Chicago Illinois Assignment of Interest in Joint Venture is a legal document that outlines the transfer of rights, responsibilities, and ownership in a joint venture located in Chicago, Illinois. This assignment of interest occurs when one party (assignor) transfers their interest to another party (assignee) involved in the joint venture. The Joint Venture serves as a business arrangement where two or more companies collaborate and combine their resources, expertise, and capital to achieve mutual goals, such as creating a new product or entering a new market. Keywords: Chicago Illinois, Assignment of Interest, Joint Venture, legal document, transfer of rights, responsibilities, ownership, assignor, assignee, business arrangement, collaboration, resources, expertise, capital, mutual goals, product, market. There are various types of Assignment of Interest in Joint Venture agreements in Chicago, Illinois, each serving different purposes within the business collaboration. Some of these types include: 1. Full Assignment: This type involves the complete transfer of the assignor's interest in the joint venture to the assignee. The assignee assumes all rights, obligations, and liabilities associated with the assignor's position in the partnership. 2. Partial Assignment: In this type, the assignor transfers only a portion of their interest in the joint venture to the assignee. The assignee then becomes responsible for managing the assigned percentage of the partnership's affairs. 3. Temporary Assignment: Sometimes, joint ventures require a temporary transfer of interest due to specific circumstances or time-bound projects. This type allows the assignor to transfer their rights and responsibilities temporarily, with an agreed-upon duration for the assignment. 4. Permanence Assignment: Unlike temporary assignments, permanence assignment involves an irrevocable transfer of interest. The assignor relinquishes their rights, responsibilities, and ownership permanently to the assignee, making the assignee a permanent partner in the joint venture. 5. Proportional Assignment: This type involves the transfer of interest in proportion to the assignor's current ownership percentage in the joint venture. It ensures that the assignee assumes a proportional stake in the partnership based on their financial or other contributions. 6. Capital Assignment: In joint ventures where financial contributions significantly impact ownership and decision-making, capital assignment occurs. This type involves assigning interest based on the assignor's capital contributions to the partnership. 7. Non-Capital Assignment: Non-capital assignment is the opposite of capital assignment. It involves assigning interest in the joint venture based on factors other than financial contributions, such as expertise, resources, or specialized skills. Each of these types of assignments serves a unique purpose within the context of a Chicago Illinois Assignment of Interest in Joint Venture, offering flexibility and customization options to suit the specific needs and goals of the involved parties.

