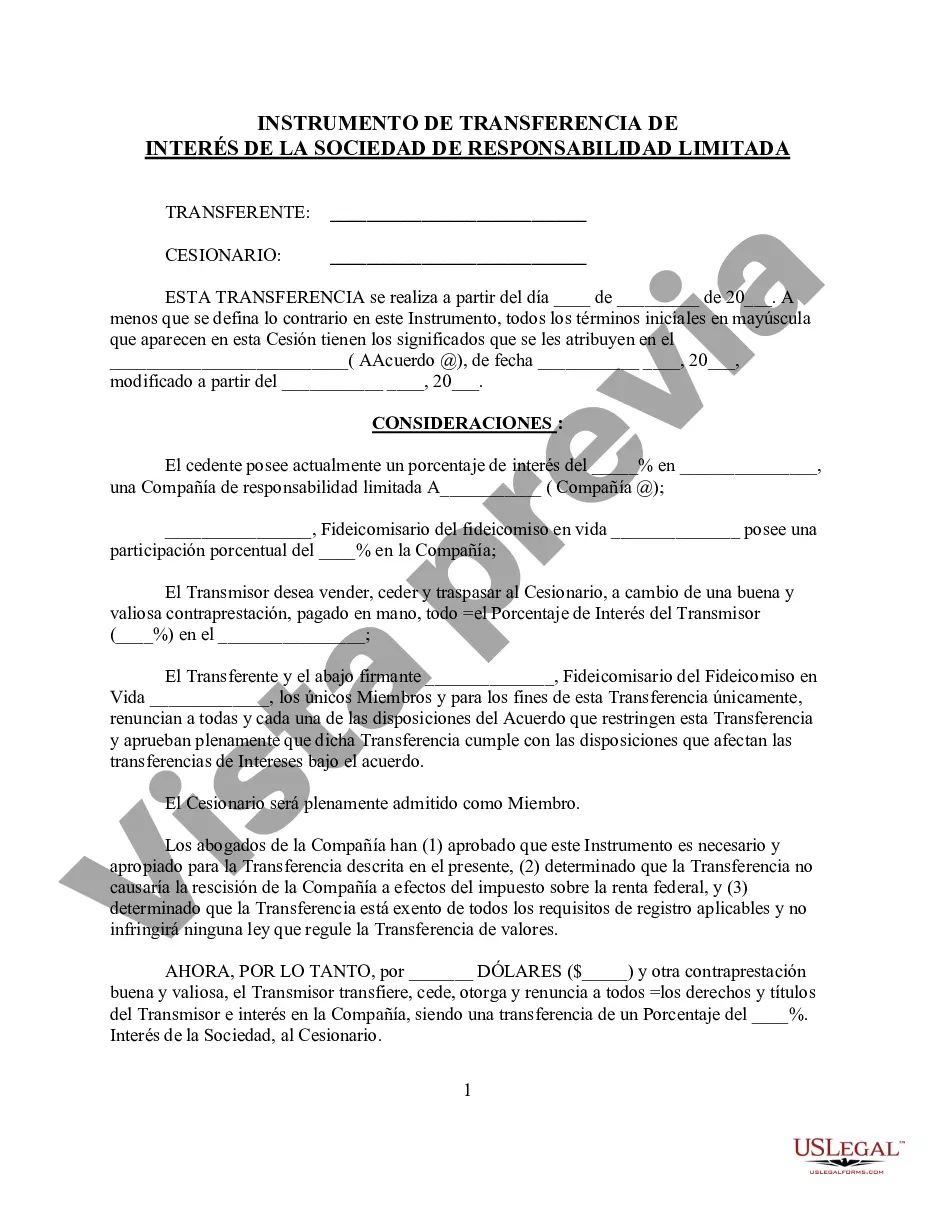

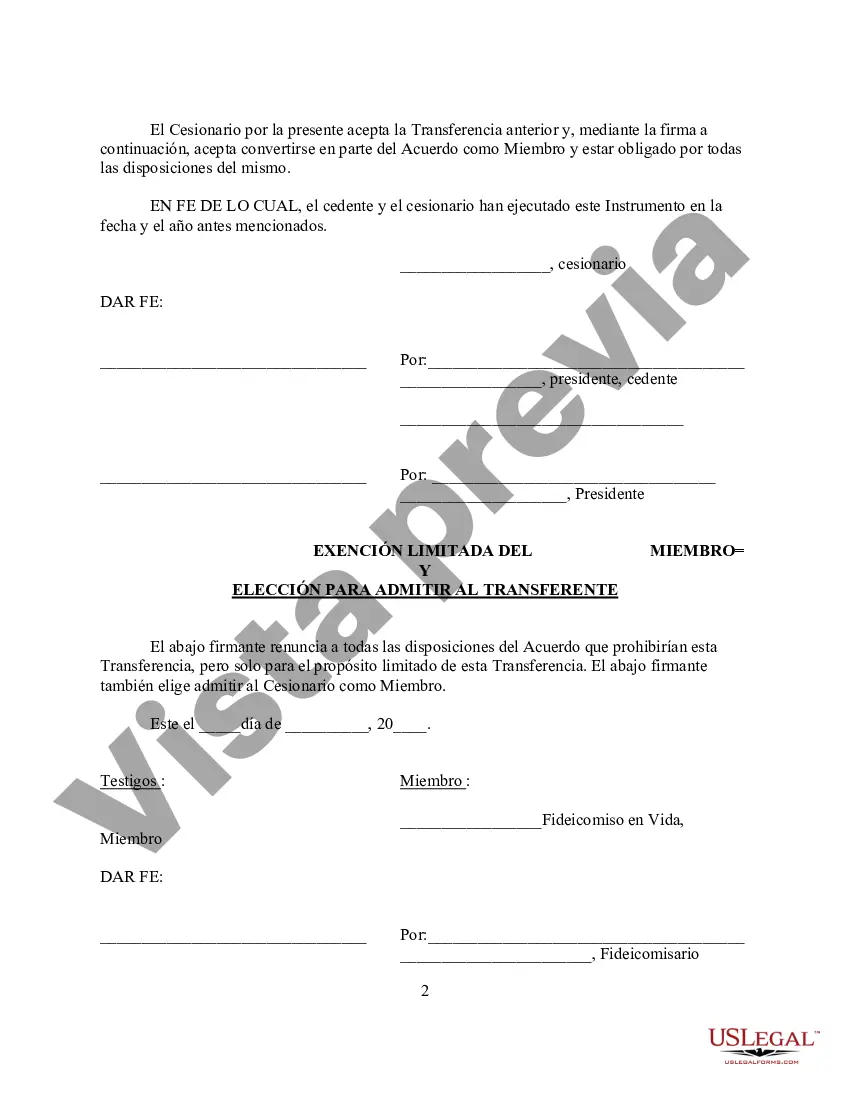

Bronx New York Assignment of LLC Company Interest to Living Trust is a legal process that involves transferring ownership of a Limited Liability Company (LLC) to a living trust based in the Bronx, New York. This assignment allows the LLC owner to place their business interest into a trust, ensuring smoother estate planning and potential benefits associated with trust ownership. An Assignment of LLC Company Interest to Living Trust can take various forms depending on the specific requirements and arrangements of the LLC owner. Some types of assignments include: 1. Irrevocable Living Trust Assignment: This type involves transferring the LLC company interest to an irrevocable living trust. Once this assignment is made, it cannot be modified or revoked, providing certain tax advantages and ensuring asset protection. 2. Revocable Living Trust Assignment: In this case, the LLC company interest is transferred to a revocable living trust, allowing the creator (trust or) to modify or revoke the trust during their lifetime. This type of assignment offers flexibility and can be beneficial for estate planning purposes. 3. Pour-Over Trust Assignment: This assignment involves creating a pour-over will, and the LLC company interest will be transferred to the living trust upon the owner's passing. This ensures that any assets not already transferred to the trust during the owner's lifetime will be distributed according to the trust's provisions, avoiding the probate process. 