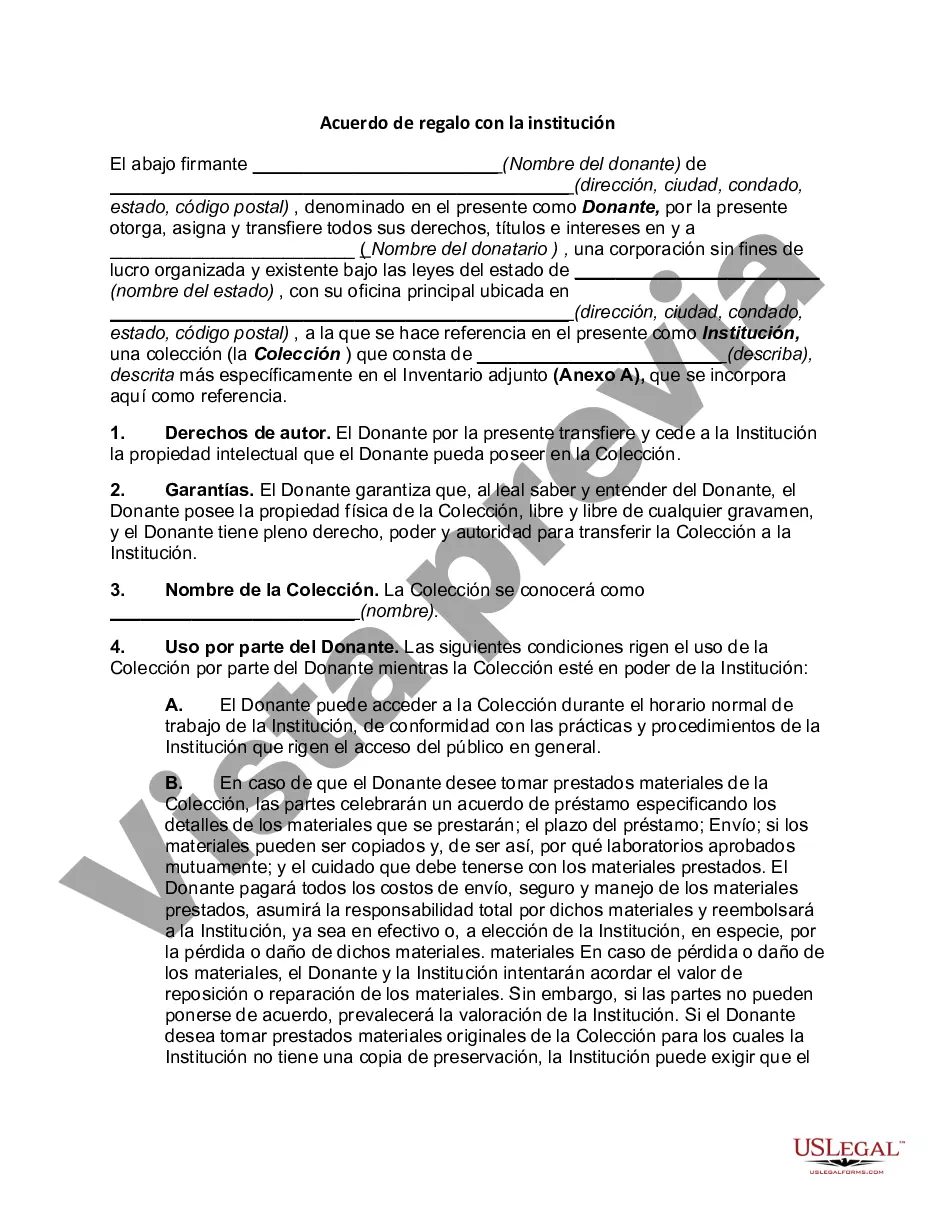

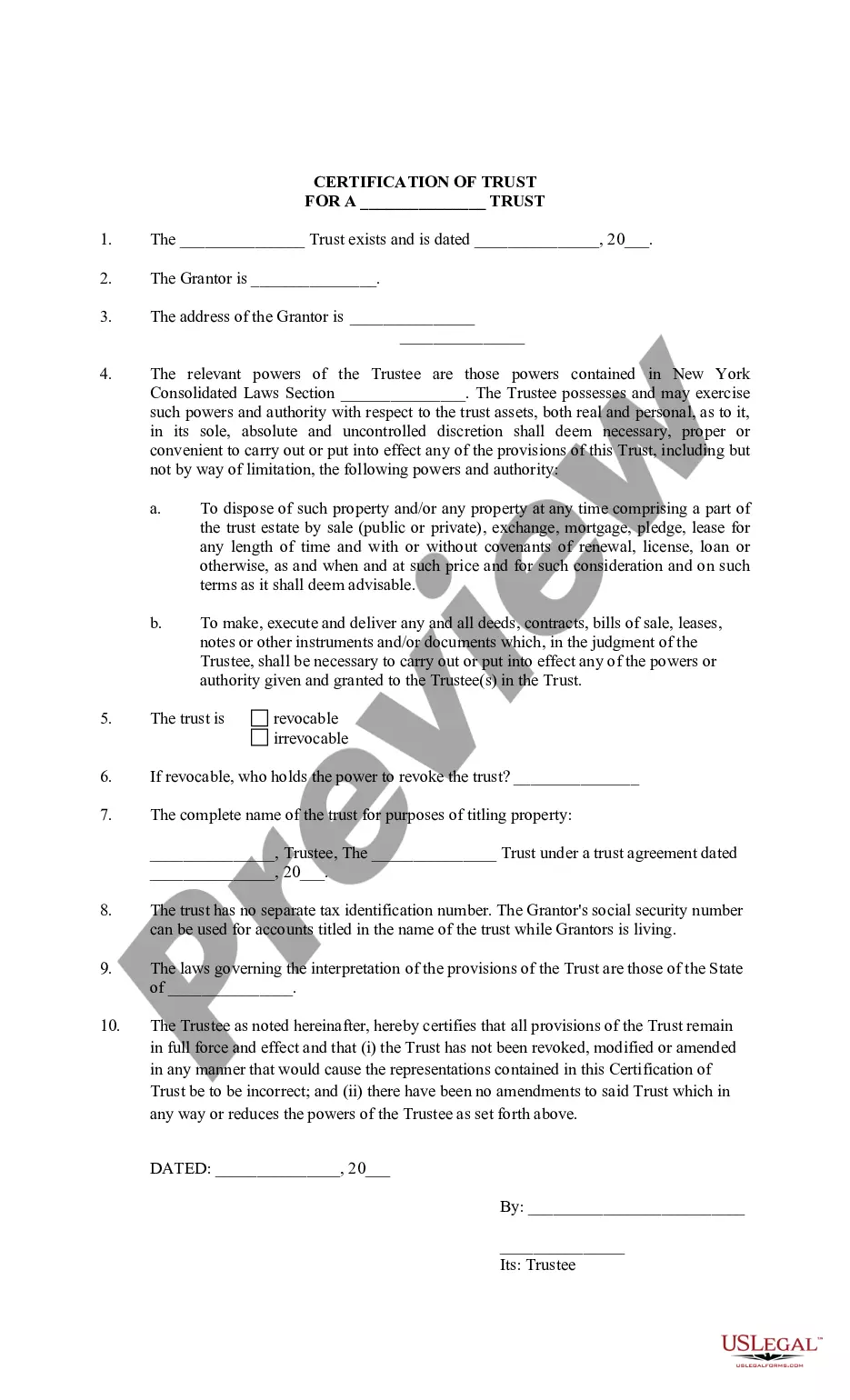

Palm Beach, Florida, Gift Agreement with Institution: A Comprehensive Guide Introduction: The Palm Beach, Florida Gift Agreement with Institution is a legally binding document that outlines the terms and conditions for charitable gifts made by individuals or organizations to institutions located in Palm Beach, Florida. This detailed description aims to provide a comprehensive overview of the Palm Beach, Florida Gift Agreement with Institution, its significance, and the different types of agreements that can be established. Key Terms and Features: 1. Donor: The individual or organization that makes a gift to the institution. 2. Institution: Refers to the charitable organization, foundation, or educational institution based in Palm Beach, Florida that accepts the gift. 3. Gift: Includes various types of donations, such as cash, real estate, stocks, artwork, or other valuable assets. 4. Intention: The purpose or objective of the gift, which may include supporting specific programs, scholarships, research projects, infrastructure development, or general operations. 5. Restrictions: Any limitations or conditions imposed by the donor regarding the use of the gift. 6. Recognition: Specifies how the institution will acknowledge and appreciate the donor's contribution, including naming opportunities, plaques, or other forms of recognition. Types of Palm Beach, Florida Gift Agreements with Institutions: 1. Cash Gift Agreement: This agreement pertains to monetary donations made by individuals or organizations to the institution. 2. Securities Gift Agreement: This type of agreement applies to gifts of stocks, bonds, or other securities, allowing the institution to sell or hold the assets as deemed appropriate. 3. Real Estate Gift Agreement: Deals with the transfer of real property, such as land, buildings, or homes, from the donor to the institution. 4. Artwork or Artifact Gift Agreement: For donations of valuable art pieces, historic artifacts, or collectibles, outlining how the institution will handle, display, and preserve the gifted items. 5. Endowment Gift Agreement: Establishes a long-term investment fund with the gift, ensuring that the institution utilizes only the annual earnings generated while preserving the principal amount intact. 