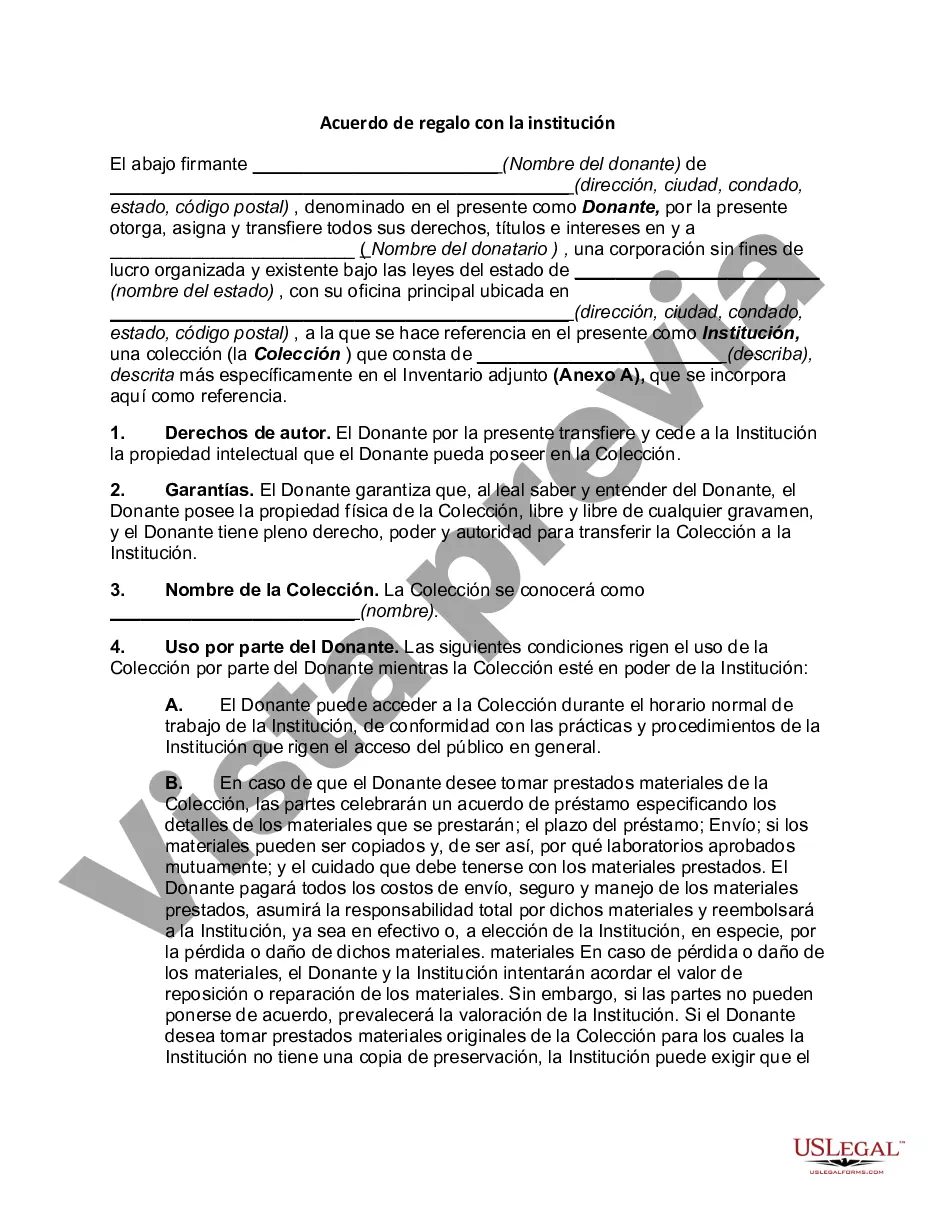

A Dallas Texas Gift Agreement with Institution is a legally binding document that outlines the terms and conditions of a gift to be donated to an institution, such as a museum, university, or nonprofit organization, located in Dallas, Texas. This agreement sets forth the rights and responsibilities of both the donor and the institution, ensuring that the gift is properly received, acknowledged, and used in accordance with the donor's intentions. The Dallas Texas Gift Agreement with Institution typically includes various key elements, such as: 1. Donation Details: This section specifies the nature of the gift, whether it is cash, real estate, artwork, securities, or any other form of valuable asset. It describes the purpose of the gift and any restrictions or limitations imposed by the donor. 2. Title and Ownership: The agreement clarifies that the donor possesses legal ownership of the gift and intends to transfer title to the institution. It also highlights any intellectual property rights associated with the gift, such as copyrights or patents. 3. Delivery and Acceptance: This section outlines the method and timeline for delivering the gift to the institution. It details the process of acceptance by the institution, including any required appraisals, inspections, or legal documentation. 4. Use and Display: The agreement specifies how the institution will use and display the gift. It may include provisions for public exhibition, loaning to other institutions, or incorporation into the institution's permanent collection. 5. Conservation and Preservation: This section addresses the responsibility of the institution to properly care for and preserve the gift. It may include provisions for maintenance, restoration, conservation, and insurance coverage. 6. Recognition and Acknowledgment: The agreement outlines how the institution will recognize and acknowledge the donor's gift. This may include public recognition, naming opportunities, or inclusion in donor recognition programs. 7. Legal and Tax Considerations: The agreement may include provisions related to tax implications, including the donor's eligibility for tax deductions and the institution's responsibility to comply with applicable tax laws and regulations. Types of Dallas Texas Gift Agreements with Institutions may include: — Cash Gift Agreement: This agreement focuses on donations in the form of monetary funds, specifying the amount, purpose, and conditions of the cash gift. — Real Estate Gift Agreement: This agreement deals with the donation of real property, such as land, buildings, or homes, outlining the transfer of ownership and any associated liabilities. — Artwork Gift Agreement: This agreement specifically addresses the donation of artwork, including paintings, sculptures, or other visual art forms, detailing exhibition rights, reproduction permissions, and copyright considerations. — Endowment Gift Agreement: This type of agreement establishes a permanent fund where the principal gift is invested, and the institution uses the generated income to support specific programs or purposes. In conclusion, a Dallas Texas Gift Agreement with Institution is a contractual agreement that ensures the proper transfer and utilization of a gift to an institution located in Dallas, Texas. Different types of agreements may focus on cash, real estate, artwork, or endowment gifts, outlining specific terms and conditions tailored to the nature of the donation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Acuerdo de regalo con la institución - Gift Agreement with Institution