4. Testamentary Trust Assignment: With this assignment, the LLC company interest will be transferred to a trust established by the owner's will, which becomes effective only after their passing. This allows for more specific instructions regarding the distribution and management of the business interest. Overall, transferring the LLC company interest to a living trust in the Bronx, New York, provides a range of benefits. It helps ensure the seamless transfer of ownership, simplifies estate planning, provides potential tax advantages, protects assets, and allows for more control and flexibility in managing and distributing the business interest. When undertaking an Assignment of LLC Company Interest to Living Trust in the Bronx, New York, it is crucial to consult with a qualified attorney well-versed in trust and estate planning laws to help navigate through the legal requirements and ensure compliance with all relevant regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bronx New York Cesión del interés de la empresa LLC al fideicomiso en vida - Assignment of LLC Company Interest to Living Trust

Description

How to fill out Bronx New York Cesión Del Interés De La Empresa LLC Al Fideicomiso En Vida?

Drafting paperwork for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to create Bronx Assignment of LLC Company Interest to Living Trust without expert assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Bronx Assignment of LLC Company Interest to Living Trust on your own, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, adhere to the step-by-step guide below to obtain the Bronx Assignment of LLC Company Interest to Living Trust:

- Look through the page you've opened and check if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any use case with just a few clicks!