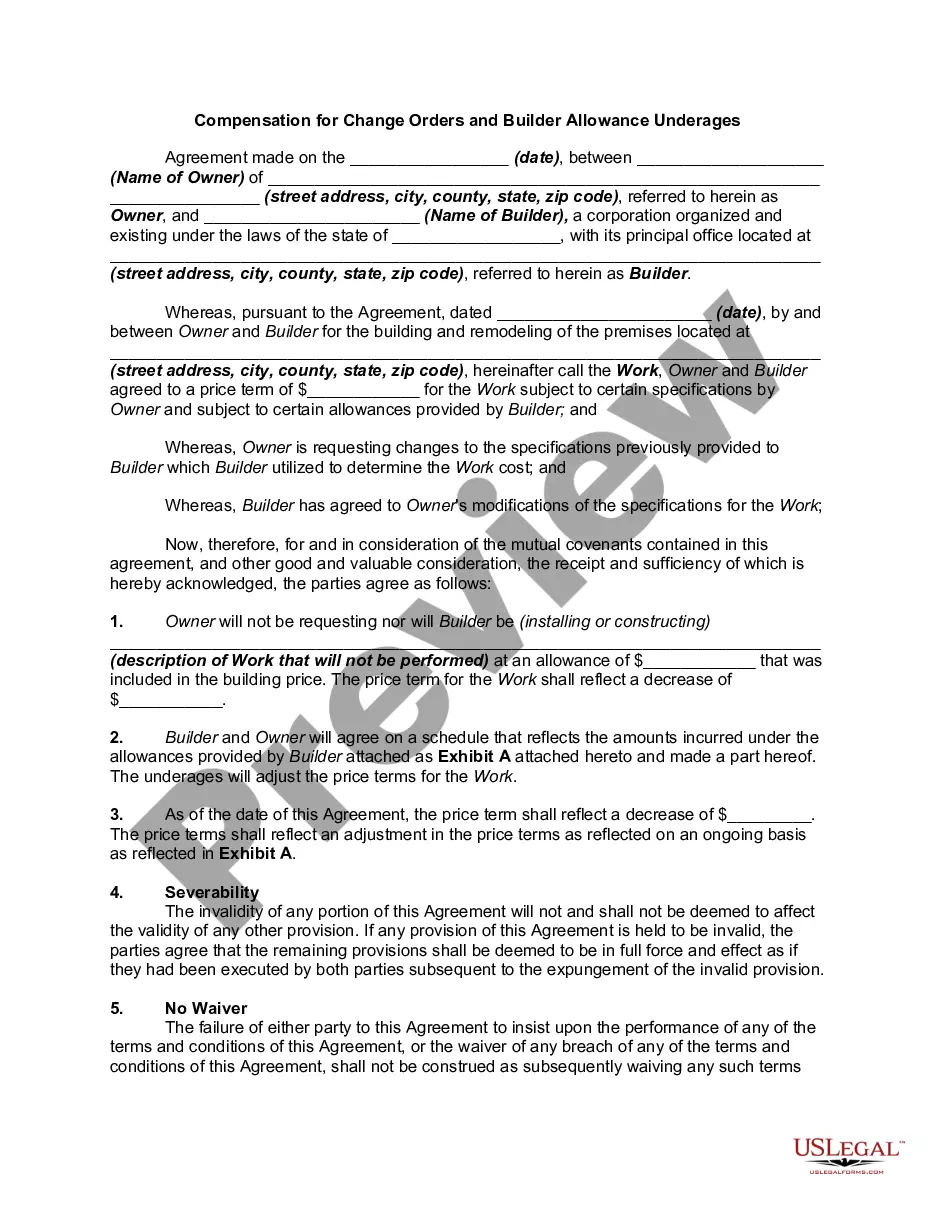

The Wake North Carolina Loan Agreement for Business is a legally binding contract that outlines the terms and conditions of a loan granted to a business entity in the Wake County, North Carolina area. This agreement serves as a critical document in establishing the responsibilities and obligations of both the lender and the borrower. The Wake North Carolina Loan Agreement for Business includes several key elements reflecting the specifics of the loan and the parties involved. These typically comprise the loan amount, interest rate, repayment terms, collateral, late payment penalties, loan duration, and any other relevant provisions. By clearly defining these aspects, the agreement ensures that both parties have a mutual understanding of their rights and obligations throughout the loan's duration. Wake North Carolina Loan Agreements for business may vary depending on the purpose of the loan or the unique requirements of the parties involved. Some common types of loan agreements found in the Wake County area include: 1. Small Business Loan Agreement: This type of loan agreement caters to small businesses seeking financial assistance for various purposes, such as expansion, working capital, equipment purchases, or inventory management. 2. Commercial Real Estate Loan Agreement: If a business intends to finance the purchase, construction, or renovation of commercial properties in Wake County, a commercial real estate loan agreement outlines the loan terms specific to this kind of investment. 3. Equipment Financing Agreement: For businesses requiring equipment or machinery for their operations, an equipment financing agreement helps establish the terms of loan repayment and any associated warranties or maintenance requirements. 4. Line of Credit Agreement: This type of loan agreement provides businesses with access to a predetermined amount of credit that they can draw upon whenever needed. The agreement delineates the terms of borrowing, interest rates, and repayment procedures. 5. Start-up Financing Agreement: Specifically designed for new businesses or ventures, this loan agreement provides the necessary capital to fund initial operations, marketing efforts, prototype development, or market research. Regardless of the specific type, all Wake North Carolina Loan Agreements for Business aim to protect both the lender and borrower by clearly delineating their rights, responsibilities, and expectations. Seeking legal advice and careful consideration of the terms outlined in these agreements ensures a transparent and productive relationship between the parties involved in the loan transaction.

Wake North Carolina Loan Agreement for Business

Description

How to fill out Wake North Carolina Loan Agreement For Business?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare official documentation that varies from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business objective utilized in your county, including the Wake Loan Agreement for Business.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Wake Loan Agreement for Business will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to get the Wake Loan Agreement for Business:

- Ensure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template corresponds to your needs.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Wake Loan Agreement for Business on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!