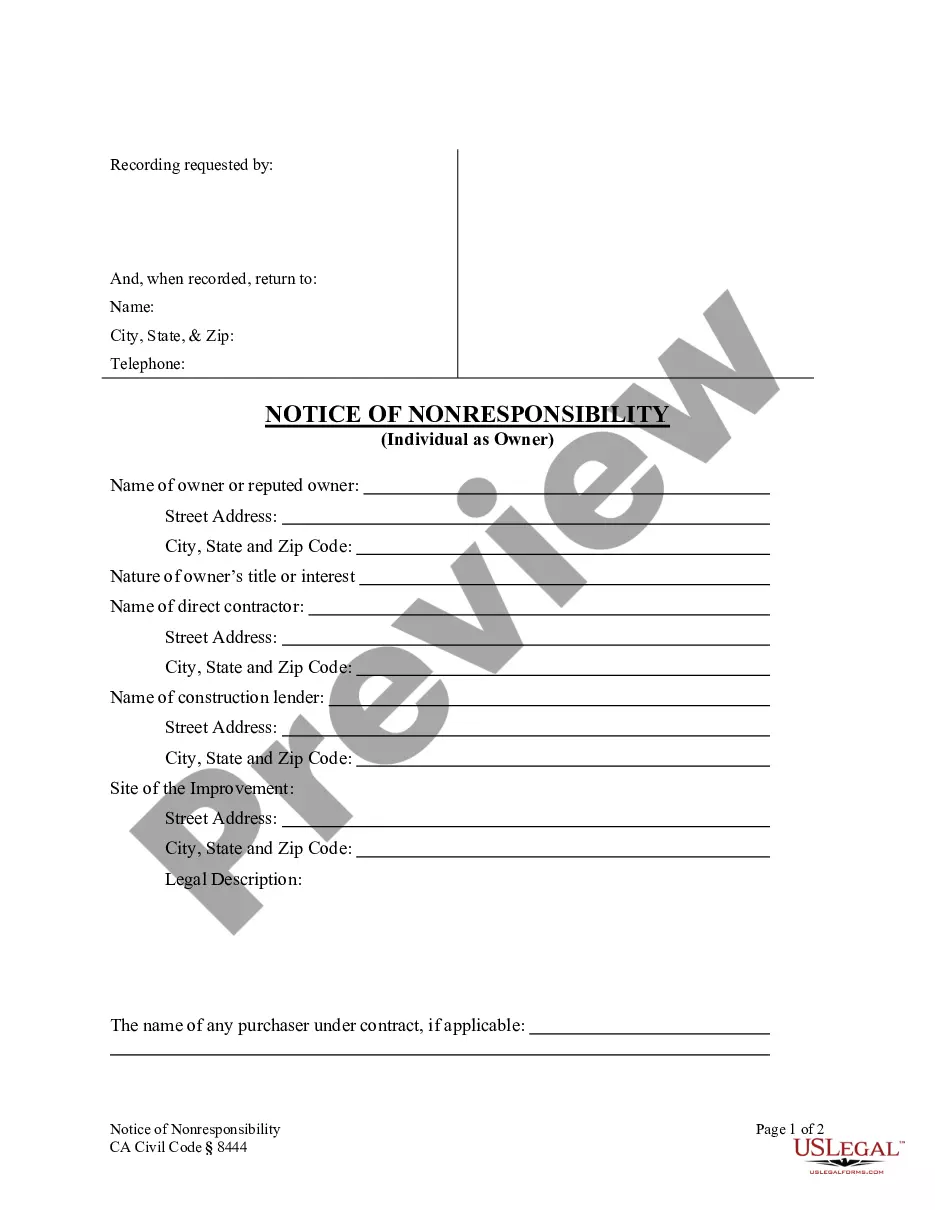

Description

How to fill out Dallas Texas Acuerdo De Regalo Con La Institución?

Whether you intend to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business case. All files are collected by state and area of use, so opting for a copy like Dallas Gift Agreement with Institution is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to obtain the Dallas Gift Agreement with Institution. Follow the guidelines below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the file once you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Dallas Gift Agreement with Institution in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!