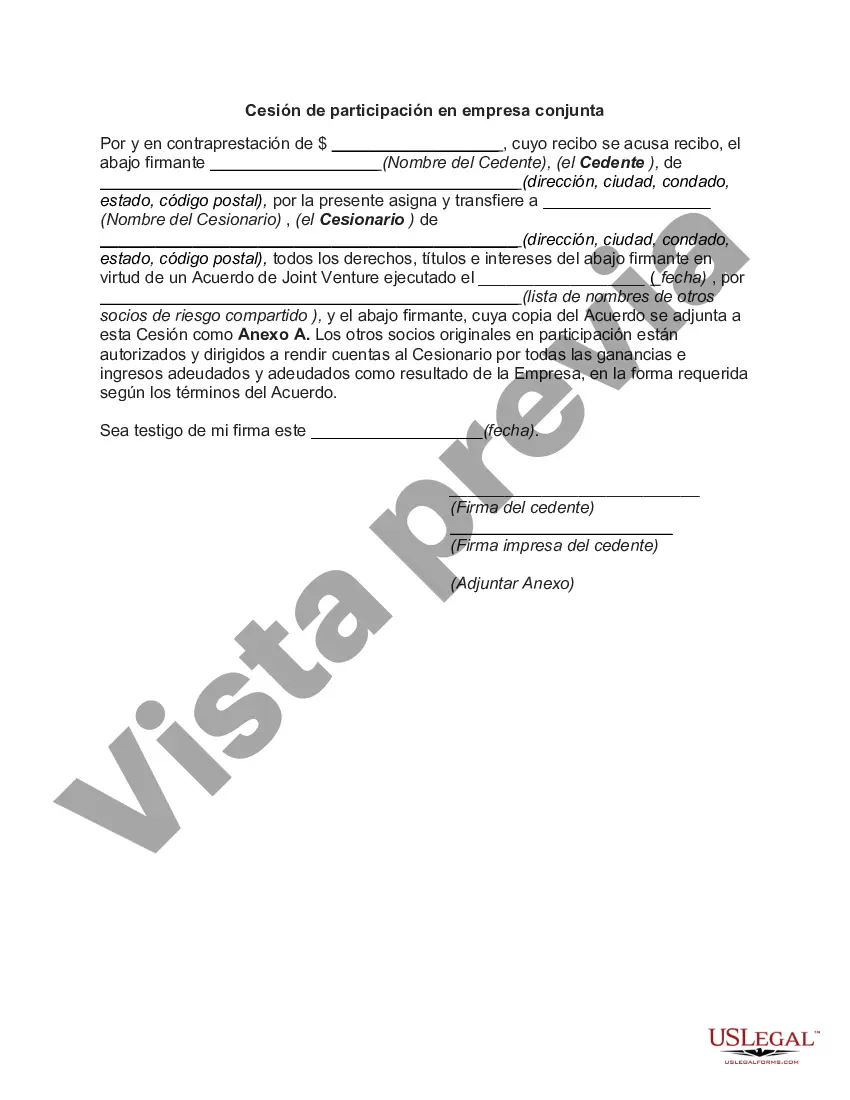

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Cesión de participación en empresa conjunta - Assignment of Interest in Joint Venture

Description

How to fill out Chicago Illinois Cesión De Participación En Empresa Conjunta?

Drafting documents for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to create Chicago Assignment of Interest in Joint Venture without professional help.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Chicago Assignment of Interest in Joint Venture by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, follow the step-by-step guideline below to obtain the Chicago Assignment of Interest in Joint Venture:

- Examine the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To find the one that fits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any scenario with just a couple of clicks!

Form popularity

FAQ

Las ventajas de los asociados son: No existe ninguna relacion juridica entre terceros y asociados, ya que el asociante realiza los actos de comercio en nombre propio. Participan en el negocio sin necesidad de intervenir en el mismo. Tienen derecho a una parte de las utilidades que genero la empresa.

- El contrato de asociacion civil es utilizado para la creacion de una persona moral sin fines de lucro mientras que el contrato de joint venture es utilizado para obtener ganancias de uno o varios negocios por lo que tiene una finalidad primordialmente economica.

Que es una 'joint venture' y cuando interesa crear una La joint venture es una formula empresarial interesante para aquellas empresas que buscan explotar sinergias junto con otras.Castellanizado como empresa conjunta, una joint venture es una alianza comercial entre dos o mas empresas.

Podemos traducir el termino Joint Venture como una Aventura Conjunta, una definicion bastante acertada ya que en su concepcion, es un acuerdo que se da entre dos o mas empresas, las cuales conservan su autonomia empresarial y juridica ademas de que se comprometen a aportar recursos para llevar a cabo un proyecto y

En palabras simples, se puede decir que se trata de un documento o contrato en el que una persona (asociante) se une a otra u otras (asociados) con un fin comercial. Los asociados pueden aportar dinero, tiempo o trabajo al asociante, a cambio de una participacion en las utilidades del negocio.

1. Joint Ventures Nacional: Son las creadas por socios con identica nacionalidad y dentro de su pais de origen. 2. Joint Venture Internacional: Son las creadas por socios de diferentes nacionalidades.

La joint venture es una asociacion estrategica temporal (de corto, mediano o largo plazo) de organizacion, una agrupacion o alianza de personas o grupos de empresas que mantienen su individualidad e independencia juridica pero que actuan unidas bajo una misma direccion y normas, para llevar adelante una operacion

La joint venture es una asociacion estrategica temporal (de corto, mediano o largo plazo) de organizacion, una agrupacion o alianza de personas o grupos de empresas que mantienen su individualidad e independencia juridica pero que actuan unidas bajo una misma direccion y normas, para llevar adelante una operacion

Una joint venture suele realizarse en realidad entre empresas que complementen recursos unas con otras, que pertenezcan al mismo sector. De este modo cada una estara encargada de aportar la experiencia que posee sobre la materia. Asi mismo, es una alianza muy recurrente en las startups.

Una joint venture no tiene por que constituir una compania o entidad legal separada. Tambien se conoce como «riesgo compartido», debido a que dos o mas empresas se unen para formar una nueva en la cual se usa un producto tomando en cuenta las mejores tacticas de mercado.