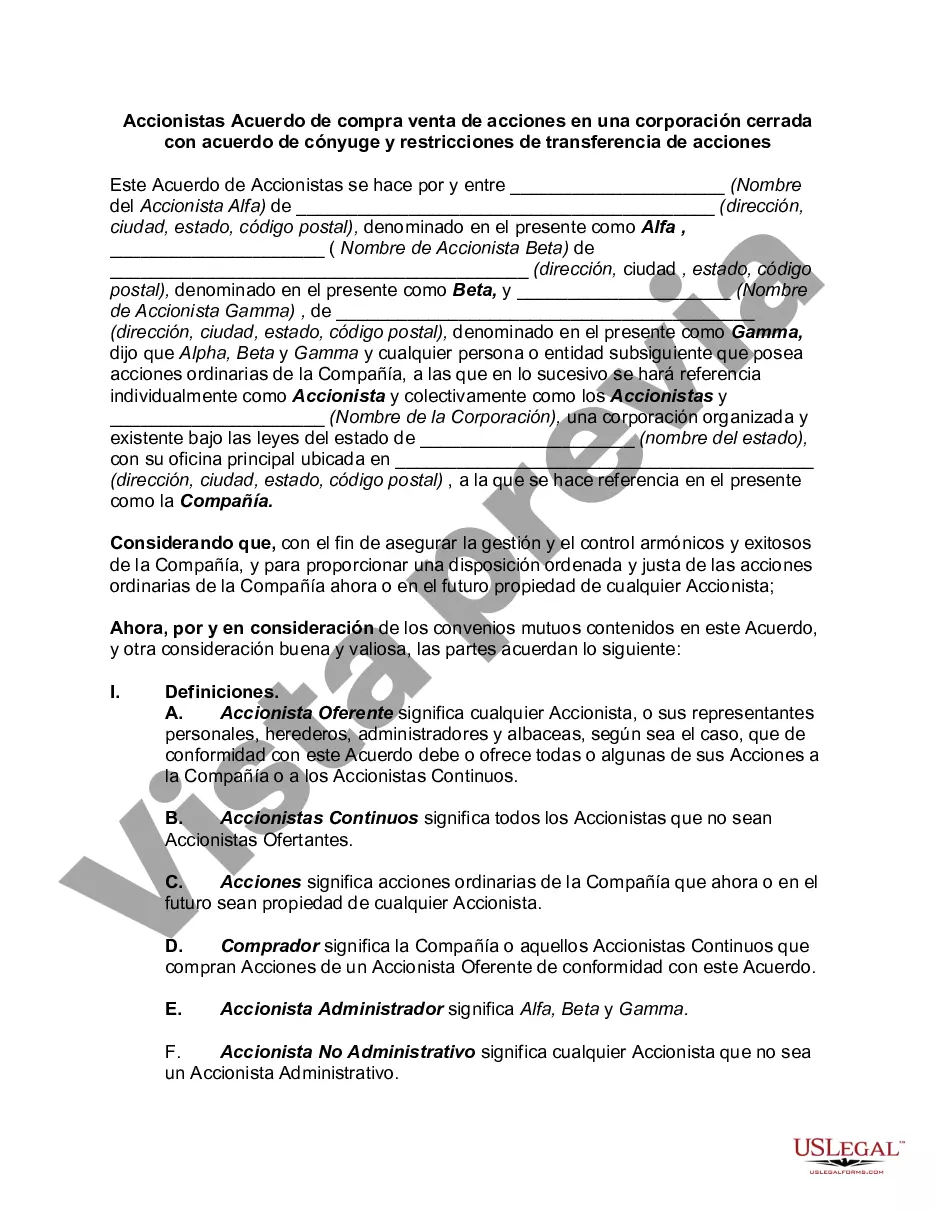

Kings New York Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions is a legal document that outlines the terms and conditions for buying and selling stock in a close corporation, specifically within the jurisdiction of Kings County in New York. This agreement is designed to protect the interests of shareholders and ensure smooth transitions in ownership. The agreement includes provisions for the sale of stock between shareholders, allowing them to buy or sell their shares in the company through a predefined process. This process typically involves offering the shares to existing shareholders before offering them to outside parties. Additionally, the agreement includes clauses that require the agreement of a shareholder's spouse in the event of a stock transfer. This provision ensures that both parties are in agreement before any transfer of shares can take place, preventing any disputes or complications that may arise from one spouse making decisions regarding stock ownership without the knowledge or consent of the other. Moreover, the agreement incorporates stock transfer restrictions, which are limitations on the transfer of shares. These restrictions can be customized to suit the needs of the specific close corporation and its shareholders. Common examples of stock transfer restrictions include a right of first refusal, which gives existing shareholders the first opportunity to purchase shares being sold, and a prohibition on transferring shares to competitors or non-buying entities. There may be different variations of the Kings New York Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions, depending on factors such as the size of the corporation, number of shareholders, or specific industry regulations. Examples of potential variations include agreements for different types of close corporations, such as professional corporations (PCs), non-profit corporations, or S-corporations. Each variation may have specific provisions tailored to the unique requirements and circumstances of the respective type of close corporation. In conclusion, the Kings New York Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions is a comprehensive legal document that facilitates the orderly transfer of shares in a close corporation while incorporating provisions to protect the interests of shareholders and ensure spousal consent. By implementing this agreement, close corporations can establish a clear framework for stock transactions, maintain stability within the ownership structure, and safeguard the corporation's long-term viability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Accionistas Acuerdo de compra venta de acciones en una corporación cerrada con acuerdo de cónyuge y restricciones de transferencia de acciones - Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions

Description

How to fill out Kings New York Accionistas Acuerdo De Compra Venta De Acciones En Una Corporación Cerrada Con Acuerdo De Cónyuge Y Restricciones De Transferencia De Acciones?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare formal documentation that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any individual or business objective utilized in your region, including the Kings Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions.

Locating samples on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Kings Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to obtain the Kings Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions:

- Make sure you have opened the correct page with your localised form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Kings Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!