6. Scholarship Gift Agreement: Pertains to gifts specifically designated for scholarship funds, ensuring that the donor's intentions are met in terms of the selection criteria and eligibility requirements for recipients. Importance of Palm Beach, Florida Gift Agreement with Institutions: 1. Clarity: The agreement ensures clear communication between the donor and the institution regarding the gift's purpose, restrictions, and recognition requirements. 2. Legal Compliance: A properly executed gift agreement ensures both parties adhere to legal and tax requirements, avoiding any potential disputes or complications. 3. Donor's Legacy: The gift agreement safeguards the donor's vision, enabling them to leave a lasting impact on the institution and community. 4. Stewardship: The agreement allows the institution to acknowledge the donor's generosity appropriately, reinforcing a positive donor-institution relationship. 5. Financial Planning: For donors, gift agreements aid in financial planning, tax benefits, and personal philanthropic strategies. In summary, the Palm Beach, Florida Gift Agreement with Institution serves as a crucial tool for establishing expectations, preserving the donor's legacy, and ensuring a harmonious partnership between the donor and institution. By distinguishing between different types of gift agreements, this comprehensive guide sheds light on the significance of these agreements and their relevance in successfully executing philanthropic endeavors in Palm Beach, Florida.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Beach Florida Acuerdo de regalo con la institución - Gift Agreement with Institution

Description

How to fill out Palm Beach Florida Acuerdo De Regalo Con La Institución?

Drafting documents for the business or personal needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to create Palm Beach Gift Agreement with Institution without professional assistance.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Palm Beach Gift Agreement with Institution on your own, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the Palm Beach Gift Agreement with Institution:

- Examine the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that suits your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any use case with just a couple of clicks!